As global markets rally with the S&P 500 and Nasdaq Composite reaching all-time highs, driven by easing geopolitical tensions and positive trade developments, investors are keenly observing the tech sector's potential for high growth amidst these buoyant conditions. In such a dynamic environment, identifying promising tech stocks involves assessing companies that demonstrate robust innovation, scalability, and adaptability to leverage the favorable economic landscape.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 30.80% | 45.66% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.44% | 23.48% | ★★★★★★ |

| KebNi | 20.56% | 66.21% | ★★★★★★ |

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| Pharma Mar | 29.61% | 44.92% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| Elliptic Laboratories | 36.33% | 78.99% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 81.05% | 87.21% | ★★★★★★ |

| JNTC | 54.24% | 87.93% | ★★★★★★ |

Let's dive into some prime choices out of from the screener.

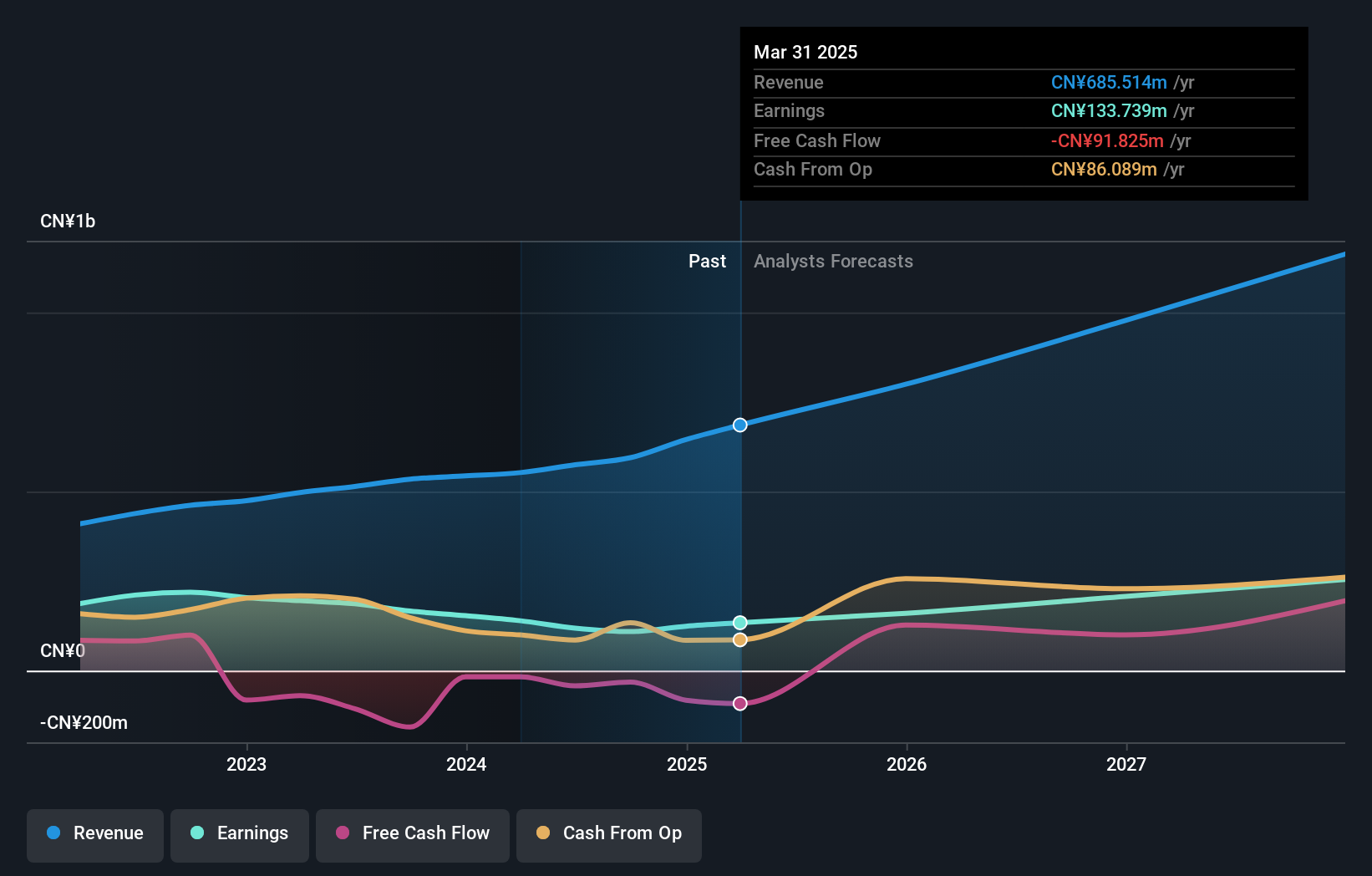

AcrobiosystemsLtd (SZSE:301080)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Acrobiosystems Co., Ltd. specializes in developing and manufacturing recombinant proteins, antibodies, and biological reagents for pharmaceutical companies, biotechnology firms, and scientific research institutions with a market cap of CN¥7.33 billion.

Operations: Acrobiosystems Co., Ltd. generates revenue primarily through its Research and Experimental Development segment, which accounted for CN¥673.43 million.

AcrobiosystemsLtd, a player in the biotech industry, has demonstrated robust financial performance with a notable increase in quarterly revenue from CNY 146 million to CNY 186.49 million and net income growth from CNY 30.67 million to CNY 40.58 million. Despite a challenging environment marked by high volatility in its share price over the past three months, the company's annual earnings are expected to grow by an impressive 23.4%. This growth is supported by strategic initiatives such as the recent approval of incentive plans aimed at bolstering long-term value creation through stock appreciation rights and restricted stock incentives, positioning Acrobiosystems well for future advancements within its sector.

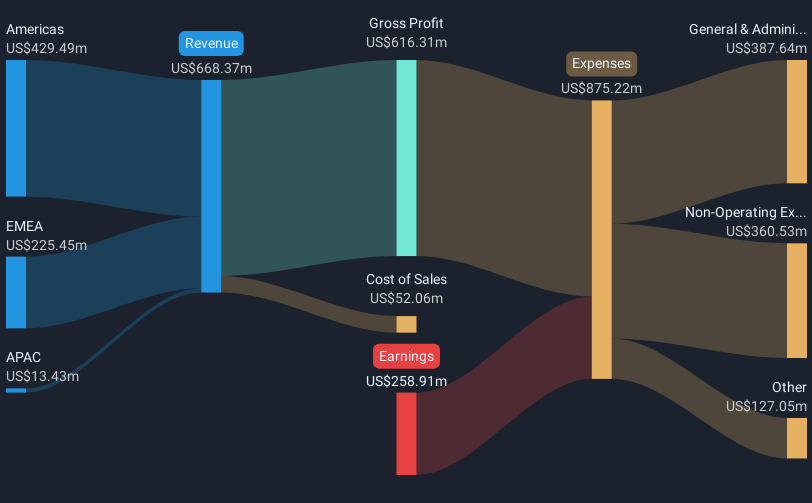

Lumine Group (TSXV:LMN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lumine Group Inc. is a global provider specializing in the development, installation, and customization of software solutions, with a market cap of CA$12.12 billion.

Operations: The company generates revenue primarily through its communications software segment, which accounts for CA$705.96 million.

Lumine Group has shown a remarkable turnaround, transitioning from a net loss to reporting a net income of USD 20.78 million this quarter, contrasting sharply with the previous year's loss of USD 304.34 million. This financial recovery is underscored by a robust revenue increase to USD 178.69 million from USD 141.1 million year-over-year, reflecting an annualized growth rate of 19.1%. The appointment of Mary Anne Lavallee as CFO is poised to further enhance this momentum, leveraging her extensive experience in finance and transformation roles to steer Lumine through its next growth phase. These strategic moves align with industry trends where software companies are increasingly adopting SaaS models to secure recurring revenue streams, positioning Lumine well within its competitive landscape.

- Unlock comprehensive insights into our analysis of Lumine Group stock in this health report.

Evaluate Lumine Group's historical performance by accessing our past performance report.

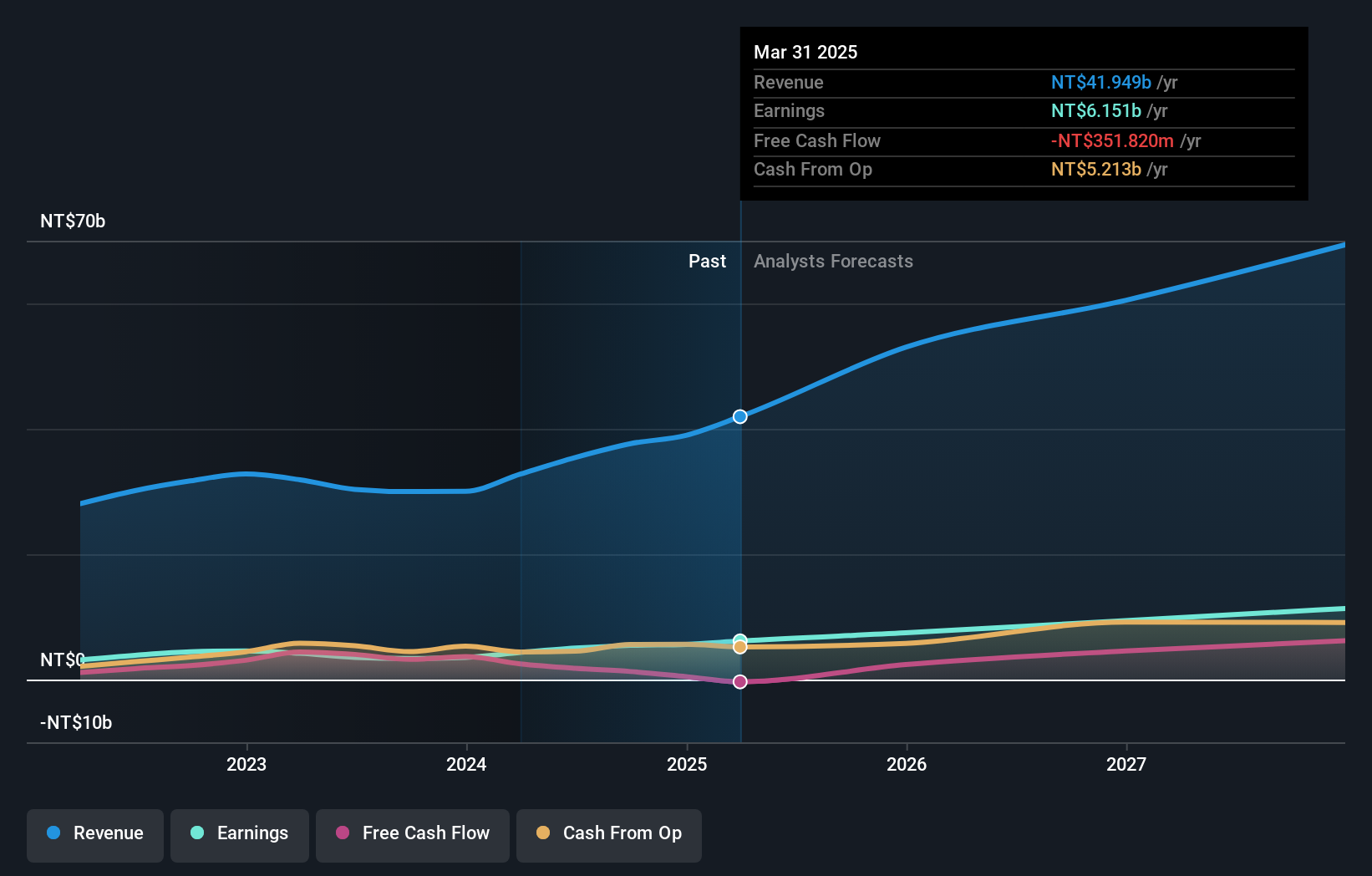

Gold Circuit Electronics (TWSE:2368)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Gold Circuit Electronics Ltd. is a Taiwanese company specializing in the design, manufacture, processing, and distribution of printed circuit boards with a market cap of NT$134.33 billion.

Operations: The company generates revenue primarily from the manufacturing and sales of printed circuit boards, amounting to NT$41.95 billion.

Gold Circuit Electronics Ltd. has demonstrated robust financial performance, with first-quarter sales soaring to TWD 12.06 billion, up from TWD 9.07 billion year-over-year, and net income rising to TWD 1.75 billion from TWD 1.22 billion in the same period. This represents a significant earnings growth of 42.5% over the past year, outpacing the electronics industry's average of 14.2%. The company's strategic presentations at key tech conferences and recent amendments to its Articles of Incorporation highlight proactive governance and engagement with technological trends, positioning it favorably in a competitive market where innovation drives growth.

Key Takeaways

- Click here to access our complete index of 757 Global High Growth Tech and AI Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:LMN

Lumine Group

Offers develops, installs, and customizes of software worldwide.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives