Amid recent market fluctuations driven by policy uncertainties and shifting economic indicators, investors are exploring diverse opportunities to navigate the current landscape. Penny stocks, though an older term, continue to represent smaller or emerging companies that might offer significant value potential. By focusing on those with strong financial foundations and growth prospects, investors can uncover promising opportunities in this often-overlooked segment of the market.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.21 | MYR346.22M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.48 | MYR2.41B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.83 | HK$539.57M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.59 | A$68.57M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.885 | MYR292.11M | ★★★★★★ |

| Wellcall Holdings Berhad (KLSE:WELLCAL) | MYR1.55 | MYR781.78M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.115 | £796.86M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.81 | A$146.79M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.76 | £373.95M | ★★★★☆☆ |

| Stelrad Group (LSE:SRAD) | £1.38 | £175.75M | ★★★★★☆ |

Click here to see the full list of 5,798 stocks from our Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Sundiro Holding (SZSE:000571)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Sundiro Holding Co., Ltd. operates in the coal industry both within China and internationally, with a market cap of CN¥3.16 billion.

Operations: Sundiro Holding Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥3.16B

Sundiro Holding Co., Ltd., with a market cap of CN¥3.16 billion, operates in the coal industry and has been reducing its losses at a rate of 49.4% per year over the past five years, despite being unprofitable. The company's short-term assets exceed its long-term liabilities, but not its short-term liabilities. It maintains more cash than total debt and has reduced its debt-to-equity ratio from 45.8% to 32.3% over five years. Recent earnings reports indicate declining sales and increasing net losses compared to previous periods, highlighting ongoing financial challenges amidst stable weekly volatility of 8%.

- Click to explore a detailed breakdown of our findings in Sundiro Holding's financial health report.

- Examine Sundiro Holding's past performance report to understand how it has performed in prior years.

Xiwang FoodstuffsLtd (SZSE:000639)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Xiwang Foodstuffs Co., Ltd., along with its subsidiaries, is involved in the research, development, production, and sales of edible vegetable oils, sports nutrition products, and nutritional supplements in China with a market capitalization of CN¥4.21 billion.

Operations: Revenue segments for the company are not reported.

Market Cap: CN¥4.21B

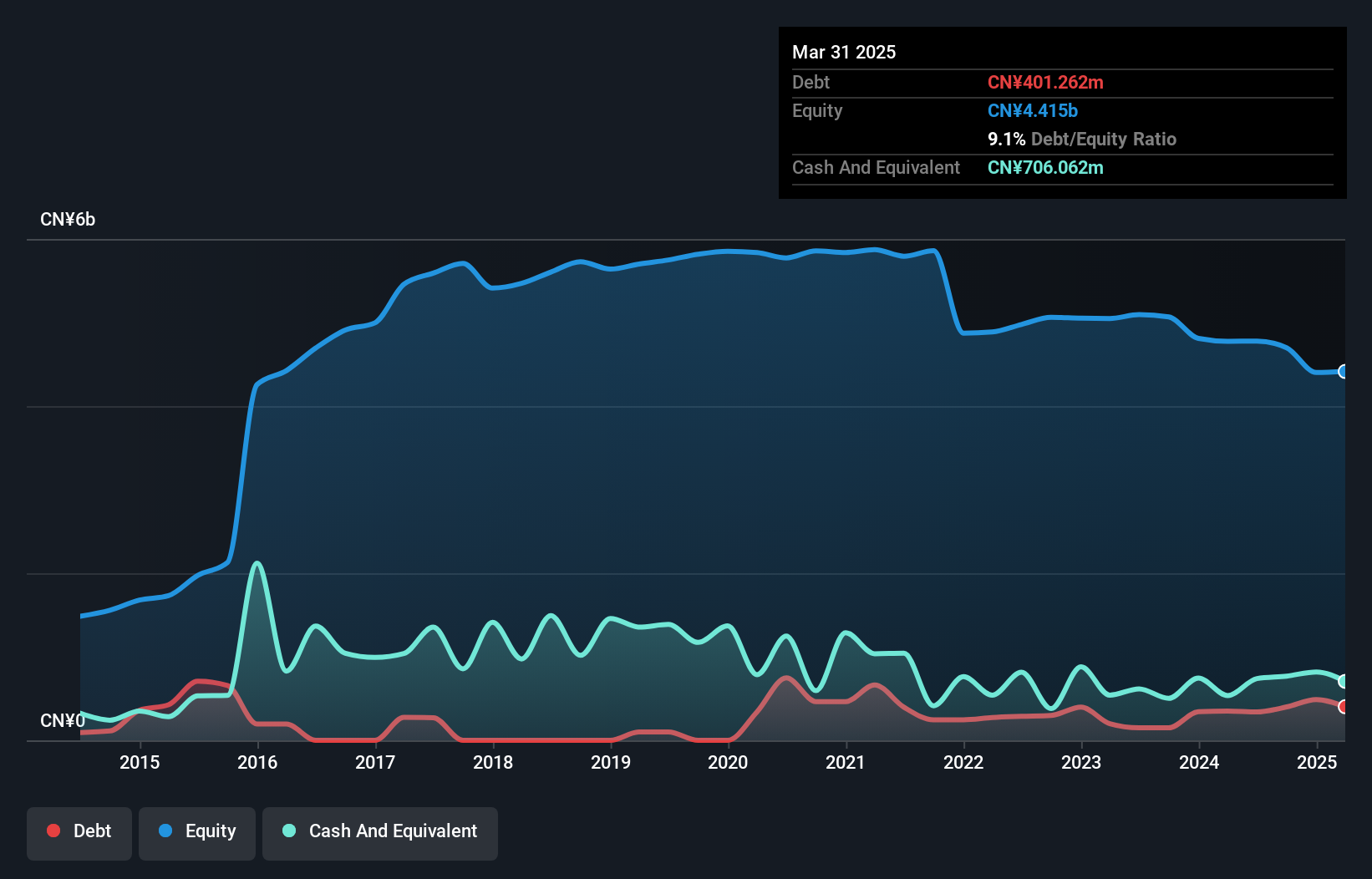

Xiwang Foodstuffs Co., Ltd., with a market cap of CN¥4.21 billion, has seen a shift to profitability this year, reporting net income of CN¥62.59 million for the nine months ending September 2024, up from CN¥6.3 million the previous year. Despite this improvement, revenue declined to CN¥3.81 billion from CN¥4.14 billion year-on-year. The company's short-term assets comfortably cover both its short and long-term liabilities, while its debt is well-managed with satisfactory net debt to equity and operating cash flow coverage ratios. However, interest coverage remains weak at 2.1x EBIT, indicating potential financial strain if not improved.

- Take a closer look at Xiwang FoodstuffsLtd's potential here in our financial health report.

- Gain insights into Xiwang FoodstuffsLtd's past trends and performance with our report on the company's historical track record.

Hunan Er-Kang Pharmaceutical (SZSE:300267)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hunan Er-Kang Pharmaceutical Co., Ltd is engaged in the manufacturing and sale of APIs, finished drug products, and pharmaceutical excipients both in China and internationally, with a market cap of CN¥6.54 billion.

Operations: Hunan Er-Kang Pharmaceutical Co., Ltd has not reported any revenue segments.

Market Cap: CN¥6.54B

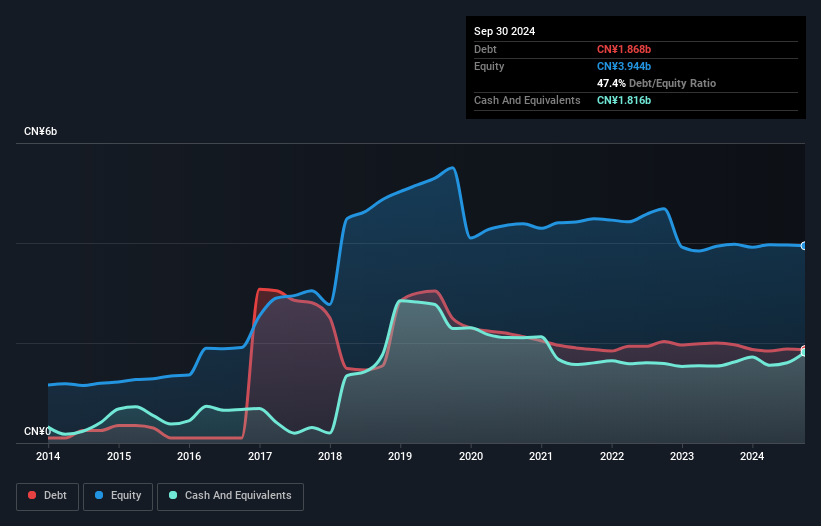

Hunan Er-Kang Pharmaceutical Co., Ltd, with a market cap of CN¥6.54 billion, reported a decline in revenue to CN¥854.29 million for the nine months ending September 2024, down from CN¥1.45 billion the previous year, alongside a net loss of CN¥25.47 million compared to a profit previously. Despite being unprofitable and experiencing increased losses over five years at 30.3% annually, the company trades significantly below its estimated fair value and maintains strong liquidity with short-term assets covering both short and long-term liabilities comfortably. Additionally, it holds more cash than total debt, indicating prudent financial management amidst challenges.

- Unlock comprehensive insights into our analysis of Hunan Er-Kang Pharmaceutical stock in this financial health report.

- Assess Hunan Er-Kang Pharmaceutical's previous results with our detailed historical performance reports.

Taking Advantage

- Dive into all 5,798 of the Penny Stocks we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hunan Er-Kang Pharmaceutical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300267

Hunan Er-Kang Pharmaceutical

Manufactures and sells APIs, finished drug products, and pharmaceutical excipients in China and internationally.

Adequate balance sheet and fair value.