Some Confidence Is Lacking In Xinjiang Tianshan Animal Husbandry Bio-engineering Co., Ltd. (SZSE:300313) As Shares Slide 35%

The Xinjiang Tianshan Animal Husbandry Bio-engineering Co., Ltd. (SZSE:300313) share price has fared very poorly over the last month, falling by a substantial 35%. Looking at the bigger picture, even after this poor month the stock is up 25% in the last year.

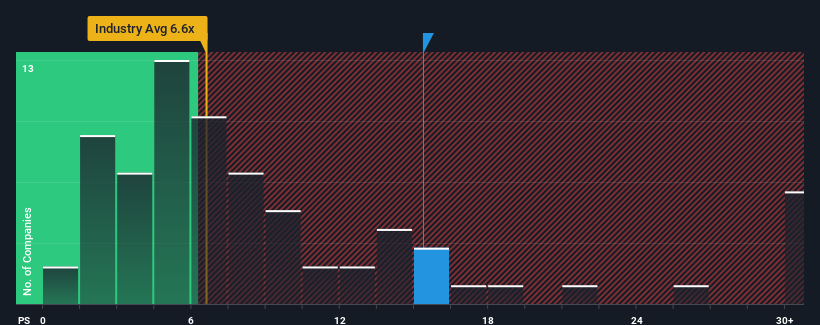

Although its price has dipped substantially, when almost half of the companies in China's Biotechs industry have price-to-sales ratios (or "P/S") below 6.6x, you may still consider Xinjiang Tianshan Animal Husbandry Bio-engineering as a stock not worth researching with its 15.4x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Xinjiang Tianshan Animal Husbandry Bio-engineering

How Has Xinjiang Tianshan Animal Husbandry Bio-engineering Performed Recently?

With revenue growth that's exceedingly strong of late, Xinjiang Tianshan Animal Husbandry Bio-engineering has been doing very well. The P/S ratio is probably high because investors think this strong revenue growth will be enough to outperform the broader industry in the near future. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Xinjiang Tianshan Animal Husbandry Bio-engineering will help you shine a light on its historical performance.How Is Xinjiang Tianshan Animal Husbandry Bio-engineering's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Xinjiang Tianshan Animal Husbandry Bio-engineering's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 80% last year. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 16% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 179% shows it's an unpleasant look.

With this in mind, we find it worrying that Xinjiang Tianshan Animal Husbandry Bio-engineering's P/S exceeds that of its industry peers. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

What We Can Learn From Xinjiang Tianshan Animal Husbandry Bio-engineering's P/S?

Xinjiang Tianshan Animal Husbandry Bio-engineering's shares may have suffered, but its P/S remains high. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Xinjiang Tianshan Animal Husbandry Bio-engineering currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. Right now we aren't comfortable with the high P/S as this revenue performance is highly unlikely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Xinjiang Tianshan Animal Husbandry Bio-engineering that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300313

Xinjiang Tianshan Animal Husbandry Bio-engineering

Xinjiang Tianshan Animal Husbandry Bio-engineering Co., Ltd.

Mediocre balance sheet with weak fundamentals.

Market Insights

Community Narratives