There's No Escaping Wuhan Hiteck Biological Pharma Co.,Ltd's (SZSE:300683) Muted Revenues Despite A 28% Share Price Rise

Wuhan Hiteck Biological Pharma Co.,Ltd (SZSE:300683) shareholders are no doubt pleased to see that the share price has bounced 28% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 33% in the last twelve months.

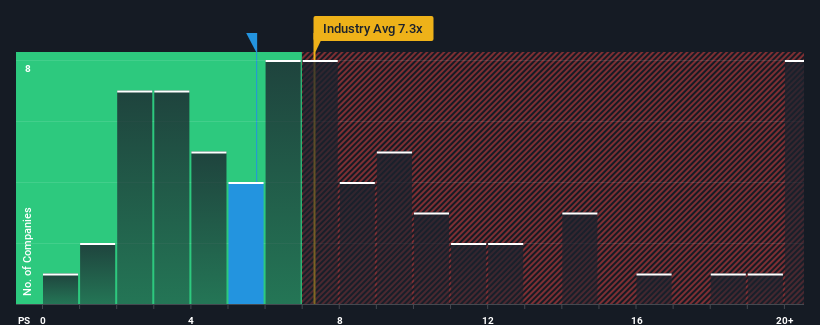

Even after such a large jump in price, Wuhan Hiteck Biological PharmaLtd may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 5.7x, considering almost half of all companies in the Biotechs industry in China have P/S ratios greater than 7.3x and even P/S higher than 12x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Wuhan Hiteck Biological PharmaLtd

How Wuhan Hiteck Biological PharmaLtd Has Been Performing

As an illustration, revenue has deteriorated at Wuhan Hiteck Biological PharmaLtd over the last year, which is not ideal at all. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. Those who are bullish on Wuhan Hiteck Biological PharmaLtd will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Wuhan Hiteck Biological PharmaLtd will help you shine a light on its historical performance.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Wuhan Hiteck Biological PharmaLtd's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 25% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 16% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Comparing that to the industry, which is predicted to deliver 162% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this in consideration, it's easy to understand why Wuhan Hiteck Biological PharmaLtd's P/S falls short of the mark set by its industry peers. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

What Does Wuhan Hiteck Biological PharmaLtd's P/S Mean For Investors?

Despite Wuhan Hiteck Biological PharmaLtd's share price climbing recently, its P/S still lags most other companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Wuhan Hiteck Biological PharmaLtd revealed its three-year revenue trends are contributing to its low P/S, given they look worse than current industry expectations. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Wuhan Hiteck Biological PharmaLtd that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

If you're looking to trade Wuhan Hiteck Biological PharmaLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Wuhan Hiteck Biological PharmaLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300683

Wuhan Hiteck Biological PharmaLtd

A biopharmaceutical company, engages in the research and development, production, and sale of bio engineering products and freeze-dried powder injection in China.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives