- China

- /

- Life Sciences

- /

- SZSE:300759

Pharmaron Beijing Co., Ltd.'s (SZSE:300759) 27% Share Price Surge Not Quite Adding Up

Those holding Pharmaron Beijing Co., Ltd. (SZSE:300759) shares would be relieved that the share price has rebounded 27% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 36% in the last twelve months.

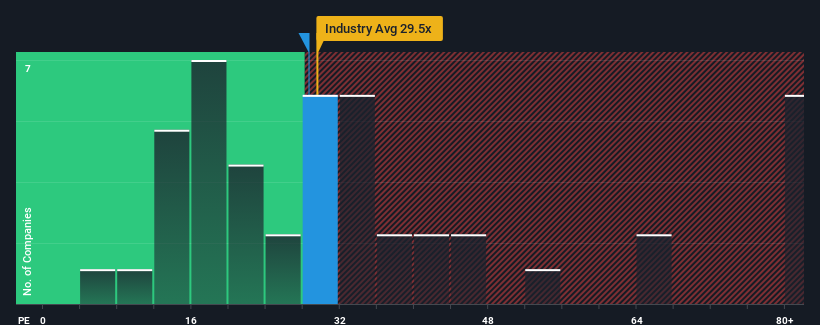

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Pharmaron Beijing's P/E ratio of 28.6x, since the median price-to-earnings (or "P/E") ratio in China is also close to 30x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Pharmaron Beijing's negative earnings growth of late has neither been better nor worse than most other companies. The P/E is probably moderate because investors think the company's earnings trend will continue to follow the rest of the market. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. In saying that, existing shareholders probably aren't too pessimistic about the share price if the company's earnings continue tracking the market.

Check out our latest analysis for Pharmaron Beijing

Is There Some Growth For Pharmaron Beijing?

In order to justify its P/E ratio, Pharmaron Beijing would need to produce growth that's similar to the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 1.5%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 49% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 21% during the coming year according to the analysts following the company. That's shaping up to be materially lower than the 42% growth forecast for the broader market.

With this information, we find it interesting that Pharmaron Beijing is trading at a fairly similar P/E to the market. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

The Key Takeaway

Pharmaron Beijing's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Pharmaron Beijing's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You should always think about risks. Case in point, we've spotted 1 warning sign for Pharmaron Beijing you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300759

Pharmaron Beijing

Provides drug research and development, and production services to the life sciences industry in North America, Europe, Japan, Mainland China, and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives