As global markets navigate a period of uncertainty marked by cautious Federal Reserve commentary and political tensions, smaller-cap indices have faced significant challenges, with the S&P 500 experiencing its longest streak of more decliners than gainers since 1978. Amid these conditions, investors are closely examining high growth tech stocks for their potential to outperform in a volatile environment, focusing on companies that demonstrate robust innovation and adaptability to shifting economic landscapes.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.34% | 70.30% | ★★★★★★ |

| TG Therapeutics | 34.86% | 56.98% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

Click here to see the full list of 1271 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Sichuan Kelun-Biotech Biopharmaceutical (SEHK:6990)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sichuan Kelun-Biotech Biopharmaceutical Co., Ltd. is a biopharmaceutical company focused on the research, development, manufacturing, and commercialization of novel drugs to address unmet medical needs both in China and internationally, with a market capitalization of approximately HK$38.44 billion.

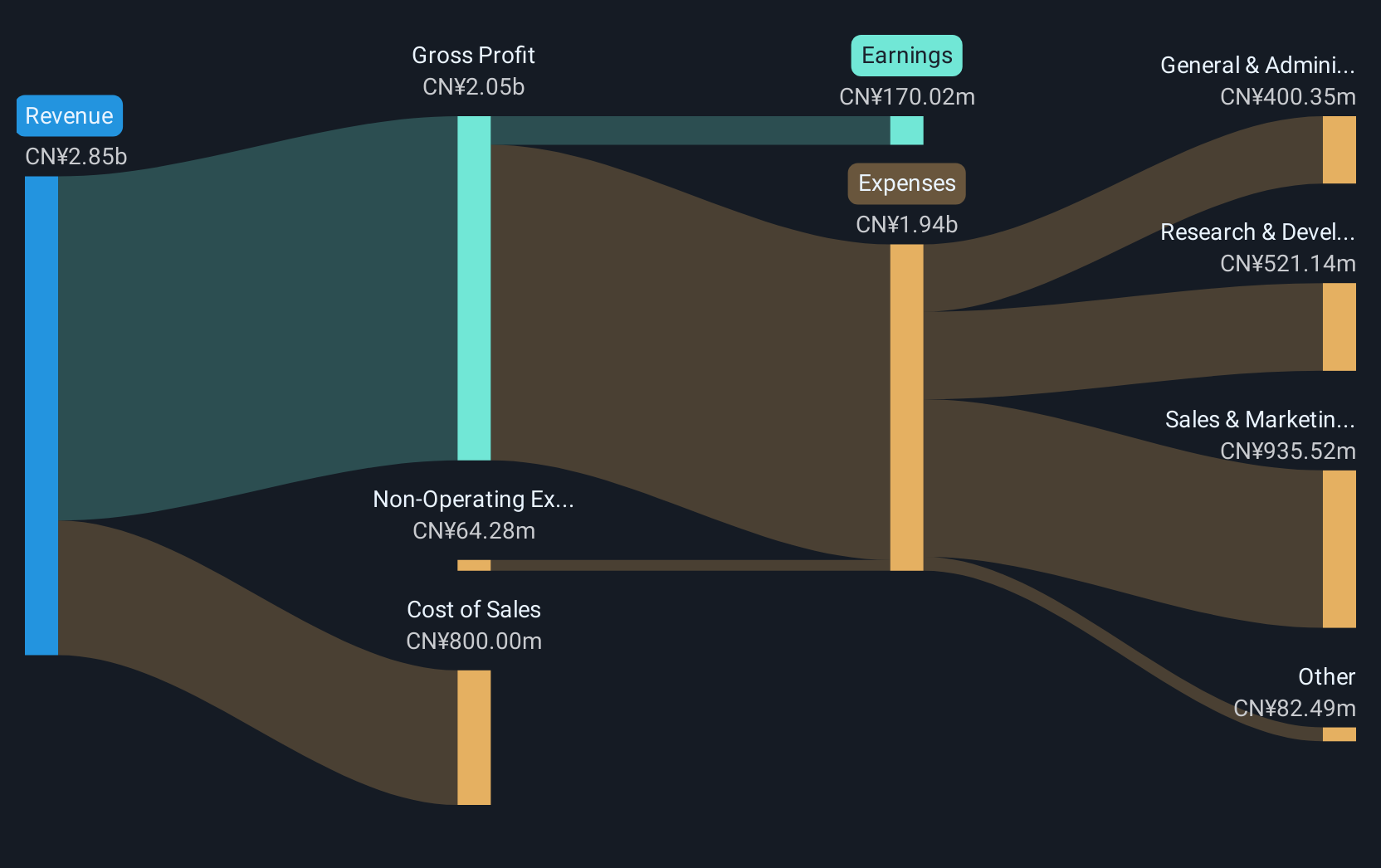

Operations: Kelun-Biotech generates revenue primarily from its pharmaceuticals segment, which amounted to CN¥1.88 billion. The company is involved in the entire drug lifecycle, from research and development to commercialization, catering to both domestic and international markets.

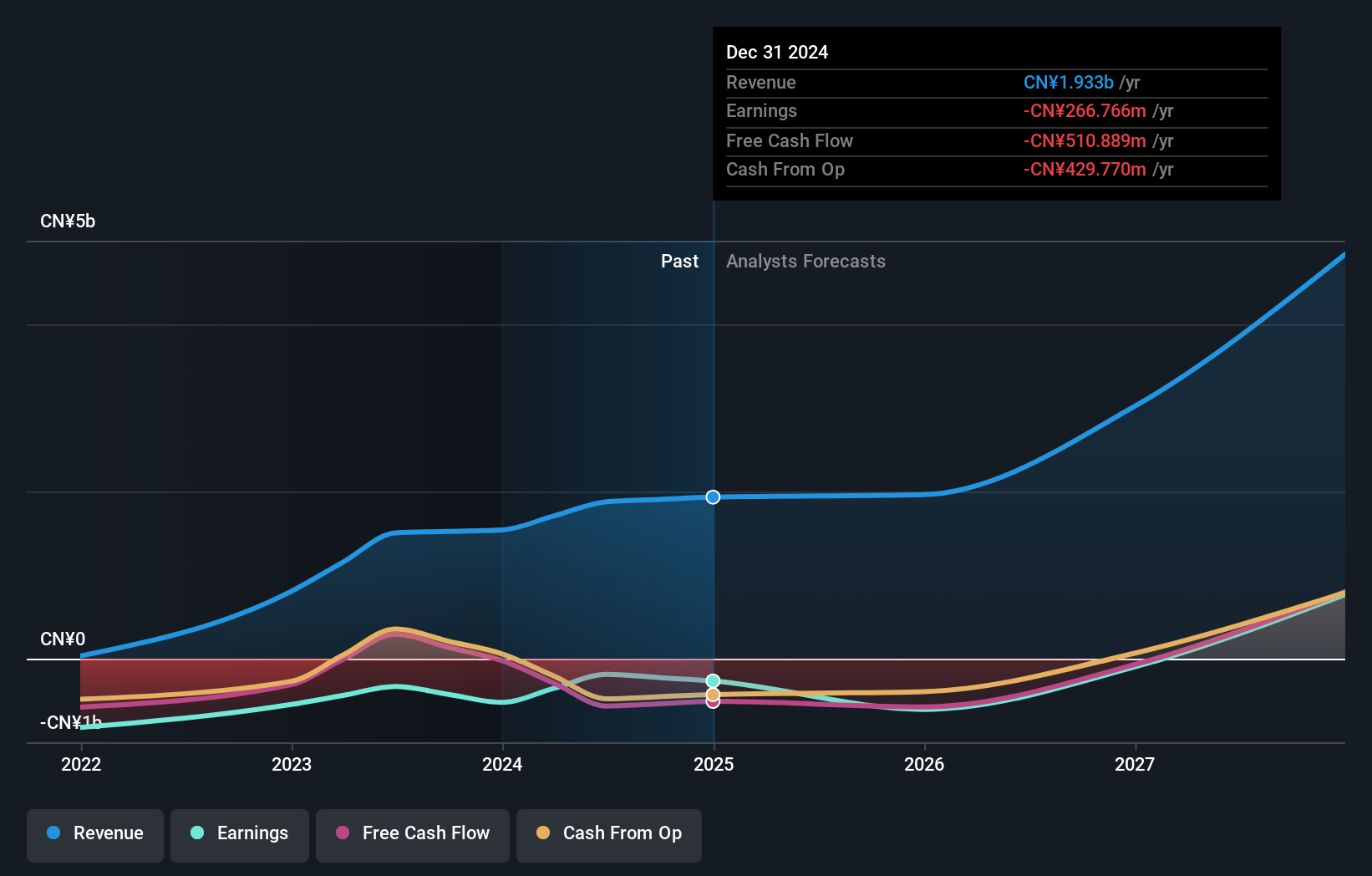

Sichuan Kelun-Biotech Biopharmaceutical's recent developments underscore its robust position in the biotech sector, particularly in advanced drug development. The company has seen a revenue growth of 24.7% over the past year and is expected to grow at an annual rate of 23.9%, outpacing the Hong Kong market's 7.8%. Despite current unprofitability, earnings are forecasted to improve by 4.48% annually. Innovations like SKB500 for solid tumors and sacituzumab tirumotecan for breast cancer, which showed significant clinical benefits at recent trials, highlight its forward-looking R&D strategy fueled by substantial investments aligning with industry demands for next-gen therapeutics.

Comet Holding (SWX:COTN)

Simply Wall St Growth Rating: ★★★★★★

Overview: Comet Holding AG, with a market cap of CHF1.95 billion, operates internationally through its subsidiaries to provide X-ray and radio frequency (RF) power technology solutions across Europe, North America, and Asia.

Operations: The company generates revenue through three primary segments: X-Ray Systems (CHF115.34 million), Industrial X-Ray Modules (CHF95.90 million), and Plasma Control Technologies (CHF180.62 million).

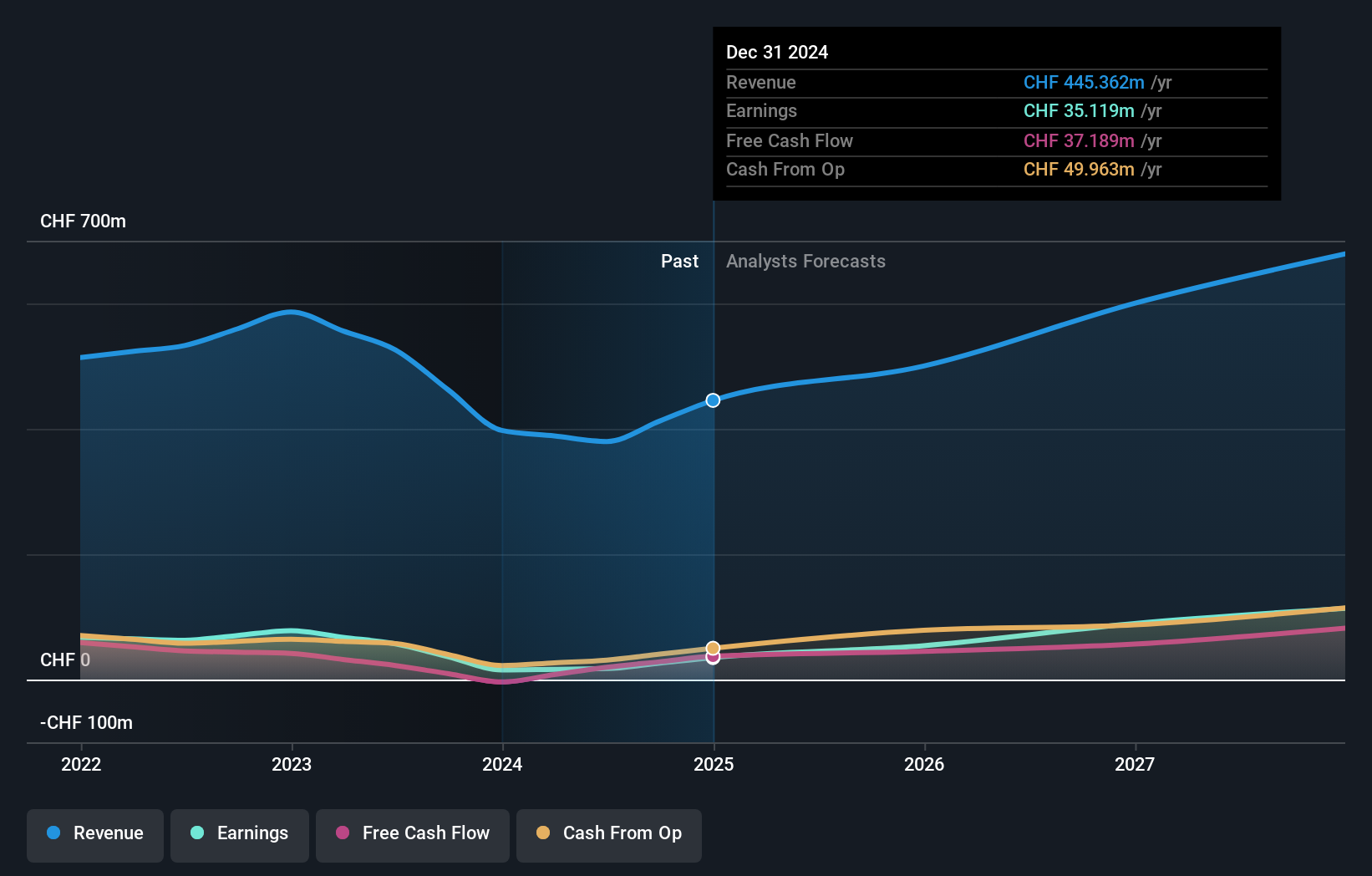

Comet Holding AG, with its revenue surging by 20.2% annually, outstrips the Swiss market's modest 4.2% growth, reflecting its robust position in the tech sector. Despite a challenging year with earnings down by 69.2%, future projections are bright, anticipating a significant rebound with an expected annual earnings increase of 48.5%. The firm's commitment to innovation is evident from its R&D expenditures which have strategically fueled these growth forecasts. Recent presentations at major tech conferences underscore Comet's active engagement in shaping industry trends and securing its competitive edge in a rapidly evolving marketplace.

- Get an in-depth perspective on Comet Holding's performance by reading our health report here.

Review our historical performance report to gain insights into Comet Holding's's past performance.

Shenzhen Kangtai Biological Products (SZSE:300601)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Kangtai Biological Products Co., Ltd. is a company engaged in the research, development, production, and sale of vaccines and biological products with a market cap of approximately CN¥19.91 billion.

Operations: Kangtai Biological Products generates revenue primarily from its biochemical products segment, amounting to CN¥3.03 billion.

Shenzhen Kangtai Biological Products, despite a recent dip in sales and net income as reported for the nine months ending September 2024, with revenues dropping to CNY 2.02 billion from CNY 2.46 billion year-over-year, remains poised for substantial growth. The company's earnings are expected to surge by an annual rate of 38.7%, significantly outpacing the broader Chinese market's forecast of 25.5%. This robust projection is underpinned by a previous year’s earnings growth of 42.7%, highlighting its resilience and potential in the biotech sector despite short-term fluctuations influenced by one-off gains of CN¥154.4 million affecting its financials last year.

- Click here to discover the nuances of Shenzhen Kangtai Biological Products with our detailed analytical health report.

Understand Shenzhen Kangtai Biological Products' track record by examining our Past report.

Key Takeaways

- Reveal the 1271 hidden gems among our High Growth Tech and AI Stocks screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300601

Shenzhen Kangtai Biological Products

Shenzhen Kangtai Biological Products Co., Ltd.

Undervalued with high growth potential.

Market Insights

Community Narratives