- China

- /

- Real Estate

- /

- SHSE:600223

Lushang Freda Pharmaceutical Co.,Ltd. (SHSE:600223) Stock Rockets 26% As Investors Are Less Pessimistic Than Expected

Lushang Freda Pharmaceutical Co.,Ltd. (SHSE:600223) shareholders are no doubt pleased to see that the share price has bounced 26% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 22% in the last twelve months.

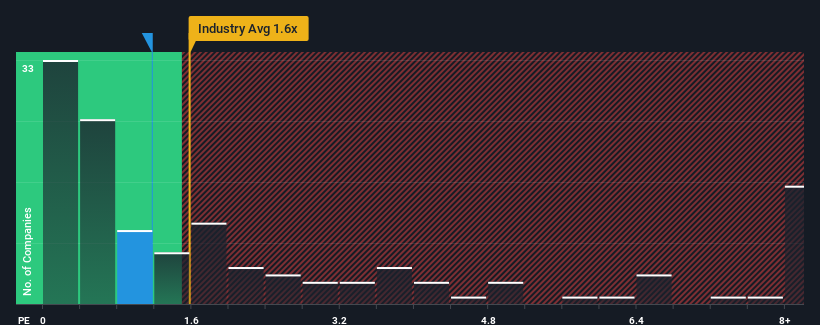

In spite of the firm bounce in price, there still wouldn't be many who think Lushang Freda PharmaceuticalLtd's price-to-sales (or "P/S") ratio of 1.2x is worth a mention when the median P/S in China's Real Estate industry is similar at about 1.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Lushang Freda PharmaceuticalLtd

What Does Lushang Freda PharmaceuticalLtd's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Lushang Freda PharmaceuticalLtd's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Lushang Freda PharmaceuticalLtd will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Lushang Freda PharmaceuticalLtd?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Lushang Freda PharmaceuticalLtd's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 46%. As a result, revenue from three years ago have also fallen 24% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to slump, contracting by 39% during the coming year according to the nine analysts following the company. That's not great when the rest of the industry is expected to grow by 9.2%.

With this in consideration, we think it doesn't make sense that Lushang Freda PharmaceuticalLtd's P/S is closely matching its industry peers. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

The Key Takeaway

Lushang Freda PharmaceuticalLtd appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

While Lushang Freda PharmaceuticalLtd's P/S isn't anything out of the ordinary for companies in the industry, we didn't expect it given forecasts of revenue decline. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If the declining revenues were to materialize in the form of a declining share price, shareholders will be feeling the pinch.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Lushang Freda PharmaceuticalLtd that you should be aware of.

If these risks are making you reconsider your opinion on Lushang Freda PharmaceuticalLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Lushang Freda PharmaceuticalLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600223

Lushang Freda PharmaceuticalLtd

Engages in the production and sales of pharmaceuticals, raw materials, and additives in China.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives