As global markets navigate a landscape of fluctuating interest rates and geopolitical uncertainties, investors are keenly observing the impact on stock indices worldwide. With U.S. corporate earnings showing mixed results amid AI competition fears and European markets buoyed by rate cuts, dividend stocks continue to attract attention for their potential to provide steady income streams. In this context, selecting dividend stocks with reliable yields can be an appealing strategy for investors looking to balance growth with income amidst market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Totech (TSE:9960) | 3.80% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.31% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 5.78% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.49% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.01% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.99% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.68% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.93% | ★★★★★★ |

Click here to see the full list of 1956 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

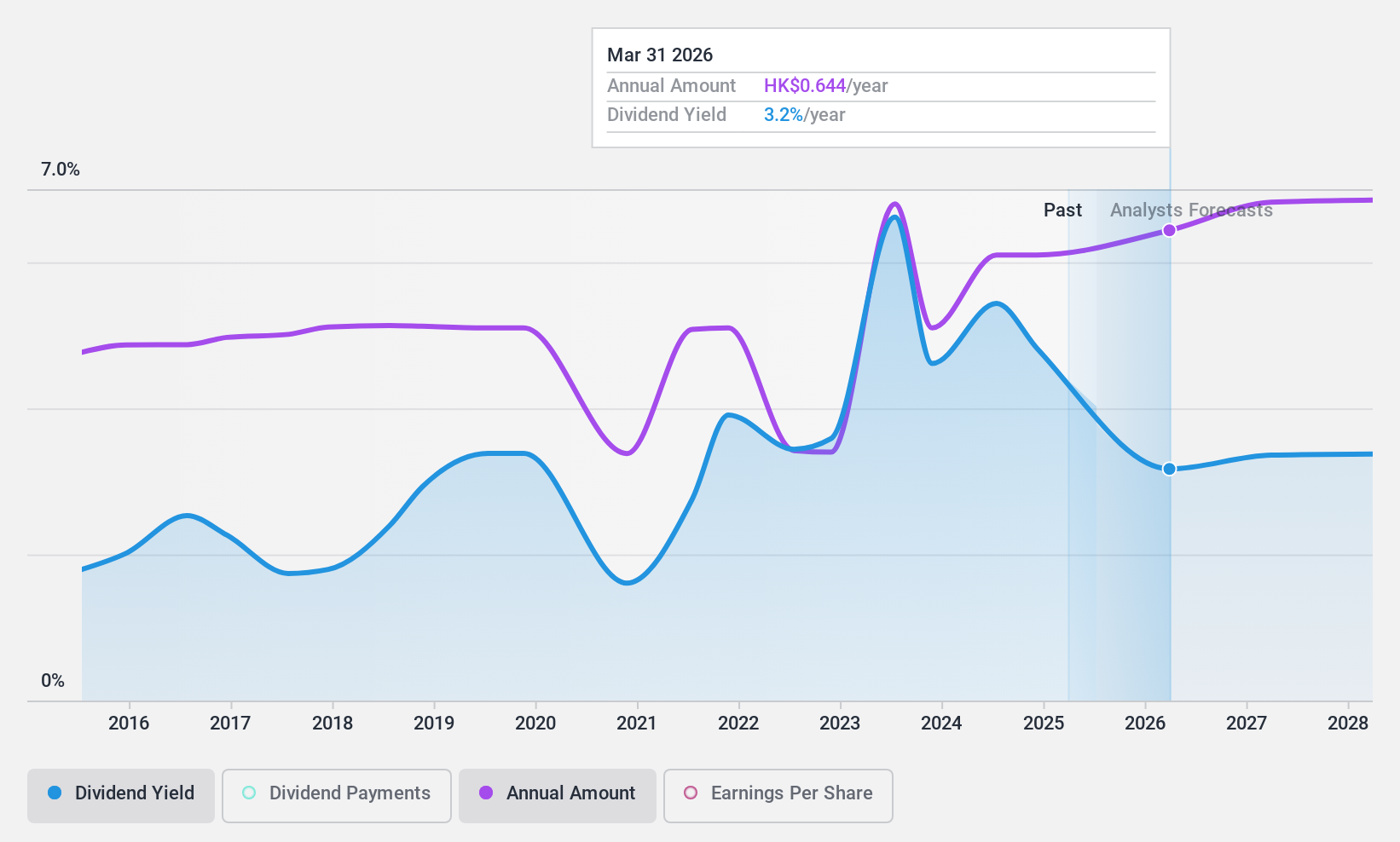

Johnson Electric Holdings (SEHK:179)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Johnson Electric Holdings Limited is an investment holding company involved in the global manufacture and sale of motion systems, with a market cap of HK$9.36 billion.

Operations: Johnson Electric Holdings Limited generates its revenue primarily from the Auto Parts & Accessories segment, which accounts for $3.73 billion.

Dividend Yield: 5.8%

Johnson Electric Holdings offers a dividend yield of 5.8%, which is lower than the top 25% in Hong Kong. The company's dividends are well-covered by earnings and cash flows, with payout ratios of 30.3% and 22.6%, respectively, although they have been volatile over the past decade. Recent sales decreased by 5% year-over-year to US$2.73 billion due to unfavorable exchange rates, but net income improved slightly to US$129.61 million for H1 2024-2025.

- Click to explore a detailed breakdown of our findings in Johnson Electric Holdings' dividend report.

- Our expertly prepared valuation report Johnson Electric Holdings implies its share price may be lower than expected.

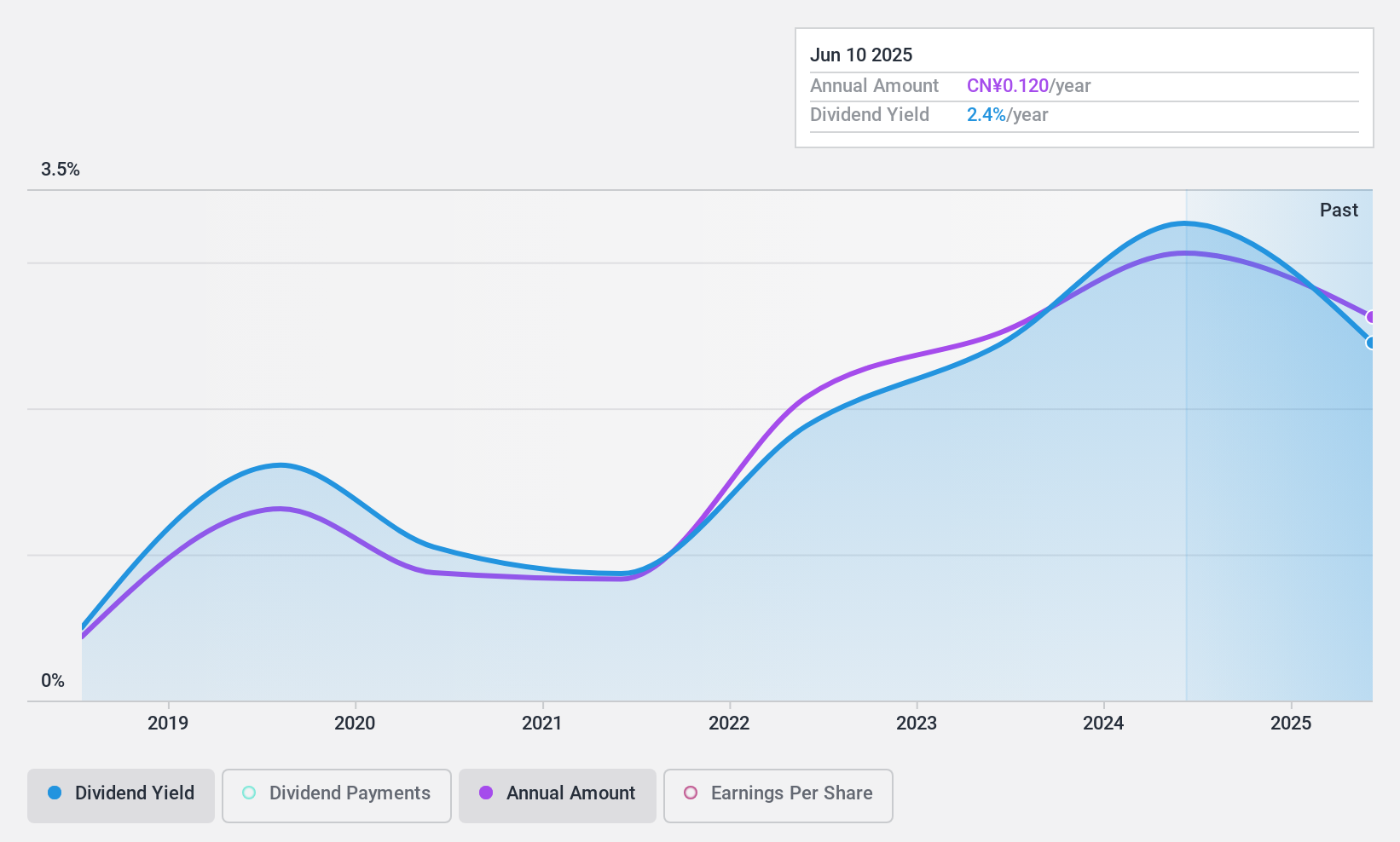

Jiangsu chunlan refrigerating equipment stockltd (SHSE:600854)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jiangsu Chunlan Refrigerating Equipment Stock Co., Ltd. manufactures and sells residential and commercial air conditioners in China and internationally, with a market cap of CN¥2.37 billion.

Operations: Jiangsu Chunlan Refrigerating Equipment Stock Co., Ltd.'s revenue primarily comes from the production and sale of air conditioning units for both residential and commercial use.

Dividend Yield: 3%

Jiangsu Chunlan Refrigerating Equipment offers a 3% dividend yield, placing it in the top 25% of China's market. However, its dividends are not well-supported by cash flows, with a high cash payout ratio of 134.7%. While the payout ratio relative to earnings is reasonable at 49.1%, dividends have been volatile and unreliable over the past decade despite some growth. The company's price-to-earnings ratio of 16.3x suggests it may be undervalued compared to the broader CN market average.

- Click here and access our complete dividend analysis report to understand the dynamics of Jiangsu chunlan refrigerating equipment stockltd.

- Insights from our recent valuation report point to the potential overvaluation of Jiangsu chunlan refrigerating equipment stockltd shares in the market.

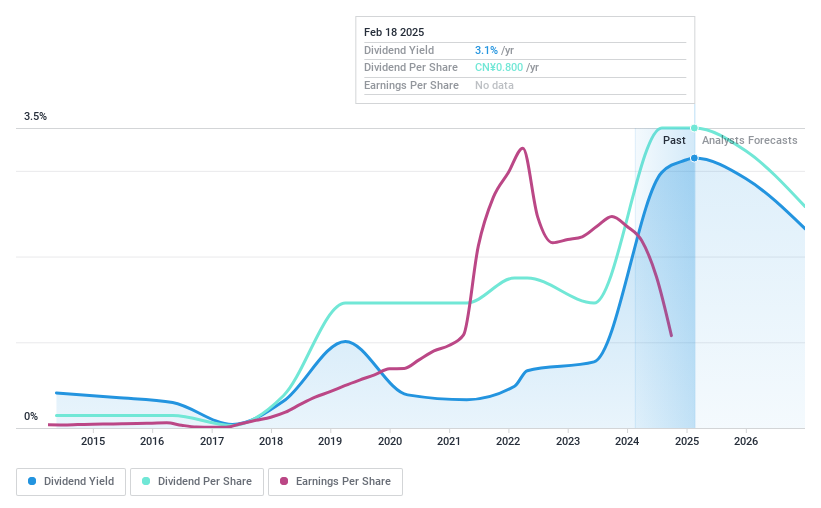

Chongqing Zhifei Biological Products (SZSE:300122)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Chongqing Zhifei Biological Products Co., Ltd. is a biopharmaceutical company involved in the research, development, production, and sale of vaccines and has a market cap of approximately CN¥58.15 billion.

Operations: Chongqing Zhifei Biological Products Co., Ltd. generates revenue primarily from its Biochemical Product segment, which amounts to CN¥36.43 billion.

Dividend Yield: 3.2%

Chongqing Zhifei Biological Products' dividend yield of 3.25% ranks in the top 25% in China, supported by a reasonable payout ratio of 65% and cash coverage at 82.2%. However, dividends have been volatile over the past decade despite growth. The company trades at a significant discount to its estimated fair value and maintains strong earnings forecasts. Recent agreements with GSK for vaccine distribution could bolster future revenue streams, potentially stabilizing dividend payments.

- Navigate through the intricacies of Chongqing Zhifei Biological Products with our comprehensive dividend report here.

- The analysis detailed in our Chongqing Zhifei Biological Products valuation report hints at an deflated share price compared to its estimated value.

Where To Now?

- Get an in-depth perspective on all 1956 Top Dividend Stocks by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300122

Chongqing Zhifei Biological Products

Chongqing Zhifei Biological Products Co., Ltd.

Adequate balance sheet and fair value.

Market Insights

Community Narratives