PharmaBlock Sciences (Nanjing), Inc. (SZSE:300725) Looks Just Right With A 25% Price Jump

Those holding PharmaBlock Sciences (Nanjing), Inc. (SZSE:300725) shares would be relieved that the share price has rebounded 25% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 59% share price drop in the last twelve months.

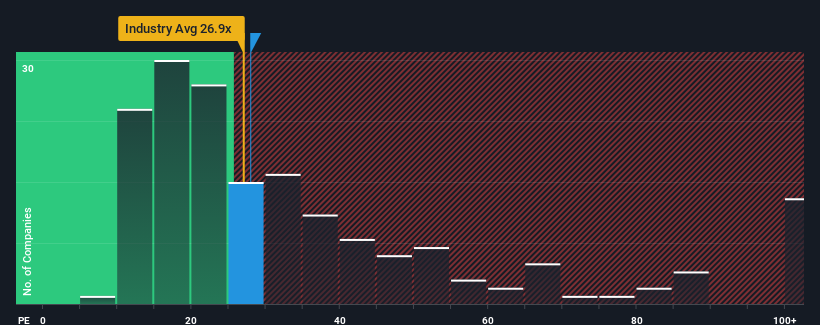

Although its price has surged higher, there still wouldn't be many who think PharmaBlock Sciences (Nanjing)'s price-to-earnings (or "P/E") ratio of 27.9x is worth a mention when the median P/E in China is similar at about 30x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

With earnings that are retreating more than the market's of late, PharmaBlock Sciences (Nanjing) has been very sluggish. It might be that many expect the dismal earnings performance to revert back to market averages soon, which has kept the P/E from falling. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for PharmaBlock Sciences (Nanjing)

Does Growth Match The P/E?

PharmaBlock Sciences (Nanjing)'s P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Retrospectively, the last year delivered a frustrating 26% decrease to the company's bottom line. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 16% in total. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the four analysts covering the company suggest earnings should grow by 38% over the next year. Meanwhile, the rest of the market is forecast to expand by 41%, which is not materially different.

In light of this, it's understandable that PharmaBlock Sciences (Nanjing)'s P/E sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What We Can Learn From PharmaBlock Sciences (Nanjing)'s P/E?

PharmaBlock Sciences (Nanjing) appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that PharmaBlock Sciences (Nanjing) maintains its moderate P/E off the back of its forecast growth being in line with the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. It's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Having said that, be aware PharmaBlock Sciences (Nanjing) is showing 1 warning sign in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on PharmaBlock Sciences (Nanjing), explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade PharmaBlock Sciences (Nanjing), open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300725

PharmaBlock Sciences (Nanjing)

Provides chemistry products and services throughout the pharmaceutical research and development, and commercial production.

Reasonable growth potential with adequate balance sheet.