As global markets continue to reach new heights, with indices such as the Dow Jones and S&P 500 setting record intraday highs, investors are exploring opportunities beyond traditional blue-chip stocks. Penny stocks, often representing smaller or newer companies, remain a relevant investment area despite their historical association with speculative trading. This article highlights three penny stocks that stand out for their financial strength and potential for significant returns, offering investors a chance to uncover hidden value in quality companies.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.48 | MYR2.39B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.78 | A$145.87M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.41 | MYR1.14B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.875 | MYR290.45M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.255 | £849.6M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.03 | HK$44.38B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.595 | A$69.16M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.345 | £432.14M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.57 | £68.08M | ★★★★☆☆ |

Click here to see the full list of 5,688 stocks from our Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

JBM (Healthcare) (SEHK:2161)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: JBM (Healthcare) Limited is an investment holding company involved in the manufacture, marketing, distribution, and sale of branded healthcare and wellness products across Hong Kong, Macau, Mainland China, and internationally with a market cap of approximately HK$1.50 billion.

Operations: The company's revenue is derived from three segments: Branded Medicines generating HK$215.22 million, Health and Wellness Products contributing HK$85.81 million, and Proprietary Chinese Medicines accounting for HK$419.51 million.

Market Cap: HK$1.5B

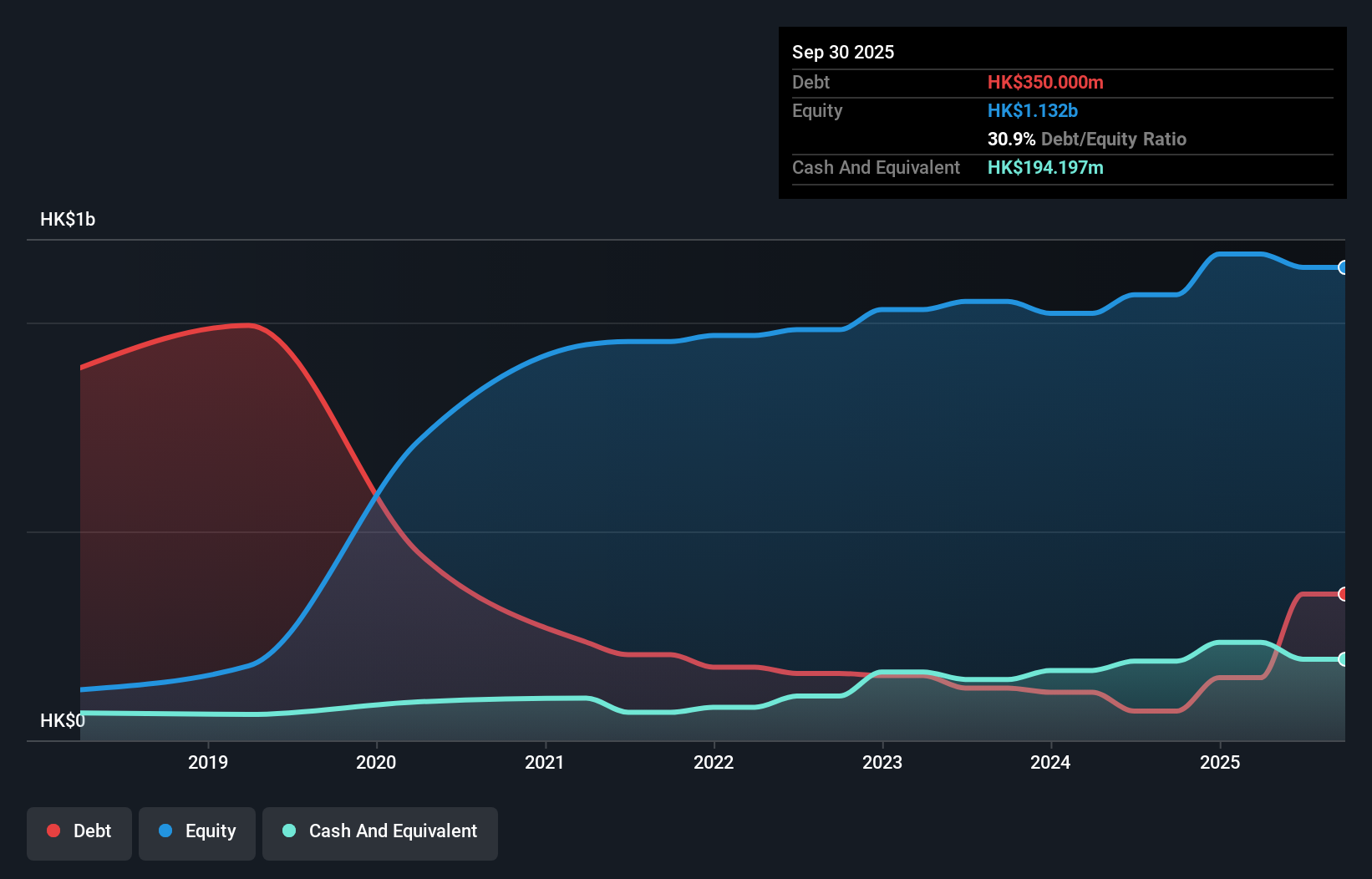

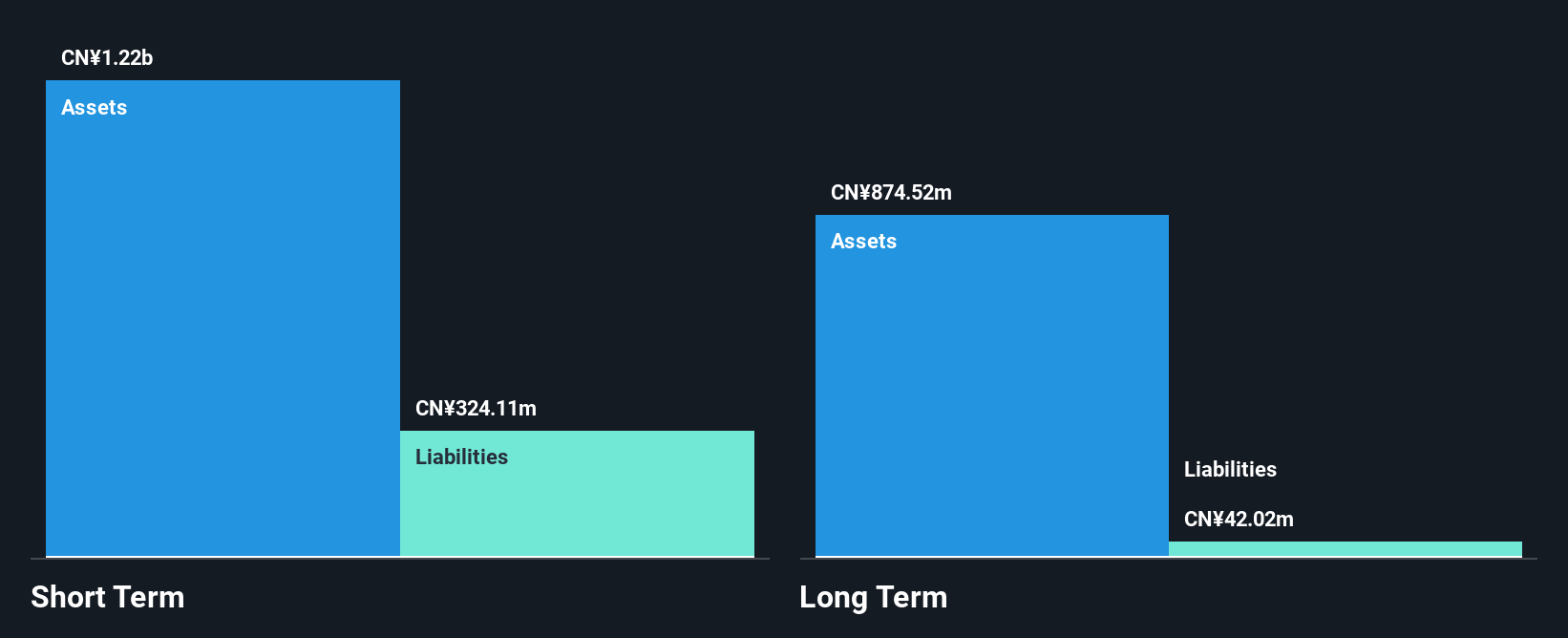

JBM (Healthcare) Limited has demonstrated strong financial performance, with earnings growing by 67.2% over the past year, significantly outpacing industry growth. The company's revenue is robust across its segments, with proprietary Chinese medicines contributing HK$419.51 million. JBM's short-term assets exceed both its short and long-term liabilities, indicating solid liquidity management. Recent announcements highlight a substantial interim dividend and a notable increase in net income to HK$95.88 million for the half-year ended September 2024, driven by successful sales strategies in key markets like Hong Kong and Macau. Additionally, debt levels are well-managed with more cash than total debt.

- Click to explore a detailed breakdown of our findings in JBM (Healthcare)'s financial health report.

- Evaluate JBM (Healthcare)'s historical performance by accessing our past performance report.

PropNex (SGX:OYY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: PropNex Limited offers real estate services both in Singapore and internationally, with a market capitalization of SGD673.40 million.

Operations: The company generates revenue primarily through Agency Services (SGD793.97 million), Project Marketing Services (SGD220.11 million), Training Services (SGD2.69 million), and Administrative Support Services (SGD4.41 million).

Market Cap: SGD673.4M

PropNex Limited operates without debt, which simplifies its financial structure and eliminates concerns over interest payments. Its short-term assets of SGD269.4 million comfortably cover both short and long-term liabilities, reflecting strong liquidity. Despite a high return on equity at 38.7%, recent earnings growth has been negative at -22%, contrasting with its historical annual profit growth of 19%. The management team is relatively new with an average tenure of just 0.1 years, suggesting potential strategic shifts ahead. Recent board changes include new company secretaries, while the stock was recently dropped from the S&P Global BMI Index.

- Get an in-depth perspective on PropNex's performance by reading our balance sheet health report here.

- Evaluate PropNex's prospects by accessing our earnings growth report.

Zhongzhu Healthcare HoldingLtd (SHSE:600568)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhongzhu Healthcare Holding Co., Ltd operates in the research, development, production, and sales of pharmaceutical drugs in China with a market capitalization of CN¥2.89 billion.

Operations: The company generates revenue of CN¥641.61 million from its operations in China.

Market Cap: CN¥2.89B

Zhongzhu Healthcare Holding Co., Ltd, with a market cap of CN¥2.89 billion, is navigating financial challenges despite its unprofitability. The company has managed to maintain a positive free cash flow and boasts sufficient cash runway for over three years. Its short-term assets significantly exceed liabilities, ensuring liquidity stability. Notably, the company is debt-free and has reduced losses by 6.7% annually over the past five years. Recent earnings reports show slight revenue growth to CN¥383.9 million over nine months in 2024, while net losses have decreased compared to the previous year, indicating potential operational improvements ahead.

- Jump into the full analysis health report here for a deeper understanding of Zhongzhu Healthcare HoldingLtd.

- Assess Zhongzhu Healthcare HoldingLtd's previous results with our detailed historical performance reports.

Make It Happen

- Access the full spectrum of 5,688 Penny Stocks by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2161

JBM (Healthcare)

An investment holding company, engages in the manufacture, marketing, distribution, and sale of branded healthcare and wellness products in Hong Kong, Macau, Mainland China, and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives