- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A140860

3 Stocks That Might Be Trading Below Their Estimated Intrinsic Values

Reviewed by Simply Wall St

As global markets navigate a mixed start to the new year, with U.S. stocks closing out a strong 2024 despite recent declines, investors are keenly observing economic indicators such as the Chicago PMI and GDP forecasts for insights into future trends. In this environment of fluctuating indices and cautious optimism, identifying stocks that may be trading below their estimated intrinsic values can present intriguing opportunities for those looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sichuan Injet Electric (SZSE:300820) | CN¥50.39 | CN¥100.77 | 50% |

| NBTM New Materials Group (SHSE:600114) | CN¥15.60 | CN¥31.09 | 49.8% |

| Gaming Realms (AIM:GMR) | £0.36 | £0.72 | 49.9% |

| Tongqinglou Catering (SHSE:605108) | CN¥21.59 | CN¥43.14 | 50% |

| Hyundai Rotem (KOSE:A064350) | ₩54700.00 | ₩109043.21 | 49.8% |

| Kinaxis (TSX:KXS) | CA$170.99 | CA$340.11 | 49.7% |

| Aguas Andinas (SNSE:AGUAS-A) | CLP291.00 | CLP578.59 | 49.7% |

| Vogo (ENXTPA:ALVGO) | €2.94 | €5.87 | 49.9% |

| Exosens (ENXTPA:EXENS) | €22.505 | €44.77 | 49.7% |

| Salmones Camanchaca (SNSE:SALMOCAM) | CLP2434.90 | CLP4848.26 | 49.8% |

Let's explore several standout options from the results in the screener.

Park Systems (KOSDAQ:A140860)

Overview: Park Systems Corp. develops, manufactures, and sells atomic force microscopy (AFM) systems globally, with a market cap of ₩1.68 trillion.

Operations: The company generates revenue of ₩157.20 billion from its Scientific & Technical Instruments segment, focusing on atomic force microscopy systems.

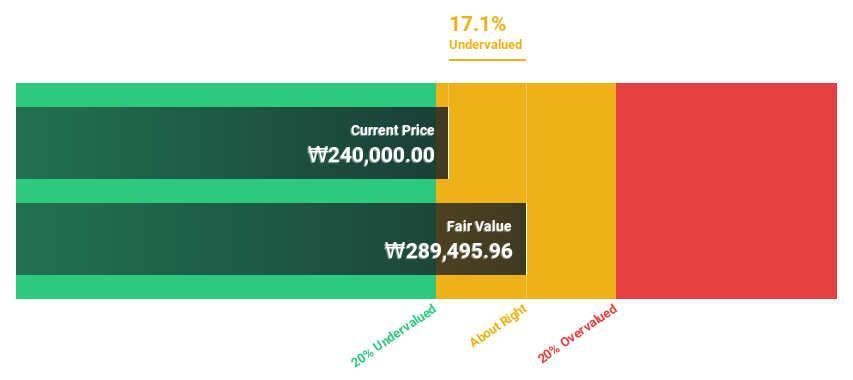

Estimated Discount To Fair Value: 17.1%

Park Systems is trading at ₩240,000, below its estimated fair value of ₩289,530.46, and exhibits high-quality earnings despite a significant level of non-cash components. Its earnings are forecast to grow 36.9% annually over the next three years, surpassing market expectations. A recent partnership with Labindia Instruments in India aligns with the country's semiconductor growth initiatives, potentially enhancing Park's revenue and influence in this rapidly expanding sector.

- Upon reviewing our latest growth report, Park Systems' projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of Park Systems stock in this financial health report.

HYBE (KOSE:A352820)

Overview: HYBE Co., Ltd. operates in music production, publishing, and artist development and management, with a market cap of approximately ₩8.39 trillion.

Operations: The company's revenue segments include Label at ₩1.29 trillion, Platform at ₩337.18 billion, and Solution at ₩1.21 trillion.

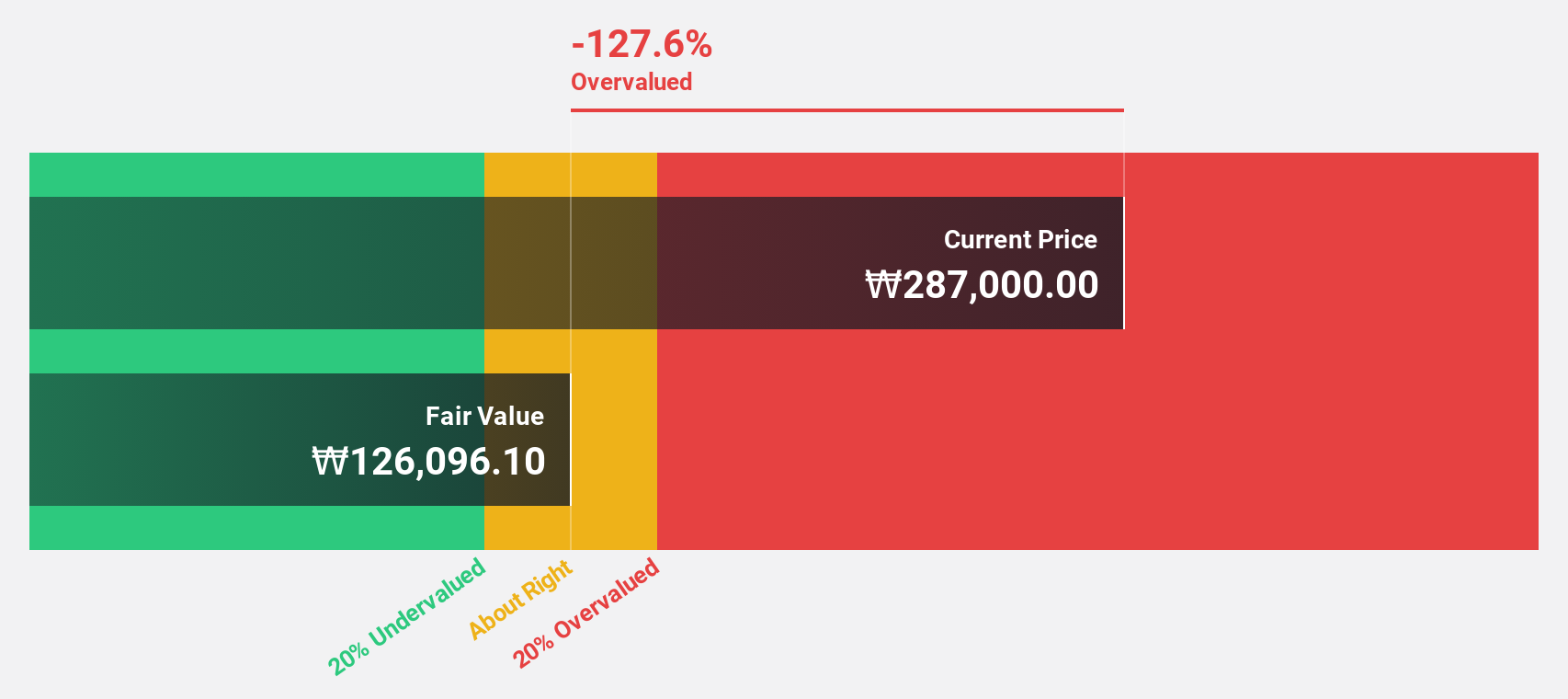

Estimated Discount To Fair Value: 17.8%

HYBE is trading at ₩215,500, below its estimated fair value of ₩262,250.87. Despite recent leadership changes and a challenging third quarter with net income dropping significantly from the previous year, HYBE's earnings are projected to grow 51.8% annually over the next three years. The company recently completed a private placement of convertible bonds worth ₩400 billion to support future growth initiatives in the global music market.

- In light of our recent growth report, it seems possible that HYBE's financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in HYBE's balance sheet health report.

Hunan Jiudian Pharmaceutical (SZSE:300705)

Overview: Hunan Jiudian Pharmaceutical Co., Ltd. is engaged in the research, development, production, and sale of pharmaceutical products both in China and internationally, with a market cap of CN¥8.29 billion.

Operations: The company generates revenue of CN¥2.95 billion from its medicine manufacturing segment.

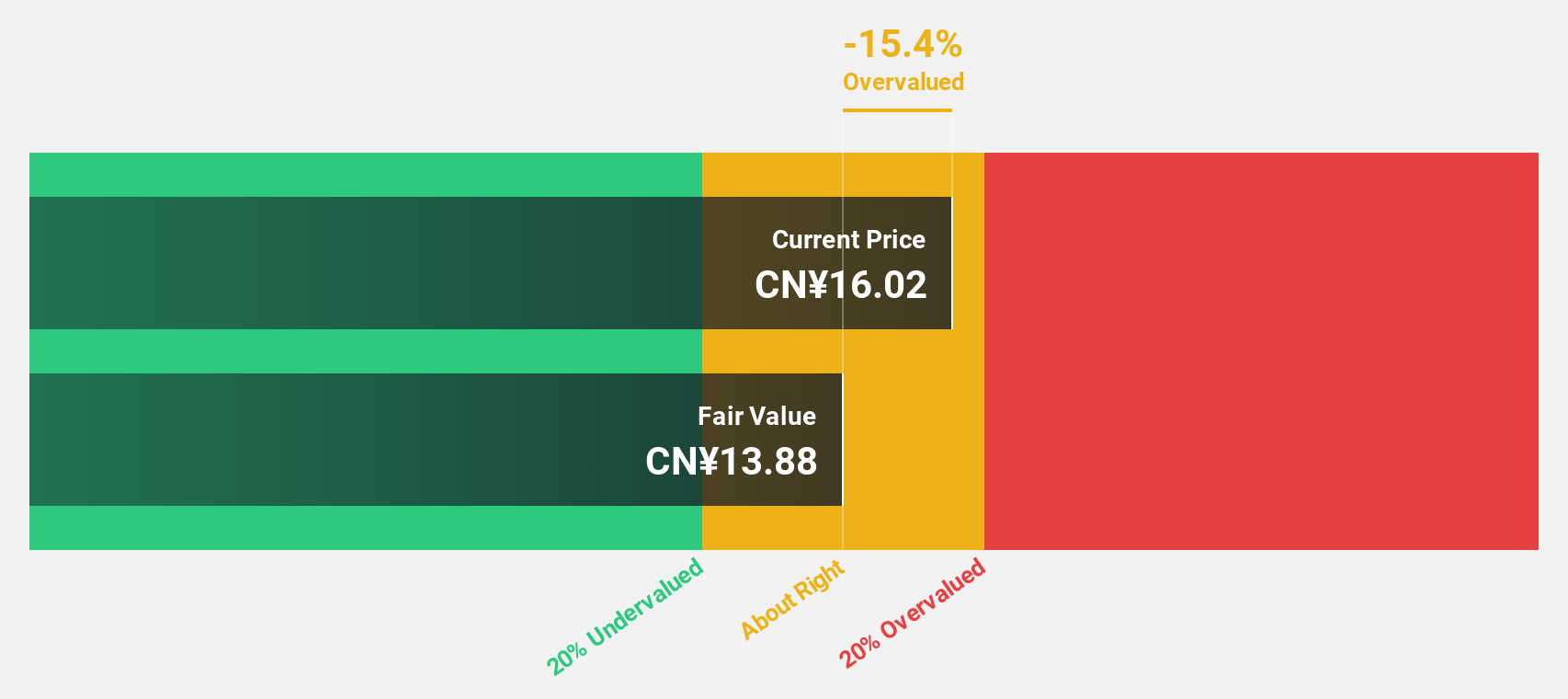

Estimated Discount To Fair Value: 49.7%

Hunan Jiudian Pharmaceutical is trading at CN¥17.19, significantly below its estimated fair value of CN¥34.17, suggesting it may be undervalued based on cash flows. The company's earnings grew by 36.8% over the past year and are expected to continue growing at 25.3% annually, surpassing market averages. Despite shareholder dilution last year, recent earnings reports show improved net income and revenue growth compared to the previous year, reinforcing its investment potential.

- Our growth report here indicates Hunan Jiudian Pharmaceutical may be poised for an improving outlook.

- Take a closer look at Hunan Jiudian Pharmaceutical's balance sheet health here in our report.

Make It Happen

- Get an in-depth perspective on all 887 Undervalued Stocks Based On Cash Flows by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A140860

Park Systems

Develops, manufactures, and sells atomic force microscopy (AFM) systems worldwide.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives