- China

- /

- Real Estate

- /

- SHSE:600266

Beijing Urban Construction Investment & Development (SHSE:600266) Has A Somewhat Strained Balance Sheet

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Beijing Urban Construction Investment & Development Co., Ltd. (SHSE:600266) makes use of debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Beijing Urban Construction Investment & Development

What Is Beijing Urban Construction Investment & Development's Net Debt?

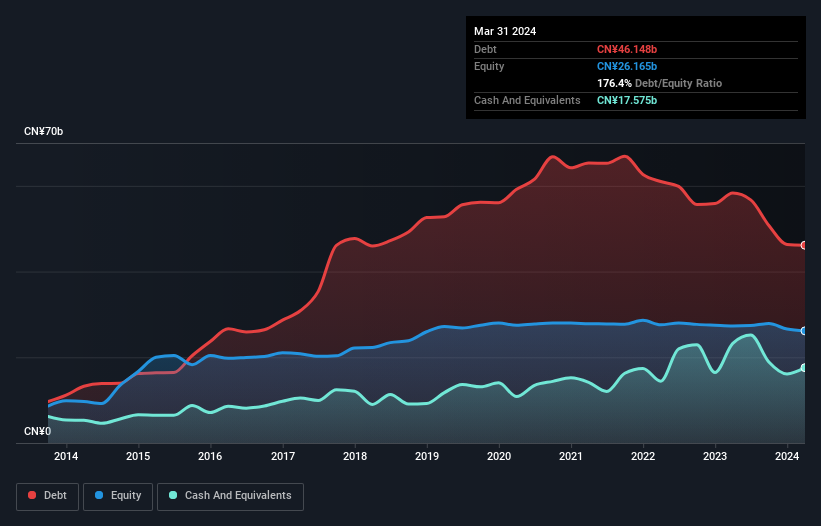

You can click the graphic below for the historical numbers, but it shows that Beijing Urban Construction Investment & Development had CN¥46.1b of debt in March 2024, down from CN¥58.3b, one year before. However, it also had CN¥17.6b in cash, and so its net debt is CN¥28.6b.

How Healthy Is Beijing Urban Construction Investment & Development's Balance Sheet?

We can see from the most recent balance sheet that Beijing Urban Construction Investment & Development had liabilities of CN¥72.9b falling due within a year, and liabilities of CN¥40.4b due beyond that. On the other hand, it had cash of CN¥17.6b and CN¥7.34b worth of receivables due within a year. So it has liabilities totalling CN¥88.4b more than its cash and near-term receivables, combined.

This deficit casts a shadow over the CN¥8.53b company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. At the end of the day, Beijing Urban Construction Investment & Development would probably need a major re-capitalization if its creditors were to demand repayment.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

As it happens Beijing Urban Construction Investment & Development has a fairly concerning net debt to EBITDA ratio of 49.3 but very strong interest coverage of 1k. So either it has access to very cheap long term debt or that interest expense is going to grow! Importantly, Beijing Urban Construction Investment & Development's EBIT fell a jaw-dropping 43% in the last twelve months. If that earnings trend continues then paying off its debt will be about as easy as herding cats on to a roller coaster. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Beijing Urban Construction Investment & Development can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we always check how much of that EBIT is translated into free cash flow. Happily for any shareholders, Beijing Urban Construction Investment & Development actually produced more free cash flow than EBIT over the last three years. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Our View

To be frank both Beijing Urban Construction Investment & Development's EBIT growth rate and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. But at least it's pretty decent at covering its interest expense with its EBIT; that's encouraging. We're quite clear that we consider Beijing Urban Construction Investment & Development to be really rather risky, as a result of its balance sheet health. For this reason we're pretty cautious about the stock, and we think shareholders should keep a close eye on its liquidity. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Be aware that Beijing Urban Construction Investment & Development is showing 4 warning signs in our investment analysis , you should know about...

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Urban Construction Investment & Development might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600266

Beijing Urban Construction Investment & Development

Beijing Urban Construction Investment & Development Co., Ltd.

Very undervalued with moderate growth potential.

Market Insights

Community Narratives