Undiscovered Gems And 2 Other Promising Small Caps For Your Portfolio

Reviewed by Simply Wall St

As global markets navigate a landscape marked by volatile earnings reports and geopolitical uncertainties, small-cap stocks have experienced mixed performance with indices like the Russell 2000 showing modest declines. Amidst these fluctuations, discovering promising small-cap companies can provide unique opportunities for investors looking to diversify their portfolios. Identifying a good stock often involves assessing its potential for growth and resilience in challenging market conditions, making it crucial to focus on companies that demonstrate strong fundamentals and adaptability in the current economic climate.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Central Forest Group | NA | 6.85% | 15.11% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Chilanga Cement | NA | 13.46% | 35.92% | ★★★★★★ |

| La Forestière Equatoriale | NA | -58.49% | 45.78% | ★★★★★★ |

| First National Bank of Botswana | 24.77% | 10.64% | 15.30% | ★★★★★☆ |

| Societe de Limonaderies et de Boissons Rafraichissantes d'Afrique | 39.37% | 4.38% | -14.46% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Zhuzhou Tianqiao Crane (SZSE:002523)

Simply Wall St Value Rating: ★★★★★★

Overview: Zhuzhou Tianqiao Crane Co., Ltd. manufactures and sells material handling equipment for the electrolytic aluminum, steel, construction machinery, and non-ferrous industries both in China and internationally, with a market cap of CN¥4.63 billion.

Operations: Zhuzhou Tianqiao Crane generates revenue primarily from the sale of material handling equipment across various industries. The company focuses on managing its cost structure to optimize profitability, with particular attention to controlling production and operational expenses. Notably, it has experienced fluctuations in its net profit margin over recent periods, reflecting changes in market conditions and internal efficiencies.

Zhuzhou Tianqiao Crane, a promising player in the machinery sector, has seen its earnings skyrocket by 6332% over the past year, outpacing the industry's -0.4% performance. Trading at 56.6% below its estimated fair value, this company seems to offer significant upside potential for investors seeking undervalued opportunities. While it boasts high-quality earnings and more cash than total debt, indicating sound financial health, its share price has been highly volatile recently. The recent amendments to its articles of association suggest strategic changes that could impact future operations and governance structure positively or negatively depending on execution.

Zhejiang Wolwo Bio-Pharmaceutical (SZSE:300357)

Simply Wall St Value Rating: ★★★★★☆

Overview: Zhejiang Wolwo Bio-Pharmaceutical Co., Ltd. is a biopharmaceutical company focused on the research, development, production, and sale of pharmaceutical products for diagnosing and treating allergic diseases in China and internationally, with a market cap of approximately CN¥10.38 billion.

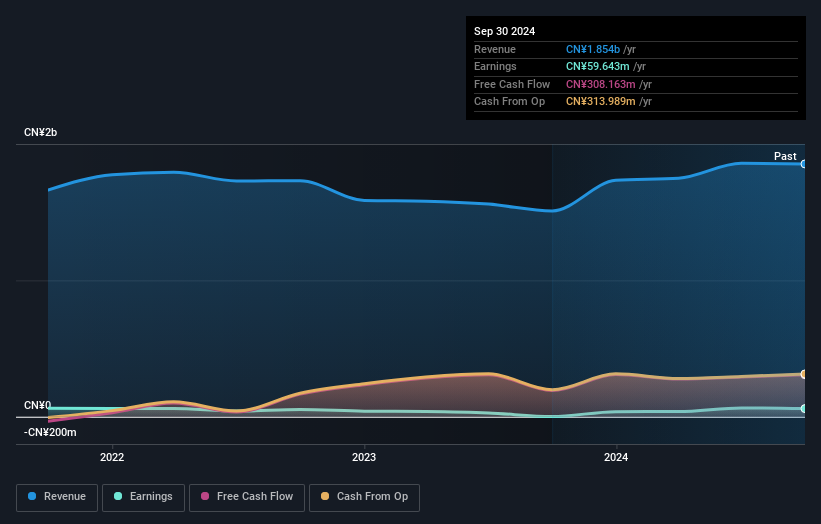

Operations: Wolwo Bio-Pharmaceutical generates revenue primarily from the research, development, production, and sales of pharmaceuticals, amounting to CN¥904.64 million.

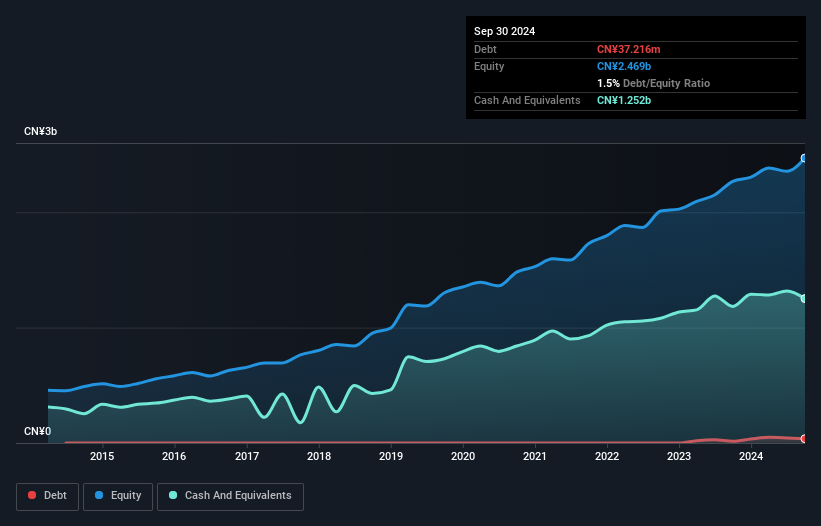

Zhejiang Wolwo Bio-Pharmaceutical seems to be a promising player in the pharmaceutical sector, with its earnings growing by 7% last year, outpacing the industry's -2.5%. The company appears undervalued, trading at nearly 47% below estimated fair value. Despite a modest increase in its debt-to-equity ratio to 1.5% over five years, it holds more cash than total debt and maintains positive free cash flow of CNY 147 million as of September 2024. With earnings forecasted to grow by over 21% annually and high-quality past earnings reported, Wolwo's financial health is robust for future growth prospects.

Chuo SpringLtd (TSE:5992)

Simply Wall St Value Rating: ★★★★★☆

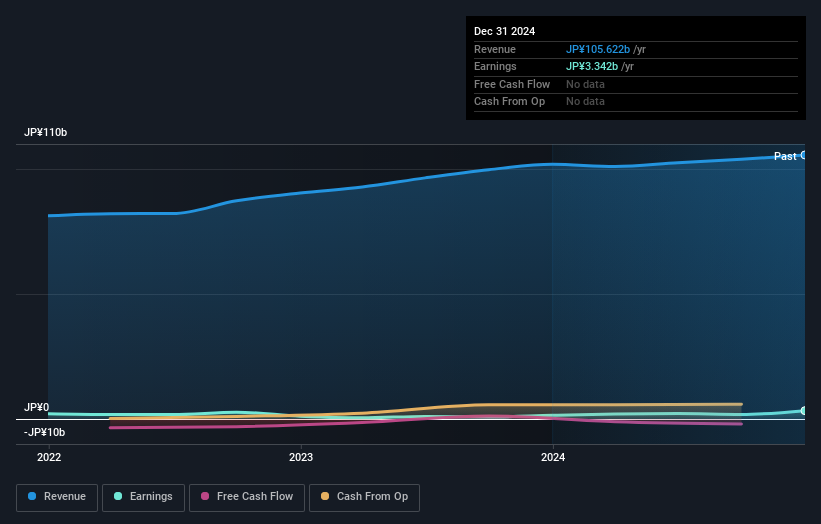

Overview: Chuo Spring Co., Ltd. is involved in the manufacture and sale of springs and control cables across Japan, the United States, Taiwan, Indonesia, Thailand, and China with a market capitalization of ¥39.65 billion.

Operations: Chuo Spring generates revenue primarily through the sale of springs and control cables in multiple regions, including Japan, the United States, Taiwan, Indonesia, Thailand, and China. The company's operations are reflected in its market capitalization of ¥39.65 billion.

Chuo Spring is making waves with its strategic moves in India, including a new subsidiary to manufacture and sell automobile chassis springs. Earnings have surged by 127% over the past year, outpacing the auto components industry's -0.9%. Despite a rise in debt-to-equity from 5.6% to 26.3% over five years, their net debt-to-equity ratio of 2.1% remains satisfactory. The company boasts high-quality earnings and a P/E ratio of 11.9x, which is favorable compared to Japan's market average of 13.4x, indicating potential value for investors seeking growth opportunities in emerging markets like India.

- Get an in-depth perspective on Chuo SpringLtd's performance by reading our health report here.

Gain insights into Chuo SpringLtd's historical performance by reviewing our past performance report.

Make It Happen

- Click here to access our complete index of 4710 Undiscovered Gems With Strong Fundamentals.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Wolwo Bio-Pharmaceutical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300357

Zhejiang Wolwo Bio-Pharmaceutical

A biopharmaceutical company, engages in the research, development, production, and sale of pharmaceutical products for the diagnosis and treatment of allergic diseases in China and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives