Investors Appear Satisfied With Imeik Technology Development Co.,Ltd.'s (SZSE:300896) Prospects As Shares Rocket 43%

Imeik Technology Development Co.,Ltd. (SZSE:300896) shareholders would be excited to see that the share price has had a great month, posting a 43% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 30% over that time.

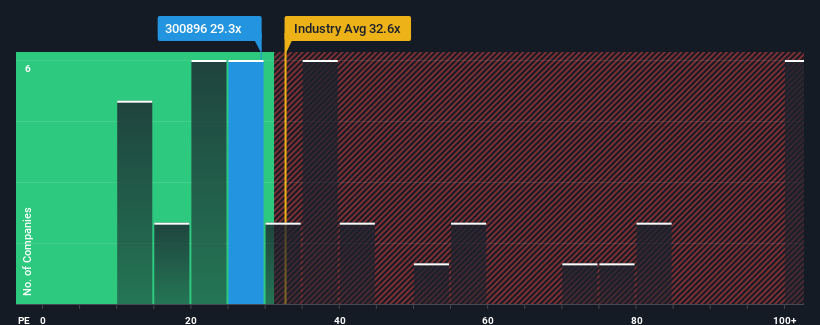

In spite of the firm bounce in price, there still wouldn't be many who think Imeik Technology DevelopmentLtd's price-to-earnings (or "P/E") ratio of 29.3x is worth a mention when the median P/E in China is similar at about 29x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Imeik Technology DevelopmentLtd certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. One possibility is that the P/E is moderate because investors think the company's earnings will be less resilient moving forward. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Check out our latest analysis for Imeik Technology DevelopmentLtd

Is There Some Growth For Imeik Technology DevelopmentLtd?

In order to justify its P/E ratio, Imeik Technology DevelopmentLtd would need to produce growth that's similar to the market.

If we review the last year of earnings growth, the company posted a terrific increase of 23%. Pleasingly, EPS has also lifted 164% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 20% per annum as estimated by the analysts watching the company. With the market predicted to deliver 19% growth per year, the company is positioned for a comparable earnings result.

In light of this, it's understandable that Imeik Technology DevelopmentLtd's P/E sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Key Takeaway

Its shares have lifted substantially and now Imeik Technology DevelopmentLtd's P/E is also back up to the market median. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Imeik Technology DevelopmentLtd maintains its moderate P/E off the back of its forecast growth being in line with the wider market, as expected. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. Unless these conditions change, they will continue to support the share price at these levels.

You always need to take note of risks, for example - Imeik Technology DevelopmentLtd has 1 warning sign we think you should be aware of.

You might be able to find a better investment than Imeik Technology DevelopmentLtd. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300896

Imeik Technology DevelopmentLtd

Engages in the research and development, production, and transformation of biomedical soft tissue repair materials in China.

Flawless balance sheet and good value.

Market Insights

Community Narratives