Tianjin Ringpu Bio-Technology Co.,Ltd.'s (SZSE:300119) Subdued P/E Might Signal An Opportunity

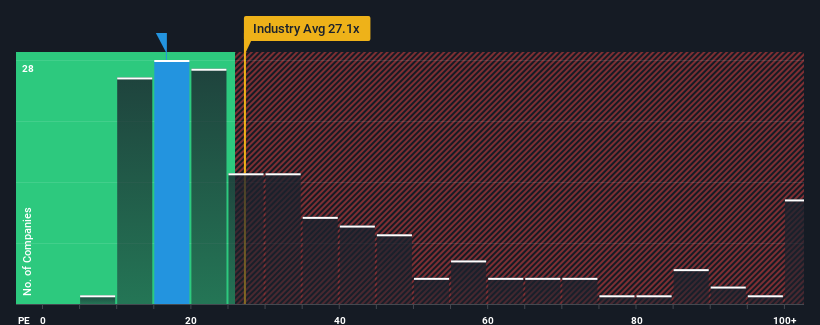

When close to half the companies in China have price-to-earnings ratios (or "P/E's") above 31x, you may consider Tianjin Ringpu Bio-Technology Co.,Ltd. (SZSE:300119) as an attractive investment with its 16.6x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Tianjin Ringpu Bio-TechnologyLtd certainly has been doing a good job lately as it's been growing earnings more than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for Tianjin Ringpu Bio-TechnologyLtd

Is There Any Growth For Tianjin Ringpu Bio-TechnologyLtd?

There's an inherent assumption that a company should underperform the market for P/E ratios like Tianjin Ringpu Bio-TechnologyLtd's to be considered reasonable.

Retrospectively, the last year delivered a decent 6.6% gain to the company's bottom line. EPS has also lifted 9.8% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing earnings over that time.

Shifting to the future, estimates from the seven analysts covering the company suggest earnings should grow by 36% over the next year. With the market predicted to deliver 39% growth , the company is positioned for a comparable earnings result.

With this information, we find it odd that Tianjin Ringpu Bio-TechnologyLtd is trading at a P/E lower than the market. It may be that most investors are not convinced the company can achieve future growth expectations.

What We Can Learn From Tianjin Ringpu Bio-TechnologyLtd's P/E?

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Tianjin Ringpu Bio-TechnologyLtd's analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide more support to the share price.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Tianjin Ringpu Bio-TechnologyLtd that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Tianjin Ringpu Bio-TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300119

Tianjin Ringpu Bio-TechnologyLtd

Engages in the research and development, production, and sale of veterinary raw materials, drug preparation, functional additives, and veterinary biological products.

Very undervalued 6 star dividend payer.

Market Insights

Community Narratives