Amidst a backdrop of easing trade tensions and positive earnings reports, small- and mid-cap indexes have shown resilience, advancing for the fourth consecutive week. In this environment, identifying high-growth tech stocks in Asia requires a keen eye on companies that can navigate economic uncertainties while capitalizing on technological advancements and market opportunities.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 28.00% | 28.07% | ★★★★★★ |

| Fositek | 31.52% | 37.08% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 28.40% | 29.29% | ★★★★★★ |

| eWeLLLtd | 24.66% | 25.31% | ★★★★★★ |

| Nanya New Material TechnologyLtd | 22.72% | 63.29% | ★★★★★★ |

| PharmaResearch | 21.74% | 25.00% | ★★★★★★ |

| giftee | 21.13% | 67.05% | ★★★★★★ |

| HFR | 33.91% | 111.76% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

| Suzhou Gyz Electronic TechnologyLtd | 27.52% | 121.67% | ★★★★★★ |

Let's dive into some prime choices out of from the screener.

Cetc Potevio Science&TechnologyLtd (SZSE:002544)

Simply Wall St Growth Rating: ★★★★★☆

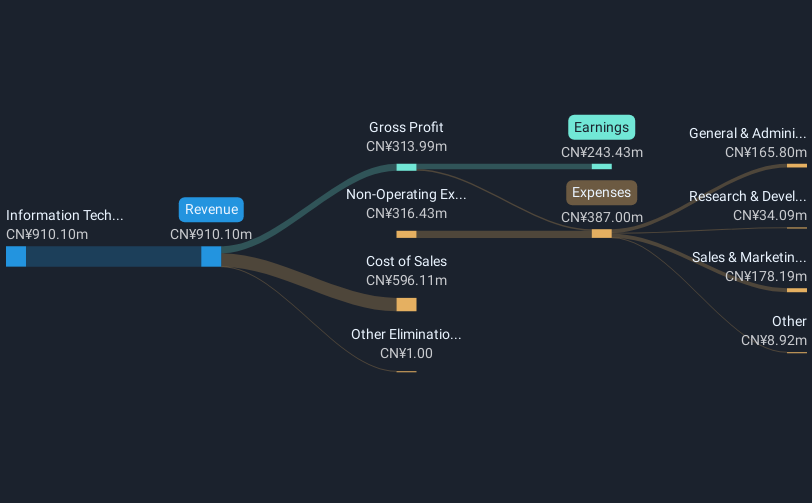

Overview: Cetc Potevio Science&Technology Co., Ltd. specializes in delivering network communication solutions within China and has a market capitalization of CN¥15.39 billion.

Operations: The company generates revenue primarily from Software and IT Services, amounting to CN¥4.76 billion.

Cetc Potevio Science&Technology Ltd. faces challenges, as evidenced by a recent earnings report showing a shift from a net income of CNY 16.11 million to a net loss of CNY 16.4 million year-over-year, alongside a revenue decline from CNY 1,083.09 million to CNY 871.04 million in the first quarter of 2025. Despite these setbacks, the company is expected to see significant growth with projected annual revenue increases at an impressive rate of 20.6%. This potential is further underscored by forecasts suggesting profitability within three years and an earnings growth rate poised at around 93.95% annually—indicative of its resilience and adaptability in the tech sector. Moreover, while currently unprofitable, this trajectory towards profitability coupled with its strategic focus on innovation could position it favorably against broader market trends where average growth rates linger around 12.6%. These figures not only highlight its capability to outpace general market expansions but also suggest that strategic adjustments and robust R&D investments could steer it back towards financial health, making it a noteworthy entity in Asia's tech landscape despite recent financial turbulence.

Doushen (Beijing) Education & Technology (SZSE:300010)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Doushen (Beijing) Education & Technology INC. operates in the education and technology sector with a market capitalization of CN¥15.97 billion.

Operations: Doushen (Beijing) Education & Technology INC. focuses on the education and technology sectors.

Doushen (Beijing) Education & Technology has demonstrated robust growth dynamics, with revenue soaring by 52.9% annually and earnings expected to climb by 42.9% each year. This trajectory is underscored by a significant R&D commitment, which not only fuels innovation but also aligns with the broader tech industry's shift towards advanced educational technologies. Recent quarterly figures reveal a rise in net income to CNY 37.37 million from CNY 22.24 million year-over-year, reflecting effective operational execution despite slight revenue dips in the latest annual report. With these performance indicators, Doushen stands out for its potential to capitalize on expanding market demands within Asia's tech-education sector.

Chongqing Zhifei Biological Products (SZSE:300122)

Simply Wall St Growth Rating: ★★★★★☆

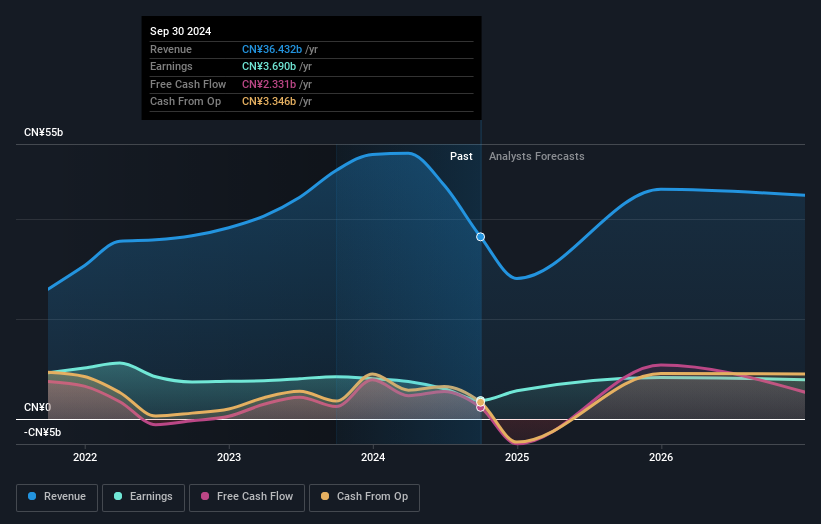

Overview: Chongqing Zhifei Biological Products Co., Ltd. is a company engaged in the research, development, production, and sale of vaccines and biological products with a market capitalization of CN¥46.68 billion.

Operations: Zhifei Biological Products focuses on the production and sale of biochemical products, generating a revenue of CN¥16.83 billion from this segment.

Despite recent setbacks, Chongqing Zhifei Biological Products remains a formidable player in the biotech sector, with an anticipated revenue growth of 33.7% per year. This contrasts starkly with its recent earnings report, where sales plummeted from CNY 52.92 billion to CNY 26.07 billion year-over-year and net income dropped significantly from CNY 8.07 billion to CNY 2.02 billion. Even amidst these challenges, the company's commitment to R&D is unwavering, aiming to revitalize its product lines and market position by harnessing cutting-edge biotechnological advancements—a strategy that may well dictate its trajectory in the competitive landscape of Asian biotech innovators.

Turning Ideas Into Actions

- Reveal the 489 hidden gems among our Asian High Growth Tech and AI Stocks screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300122

Chongqing Zhifei Biological Products

Chongqing Zhifei Biological Products Co., Ltd.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives