Revenues Not Telling The Story For Porton Pharma Solutions Ltd. (SZSE:300363) After Shares Rise 31%

Porton Pharma Solutions Ltd. (SZSE:300363) shares have continued their recent momentum with a 31% gain in the last month alone. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 35% in the last twelve months.

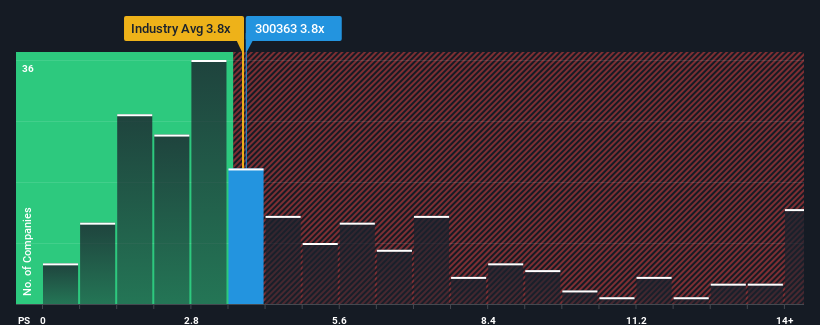

Although its price has surged higher, it's still not a stretch to say that Porton Pharma Solutions' price-to-sales (or "P/S") ratio of 3.8x right now seems quite "middle-of-the-road" compared to the Pharmaceuticals industry in China, seeing as it matches the P/S ratio of the wider industry. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Porton Pharma Solutions

What Does Porton Pharma Solutions' Recent Performance Look Like?

Porton Pharma Solutions hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Porton Pharma Solutions' future stacks up against the industry? In that case, our free report is a great place to start.How Is Porton Pharma Solutions' Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Porton Pharma Solutions' is when the company's growth is tracking the industry closely.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 43%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 5.4% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 34% during the coming year according to the four analysts following the company. With the industry predicted to deliver 226% growth, the company is positioned for a weaker revenue result.

With this information, we find it interesting that Porton Pharma Solutions is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What Does Porton Pharma Solutions' P/S Mean For Investors?

Porton Pharma Solutions appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Given that Porton Pharma Solutions' revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Porton Pharma Solutions that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300363

Porton Pharma Solutions

Provides contract development and manufacturing organization (CDMO) solutions for small molecules, tides, biologics, and conjugates from pre-clinical to commercial.

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives