Investors bid Xiangxue PharmaceuticalLtd (SZSE:300147) up CN¥747m despite increasing losses YoY, taking one-year return to 121%

Xiangxue Pharmaceutical Co.,Ltd. (SZSE:300147) shareholders might be concerned after seeing the share price drop 11% in the last month. Despite this, the stock is a strong performer over the last year, no doubt about that. Indeed, the share price is up an impressive 121% in that time. So some might not be surprised to see the price retrace some. Investors should be wondering whether the business itself has the fundamental value required to continue to drive gains.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

View our latest analysis for Xiangxue PharmaceuticalLtd

Xiangxue PharmaceuticalLtd isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually desire strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Xiangxue PharmaceuticalLtd actually shrunk its revenue over the last year, with a reduction of 3.0%. We're a little surprised to see the share price pop 121% in the last year. It just goes to show the market doesn't always pay attention to the reported numbers. Of course, it could be that the market expected this revenue drop.

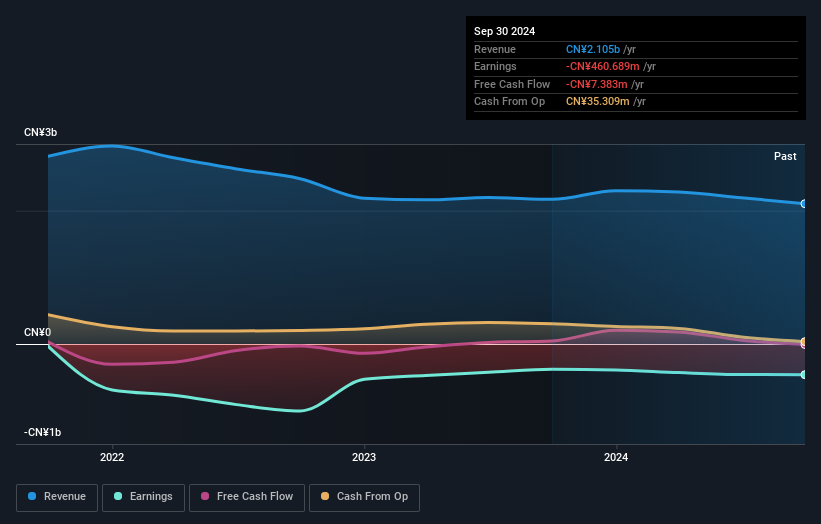

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

It's nice to see that Xiangxue PharmaceuticalLtd shareholders have received a total shareholder return of 121% over the last year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 4% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand Xiangxue PharmaceuticalLtd better, we need to consider many other factors. For example, we've discovered 3 warning signs for Xiangxue PharmaceuticalLtd that you should be aware of before investing here.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300147

Xiangxue PharmaceuticalLtd

Xiangxue Pharmaceutical Co., Ltd. engages in the research and development, procurement, manufacture, delivery, and distribution of pharmaceutical products in China.

Low and slightly overvalued.

Similar Companies

Market Insights

Community Narratives