Inner Mongolia Furui Medical Science's (SZSE:300049) five-year total shareholder returns outpace the underlying earnings growth

Buying shares in the best businesses can build meaningful wealth for you and your family. While not every stock performs well, when investors win, they can win big. Just think about the savvy investors who held Inner Mongolia Furui Medical Science Co., Ltd. (SZSE:300049) shares for the last five years, while they gained 499%. And this is just one example of the epic gains achieved by some long term investors. And in the last month, the share price has gained 31%. But this could be related to good market conditions -- stocks in its market are up 22% in the last month.

In light of the stock dropping 6.3% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive five-year return.

See our latest analysis for Inner Mongolia Furui Medical Science

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

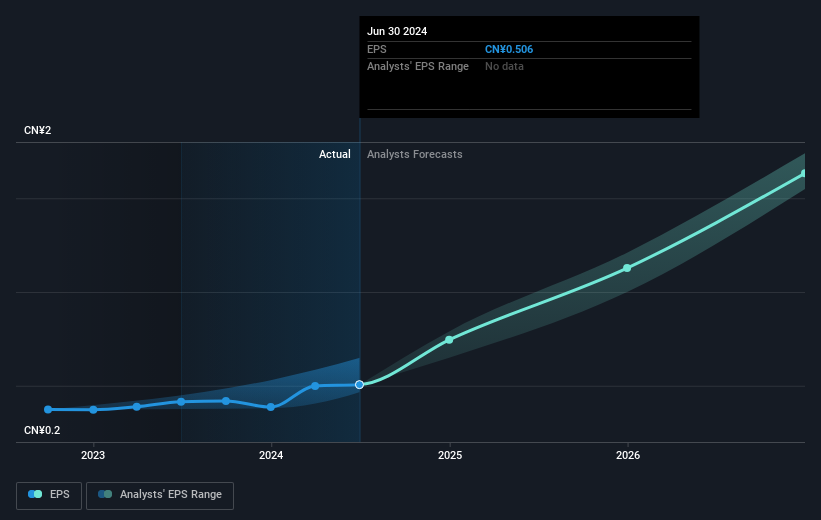

During five years of share price growth, Inner Mongolia Furui Medical Science achieved compound earnings per share (EPS) growth of 108% per year. The EPS growth is more impressive than the yearly share price gain of 43% over the same period. Therefore, it seems the market has become relatively pessimistic about the company. Having said that, the market is still optimistic, given the P/E ratio of 95.53.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. It might be well worthwhile taking a look at our free report on Inner Mongolia Furui Medical Science's earnings, revenue and cash flow.

What About The Total Shareholder Return (TSR)?

We've already covered Inner Mongolia Furui Medical Science's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Dividends have been really beneficial for Inner Mongolia Furui Medical Science shareholders, and that cash payout contributed to why its TSR of 504%, over the last 5 years, is better than the share price return.

A Different Perspective

We're pleased to report that Inner Mongolia Furui Medical Science shareholders have received a total shareholder return of 22% over one year. However, the TSR over five years, coming in at 43% per year, is even more impressive. The pessimistic view would be that be that the stock has its best days behind it, but on the other hand the price might simply be moderating while the business itself continues to execute. Before deciding if you like the current share price, check how Inner Mongolia Furui Medical Science scores on these 3 valuation metrics.

But note: Inner Mongolia Furui Medical Science may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300049

Inner Mongolia Furui Medical Science

Inner Mongolia Furui Medical Science Co., Ltd.

Flawless balance sheet with high growth potential.