As global markets show signs of optimism with cooling inflation and strong bank earnings propelling U.S. stocks higher, investors are closely watching growth companies that demonstrate robust insider confidence. In this environment, stocks with high insider ownership can be particularly appealing, as they often signal a strong belief in the company's potential for long-term success amidst fluctuating market conditions.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Pharma Mar (BME:PHM) | 11.9% | 56.2% |

| Medley (TSE:4480) | 34% | 27.2% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| Findi (ASX:FND) | 35.8% | 112.9% |

Let's review some notable picks from our screened stocks.

P/F Bakkafrost (OB:BAKKA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: P/F Bakkafrost, along with its subsidiaries, is engaged in the production and sale of salmon products across North America, Western Europe, Eastern Europe, Asia, and globally, with a market cap of NOK36.65 billion.

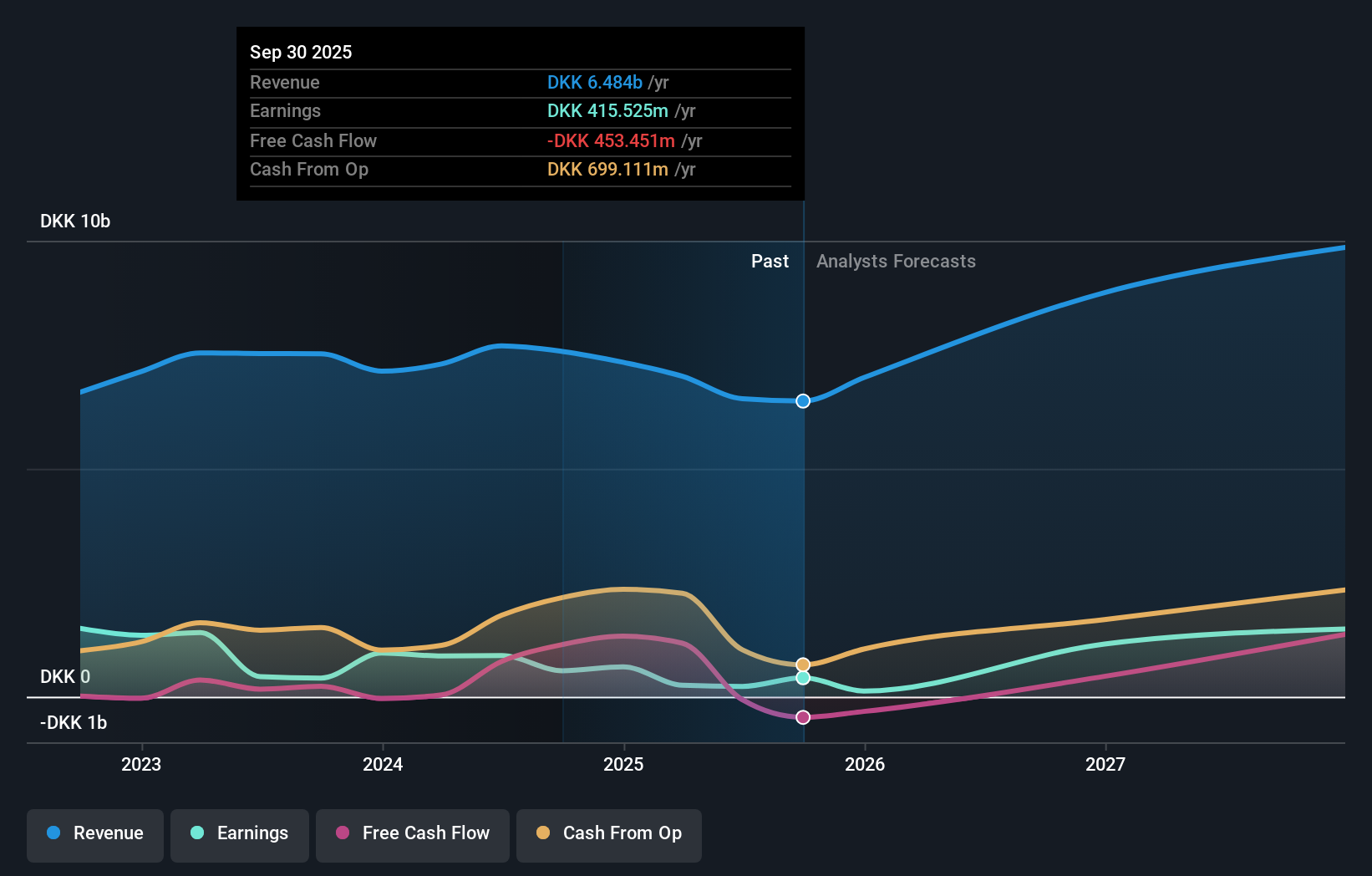

Operations: The company's revenue segments include Sales and Other at DKK10.27 billion, Farming Faroe Islands at DKK3.92 billion, Fishmeal, Oil and Feed at DKK3.13 billion, Farming Scotland at DKK1.68 billion, Services at DKK899.29 million, Freshwater Faroe Islands at DKK686.59 million, and Freshwater Scotland at DKK119.99 million.

Insider Ownership: 13.3%

Revenue Growth Forecast: 13.3% p.a.

P/F Bakkafrost demonstrates strong growth potential with forecasted annual earnings growth of 48.5%, significantly outpacing the Norwegian market's 8.7%. Despite a recent net loss of DKK 113.72 million in Q3 2024, revenue forecasts remain robust at an annual increase of 13.3%. The company's substantial insider ownership aligns with its strategic focus on expanding production capabilities, as evidenced by the total harvest of 90,700 tonnes in 2024 across the Faroe Islands and Scotland.

- Navigate through the intricacies of P/F Bakkafrost with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that P/F Bakkafrost is priced higher than what may be justified by its financials.

Runjian (SZSE:002929)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Runjian Co., Ltd. is a communication technology service company that focuses on communication network construction and maintenance in China, with a market cap of CN¥8.62 billion.

Operations: The company's revenue segments include communication network construction and maintenance services in China.

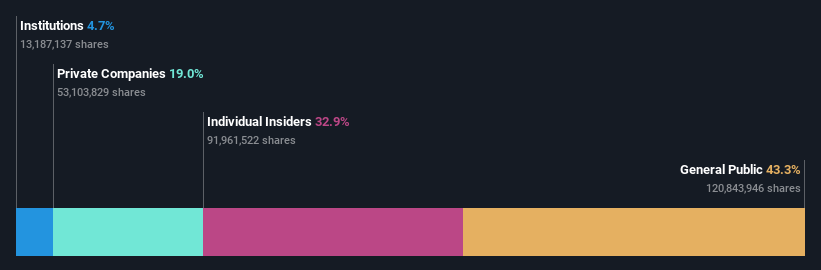

Insider Ownership: 32.9%

Revenue Growth Forecast: 15.7% p.a.

Runjian Co., Ltd. is poised for growth with forecasted earnings expansion of 28.1% per year, outpacing the Chinese market's 25.2%. Despite a decline in net income to CNY 289.69 million for the nine months ending September 2024, its revenue growth is expected to exceed the market average at 15.7% annually. The company's price-to-earnings ratio of 26.7x suggests relative value compared to China's broader market at 34.3x, although debt coverage remains a concern.

- Click here to discover the nuances of Runjian with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that Runjian is trading beyond its estimated value.

Porton Pharma Solutions (SZSE:300363)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Porton Pharma Solutions Ltd. manufactures and sells small molecule active pharmaceutical ingredients, dosage forms, and biologics to pharmaceutical companies in China, the United States, and Europe with a market cap of CN¥8.50 billion.

Operations: Porton Pharma Solutions Ltd. generates revenue through the production and distribution of small molecule active pharmaceutical ingredients, dosage forms, and biologics to pharmaceutical firms across China, the United States, and Europe.

Insider Ownership: 26.7%

Revenue Growth Forecast: 20.6% p.a.

Porton Pharma Solutions is experiencing robust growth potential with revenue expected to increase by 20.6% annually, surpassing the Chinese market's average. Despite recent financial setbacks, including a net loss of CNY 206.43 million for the first nine months of 2024 and removal from key stock indices, strategic alliances with Dragon Sail Pharmaceutical and Aojin Life Sciences enhance its position in ADC drug development. These partnerships aim to bolster technological capabilities and market competitiveness globally.

- Unlock comprehensive insights into our analysis of Porton Pharma Solutions stock in this growth report.

- Insights from our recent valuation report point to the potential undervaluation of Porton Pharma Solutions shares in the market.

Key Takeaways

- Navigate through the entire inventory of 1472 Fast Growing Companies With High Insider Ownership here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300363

Porton Pharma Solutions

Provides contract development and manufacturing organization (CDMO) solutions for small molecules, tides, biologics, and conjugates from pre-clinical to commercial.

High growth potential and fair value.