Chongqing Zhifei Biological Products Co., Ltd.'s (SZSE:300122) Share Price Boosted 45% But Its Business Prospects Need A Lift Too

Chongqing Zhifei Biological Products Co., Ltd. (SZSE:300122) shares have had a really impressive month, gaining 45% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 31% in the last twelve months.

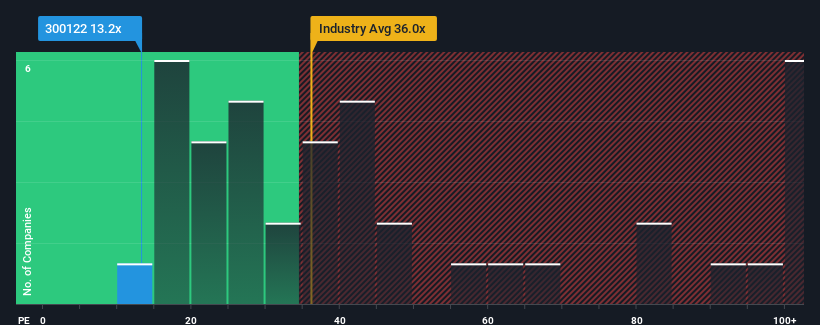

In spite of the firm bounce in price, Chongqing Zhifei Biological Products may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 13.2x, since almost half of all companies in China have P/E ratios greater than 30x and even P/E's higher than 58x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Recent times haven't been advantageous for Chongqing Zhifei Biological Products as its earnings have been falling quicker than most other companies. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

View our latest analysis for Chongqing Zhifei Biological Products

Does Growth Match The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Chongqing Zhifei Biological Products' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 25% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 17% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 16% per year as estimated by the analysts watching the company. That's shaping up to be materially lower than the 19% each year growth forecast for the broader market.

In light of this, it's understandable that Chongqing Zhifei Biological Products' P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Chongqing Zhifei Biological Products' P/E

Even after such a strong price move, Chongqing Zhifei Biological Products' P/E still trails the rest of the market significantly. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Chongqing Zhifei Biological Products maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You need to take note of risks, for example - Chongqing Zhifei Biological Products has 2 warning signs (and 1 which is a bit unpleasant) we think you should know about.

Of course, you might also be able to find a better stock than Chongqing Zhifei Biological Products. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300122

Chongqing Zhifei Biological Products

Chongqing Zhifei Biological Products Co., Ltd.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives