February 2025's Stocks Estimated To Be Trading Below Their Intrinsic Value

Reviewed by Simply Wall St

As global markets grapple with geopolitical tensions and consumer spending concerns, major indices have experienced declines despite early-week gains. Amidst this volatility, investors may find potential opportunities in stocks that are estimated to be trading below their intrinsic value, offering a chance to capitalize on market inefficiencies. Identifying such undervalued stocks requires careful analysis of fundamentals and market sentiment, particularly in the current climate of economic uncertainty and fluctuating investor confidence.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Ningbo Sanxing Medical ElectricLtd (SHSE:601567) | CN¥26.26 | CN¥52.18 | 49.7% |

| Hibino (TSE:2469) | ¥2795.00 | ¥5546.91 | 49.6% |

| Absolent Air Care Group (OM:ABSO) | SEK270.00 | SEK535.44 | 49.6% |

| Nuvoton Technology (TWSE:4919) | NT$95.80 | NT$191.46 | 50% |

| América Móvil. de (BMV:AMX B) | MX$14.89 | MX$29.71 | 49.9% |

| Neosem (KOSDAQ:A253590) | ₩12050.00 | ₩23935.35 | 49.7% |

| CD Projekt (WSE:CDR) | PLN221.70 | PLN441.47 | 49.8% |

| Siam Wellness Group (SET:SPA) | THB5.35 | THB10.69 | 49.9% |

| Sandfire Resources (ASX:SFR) | A$10.53 | A$20.98 | 49.8% |

| Integral Diagnostics (ASX:IDX) | A$2.89 | A$5.77 | 49.9% |

Let's uncover some gems from our specialized screener.

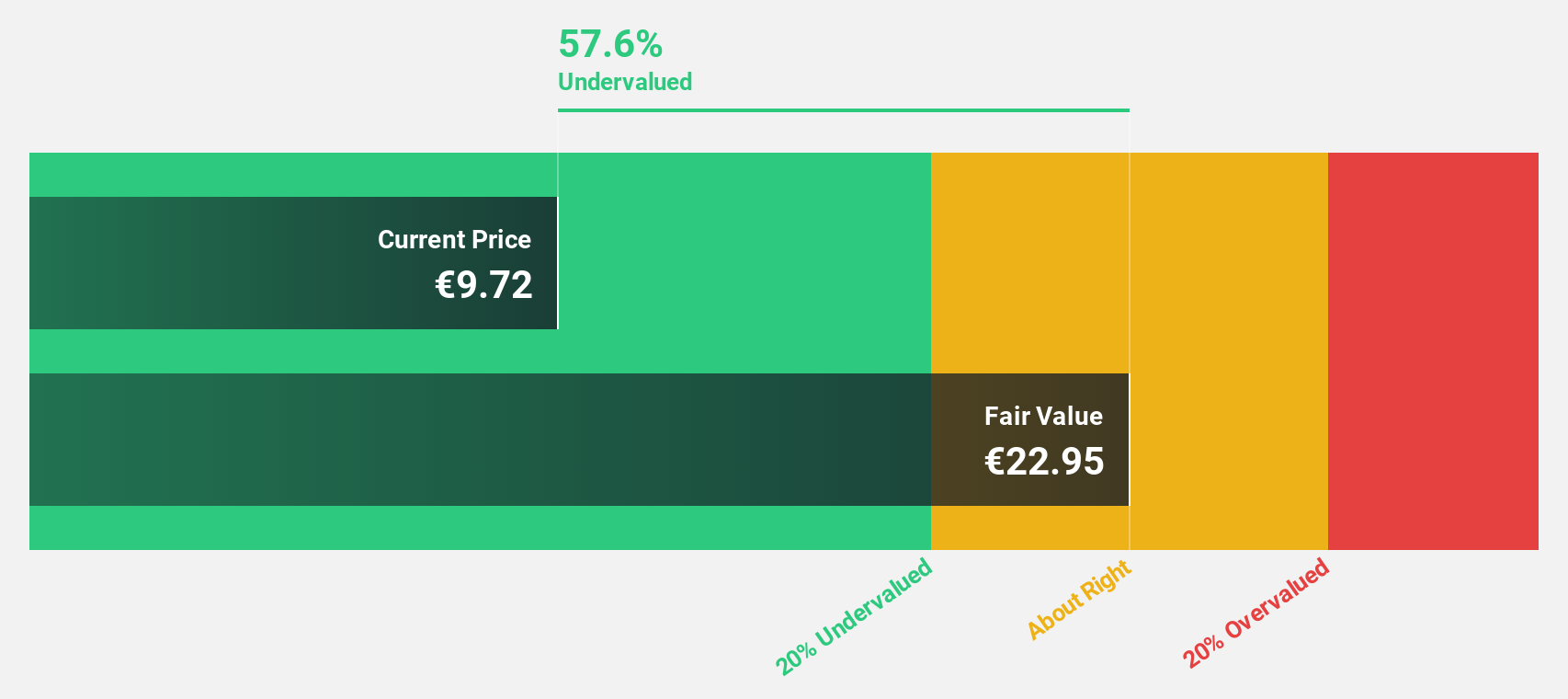

Ibersol S.G.P.S (ENXTLS:IBS)

Overview: Ibersol S.G.P.S. operates a network of restaurants in Portugal, Spain, and Angola through its subsidiaries, with a market cap of €352.32 million.

Operations: The company's revenue segments include Counters generating €172.83 million, Restaurants contributing €111.42 million, and Concessions, Travel and Catering accounting for €168.70 million.

Estimated Discount To Fair Value: 31.9%

Ibersol S.G.P.S. is trading at €8.54, significantly below its estimated fair value of €12.55, indicating potential undervaluation based on cash flows. Recent earnings show growth in sales and net income, with third-quarter sales at €136.28 million and net income rising to €7.35 million year-over-year. Despite a low return on equity forecast (6.6%), earnings are expected to grow significantly at 20% annually, outpacing the Portuguese market's growth rate of 8.7%.

- Our expertly prepared growth report on Ibersol S.G.P.S implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Ibersol S.G.P.S.

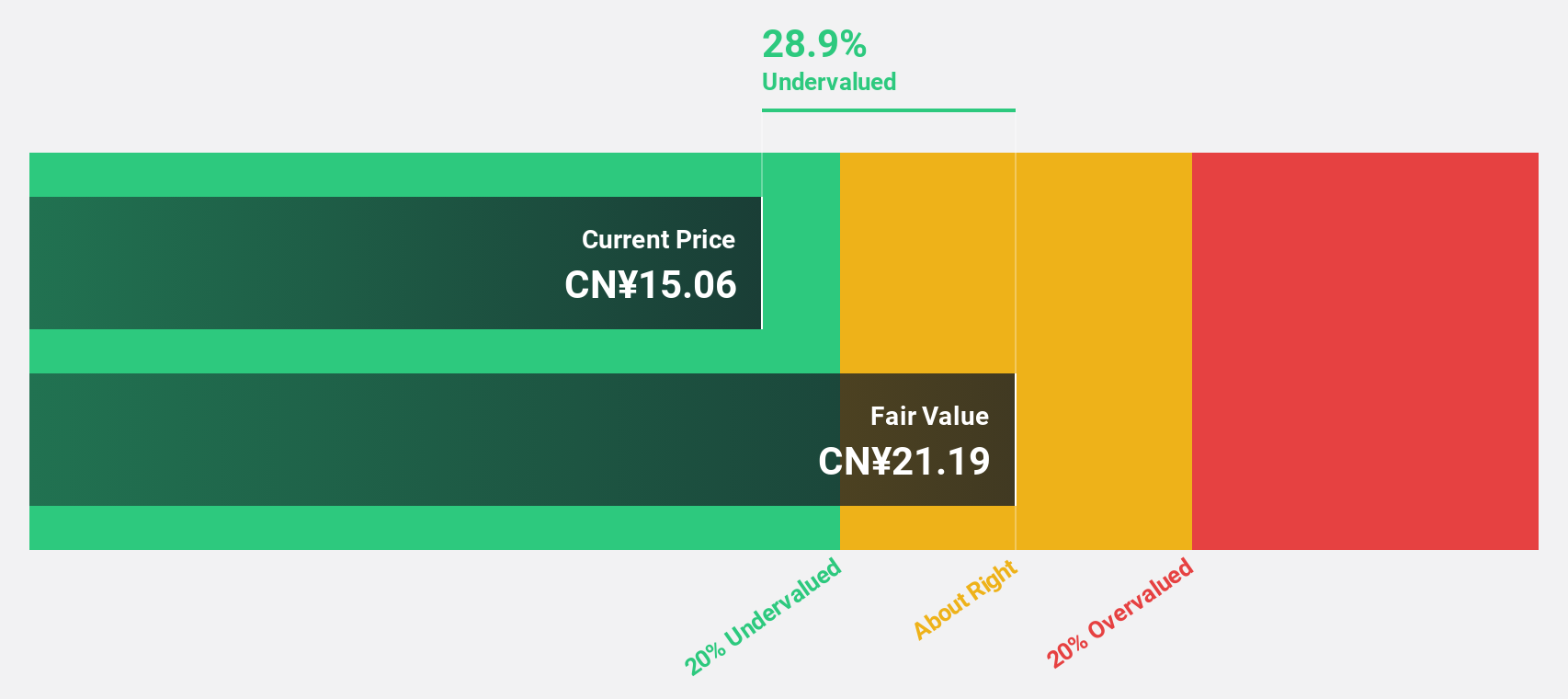

Anhui Anli Material Technology (SZSE:300218)

Overview: Anhui Anli Material Technology Co., Ltd. focuses on the R&D, production, sale, and servicing of ecological functional polyurethane synthetic leather products and other polymer composite materials in China, with a market cap of CN¥3.58 billion.

Operations: The company's revenue is primarily derived from its artificial leather synthetic leather industry segment, totaling CN¥2.37 billion.

Estimated Discount To Fair Value: 21.1%

Anhui Anli Material Technology, trading at CN¥16.76, is valued below its fair value of CN¥21.25, highlighting potential undervaluation based on cash flows. Revenue growth is forecast at 19.6% annually, outpacing the Chinese market's 13.4%. Earnings are expected to grow significantly by 27.2% per year over the next three years, surpassing the market's 25.3%. Despite this growth outlook, the company has an unstable dividend history and a low return on equity forecast of 17.5%.

- Our comprehensive growth report raises the possibility that Anhui Anli Material Technology is poised for substantial financial growth.

- Take a closer look at Anhui Anli Material Technology's balance sheet health here in our report.

Zhejiang Tianyu Pharmaceutical (SZSE:300702)

Overview: Zhejiang Tianyu Pharmaceutical Co., Ltd. focuses on the research, development, manufacture, and sale of pharmaceutical intermediates and APIs both in China and internationally, with a market cap of CN¥6.24 billion.

Operations: Zhejiang Tianyu Pharmaceutical Co., Ltd.'s revenue is primarily derived from its operations in pharmaceutical intermediates and active pharmaceutical ingredients (APIs) across domestic and international markets.

Estimated Discount To Fair Value: 43.8%

Zhejiang Tianyu Pharmaceutical, trading at CN¥18.13, is significantly undervalued with a fair value estimate of CN¥32.27 based on cash flows. Although revenue growth is forecasted at 16.8% annually, slower than 20%, earnings are expected to grow very rapidly at 71.4% per year, outpacing the Chinese market's average of 25.3%. Despite becoming profitable recently, the return on equity is projected to be low at 7.9% in three years.

- Our growth report here indicates Zhejiang Tianyu Pharmaceutical may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of Zhejiang Tianyu Pharmaceutical stock in this financial health report.

Summing It All Up

- Investigate our full lineup of 915 Undervalued Stocks Based On Cash Flows right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300218

Anhui Anli Material Technology

Engages in the research and development, production, sale, and servicing of ecological functional polyurethane synthetic leather products, polyurethane resin series products, and other polymer composite materials in China.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives