Take Care Before Jumping Onto Hvsen Biotechnology Co., Ltd. (SZSE:300871) Even Though It's 27% Cheaper

The Hvsen Biotechnology Co., Ltd. (SZSE:300871) share price has softened a substantial 27% over the previous 30 days, handing back much of the gains the stock has made lately. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 34% in that time.

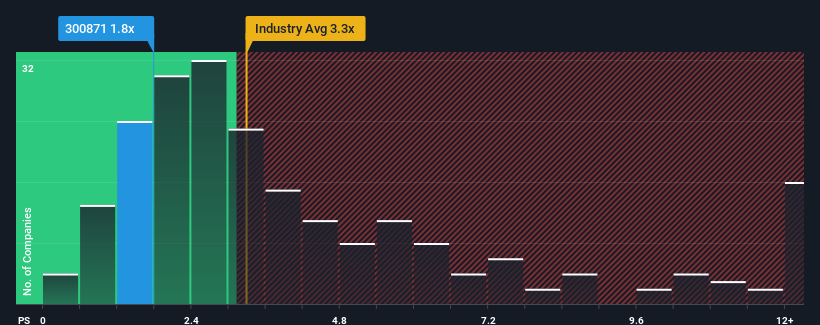

Since its price has dipped substantially, Hvsen Biotechnology's price-to-sales (or "P/S") ratio of 1.8x might make it look like a buy right now compared to the Pharmaceuticals industry in China, where around half of the companies have P/S ratios above 3.3x and even P/S above 6x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Hvsen Biotechnology

What Does Hvsen Biotechnology's Recent Performance Look Like?

Hvsen Biotechnology hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Hvsen Biotechnology's future stacks up against the industry? In that case, our free report is a great place to start.How Is Hvsen Biotechnology's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Hvsen Biotechnology's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 4.9% decrease to the company's top line. Unfortunately, that's brought it right back to where it started three years ago with revenue growth being virtually non-existent overall during that time. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 33% over the next year. With the industry only predicted to deliver 19%, the company is positioned for a stronger revenue result.

With this information, we find it odd that Hvsen Biotechnology is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What Does Hvsen Biotechnology's P/S Mean For Investors?

The southerly movements of Hvsen Biotechnology's shares means its P/S is now sitting at a pretty low level. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Hvsen Biotechnology's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Before you settle on your opinion, we've discovered 2 warning signs for Hvsen Biotechnology (1 is significant!) that you should be aware of.

If you're unsure about the strength of Hvsen Biotechnology's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade Hvsen Biotechnology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hvsen Biotechnology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300871

Hvsen Biotechnology

Engages in the research and development, and manufacture of macrolides APIs and preparations in China and internationally.

High growth potential and good value.

Market Insights

Community Narratives