Wuhan Hiteck Biological Pharma Co.,Ltd's (SZSE:300683) Shareholders Might Be Looking For Exit

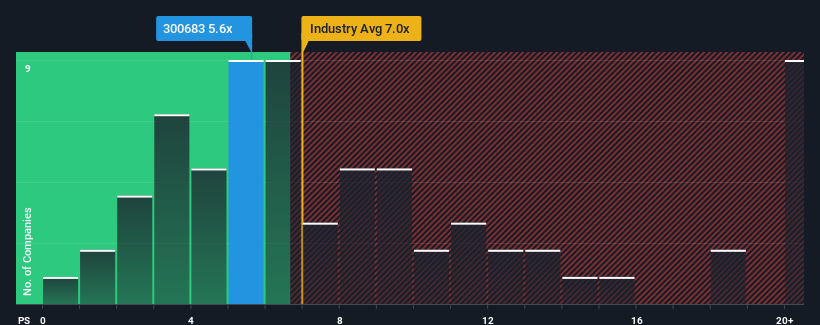

There wouldn't be many who think Wuhan Hiteck Biological Pharma Co.,Ltd's (SZSE:300683) price-to-sales (or "P/S") ratio of 5.6x is worth a mention when the median P/S for the Biotechs industry in China is similar at about 7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Wuhan Hiteck Biological PharmaLtd

What Does Wuhan Hiteck Biological PharmaLtd's Recent Performance Look Like?

It looks like revenue growth has deserted Wuhan Hiteck Biological PharmaLtd recently, which is not something to boast about. One possibility is that the P/S is moderate because investors think this benign revenue growth rate might not be enough to outperform the broader industry in the near future. Those who are bullish on Wuhan Hiteck Biological PharmaLtd will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Wuhan Hiteck Biological PharmaLtd's earnings, revenue and cash flow.How Is Wuhan Hiteck Biological PharmaLtd's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Wuhan Hiteck Biological PharmaLtd's to be considered reasonable.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Still, the latest three year period was better as it's delivered a decent 7.7% overall rise in revenue. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 230% shows it's noticeably less attractive.

With this in mind, we find it intriguing that Wuhan Hiteck Biological PharmaLtd's P/S is comparable to that of its industry peers. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

What Does Wuhan Hiteck Biological PharmaLtd's P/S Mean For Investors?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Wuhan Hiteck Biological PharmaLtd revealed its poor three-year revenue trends aren't resulting in a lower P/S as per our expectations, given they look worse than current industry outlook. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. Unless the recent medium-term conditions improve, it's hard to accept the current share price as fair value.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Wuhan Hiteck Biological PharmaLtd that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade Wuhan Hiteck Biological PharmaLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Wuhan Hiteck Biological PharmaLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300683

Wuhan Hiteck Biological PharmaLtd

A biopharmaceutical company, engages in the research and development, production, and sale of bio engineering products and freeze-dried powder injection in China.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives