Exploring 3 High Growth Tech Stocks With Promising Potential

Reviewed by Simply Wall St

As global markets experience broad-based gains with smaller-cap indexes outperforming large-caps, positive sentiment is fueled by strong labor market data and rising home sales. In this environment, high growth tech stocks are particularly appealing due to their potential for innovation and adaptability in rapidly evolving sectors, making them intriguing options for those looking to explore opportunities within the dynamic tech landscape.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Waystream Holding | 22.16% | 113.25% | ★★★★★★ |

| Pharma Mar | 25.97% | 56.89% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Sarepta Therapeutics | 24.00% | 42.88% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.98% | ★★★★★★ |

| Elliptic Laboratories | 65.73% | 103.55% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

Click here to see the full list of 1292 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

OVH Groupe (ENXTPA:OVH)

Simply Wall St Growth Rating: ★★★★★☆

Overview: OVH Groupe S.A. is a global provider of public and private cloud services, shared hosting, and dedicated server solutions with a market capitalization of approximately €1.57 billion.

Operations: The company generates revenue primarily from its Private Cloud services (€623.53 million), followed by Public Cloud (€182.82 million) and Web cloud & Other services (€186.71 million).

OVH Groupe's strategic maneuvers, including the recent launch of managed MongoDB and a partnership with Digital Realty, underscore its commitment to enhancing cloud infrastructure and services. This is evident from its projected revenue growth at 9.9% annually, signaling robust market demand. Despite a challenging past with a net loss reported in the latest fiscal year, OVH is on a path to profitability with earnings expected to surge by 105.1% per year over the next three years. These developments are pivotal as OVH continues to integrate advanced technologies and expand its service offerings, positioning itself as a key enabler in Europe's digital transformation landscape.

- Navigate through the intricacies of OVH Groupe with our comprehensive health report here.

Gain insights into OVH Groupe's historical performance by reviewing our past performance report.

Lotte Energy Materials (KOSE:A020150)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lotte Energy Materials Corporation specializes in the production and sale of elecfoils, serving both domestic and international markets, with a market cap of ₩1.24 trillion.

Operations: Lotte Energy Materials Corporation focuses on the production and sale of elecfoils, catering to both domestic and international markets. The company operates with a market cap of ₩1.24 trillion, indicating its significant presence in the industry.

Lotte Energy Materials, navigating through a challenging market landscape, has demonstrated a promising trajectory with its earnings set to surge by 84% annually. This growth is underpinned by significant R&D investments that fuel innovation and competitive edge in the energy materials sector. With an annual revenue growth projected at 15.2%, outpacing the Korean market's average of 9.1%, the company's strategic focus on expanding its product offerings and enhancing operational efficiencies is evident. Moreover, recent developments from their Q3 2024 earnings call highlight efforts to streamline costs and optimize asset utilization, positioning them well for sustained growth amidst evolving industry dynamics.

Shenzhen Kangtai Biological Products (SZSE:300601)

Simply Wall St Growth Rating: ★★★★★☆

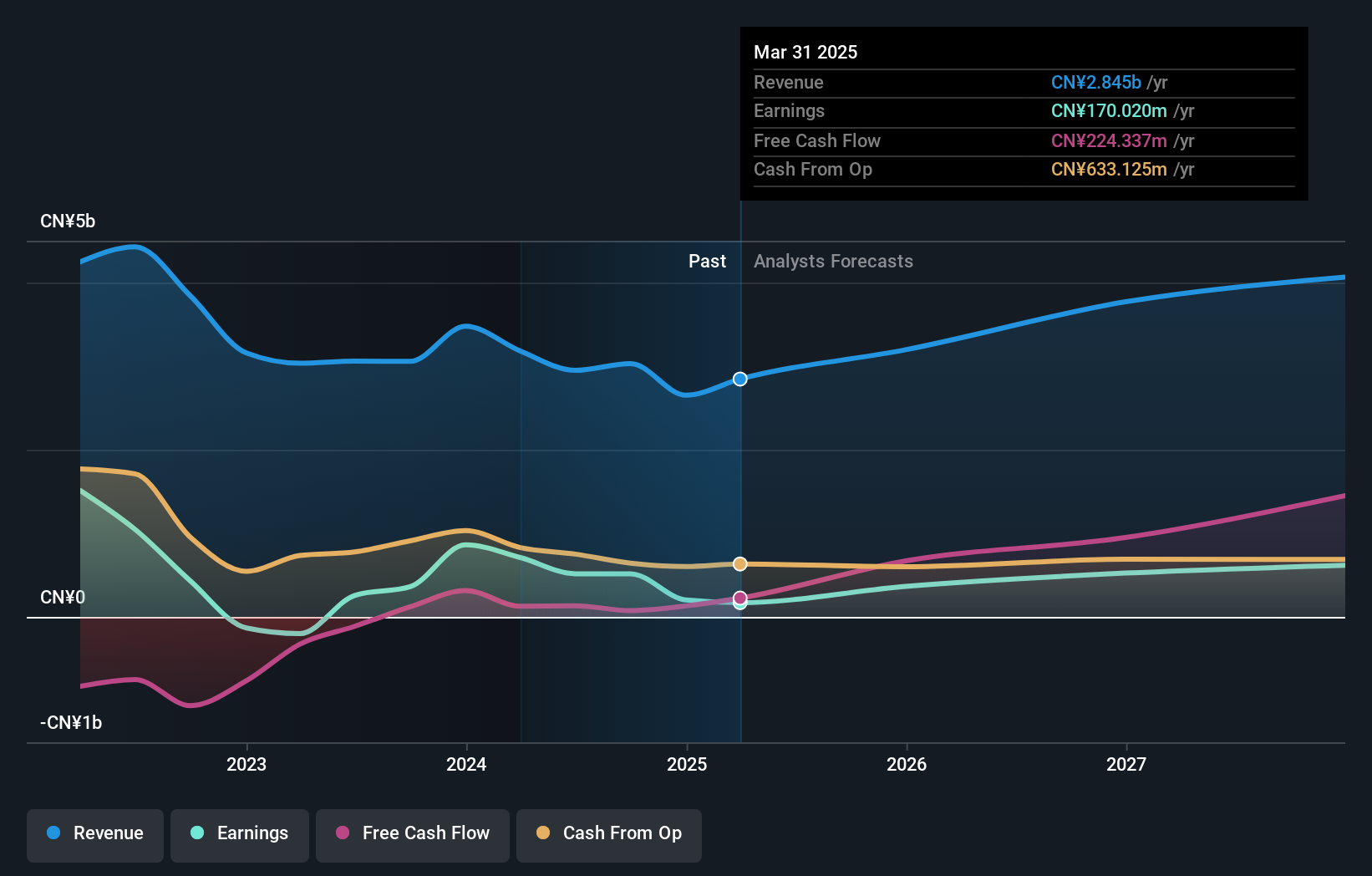

Overview: Shenzhen Kangtai Biological Products Co., Ltd. is a company engaged in the research, development, production, and sale of vaccines and biological products with a market cap of CN¥20.44 billion.

Operations: Kangtai Biological Products generates revenue primarily from its biochemical products, totaling CN¥3.03 billion.

Shenzhen Kangtai Biological Products has been navigating a challenging market with notable agility, achieving a 24.6% annual revenue growth, surpassing the Chinese market's average of 13.9%. This growth is complemented by an impressive forecast of earnings increasing at 39.8% annually, outstripping the broader CN market projection of 26.3%. The company's substantial investment in R&D has not only fueled these financial metrics but also positioned it as a leader in innovation within the biotech sector. Despite recent fluctuations in net income and earnings per share as reported for the nine months ending September 2024, Shenzhen Kangtai's strategic focus on research and development spending—which forms a significant part of their budget—underscores its commitment to pioneering new biological products that could lead future industry standards and growth trajectories.

Where To Now?

- Gain an insight into the universe of 1292 High Growth Tech and AI Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:OVH

OVH Groupe

Provides public and private cloud, shared hosting, and dedicated server products and solutions worldwide.

High growth potential and fair value.