As global markets grapple with renewed trade tensions and economic uncertainties, smaller-cap indices have experienced notable declines, reflecting the broader market sentiment. Amid this backdrop, investors are increasingly on the lookout for resilient stocks that can navigate these challenges and offer potential growth opportunities. In Asia's dynamic landscape, identifying such undiscovered gems requires a keen understanding of local markets and a focus on companies with strong fundamentals and innovative strategies.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Chudenko | NA | 4.69% | 17.78% | ★★★★★★ |

| Wuxi Chemical Equipment | NA | 13.24% | -0.17% | ★★★★★★ |

| Minmetals Development | 35.99% | 0.88% | -12.63% | ★★★★★★ |

| Jiangyin Haida Rubber And Plastic | 16.31% | 7.95% | -9.56% | ★★★★★★ |

| Shantou Institute of Ultrasonic Instrument | NA | 17.40% | 16.47% | ★★★★★★ |

| Yashima Denki | 2.36% | 1.42% | 23.63% | ★★★★★☆ |

| Hangzhou Zhengqiang | 26.03% | 2.95% | 16.75% | ★★★★★☆ |

| Jinsanjiang (Zhaoqing) Silicon Material | 3.59% | 18.23% | -7.68% | ★★★★★☆ |

| Ningbo Henghe Precision IndustryLtd | 66.02% | 5.50% | 23.91% | ★★★★☆☆ |

| Zhejiang Risun Intelligent TechnologyLtd | 27.20% | 20.30% | -23.01% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

COSCO SHIPPING International (Singapore) (SGX:F83)

Simply Wall St Value Rating: ★★★★☆☆

Overview: COSCO SHIPPING International (Singapore) Co., Ltd. is an investment holding company that offers integrated logistics services across South and Southeast Asia, with a market capitalization of SGD550.85 million.

Operations: COSCO SHIPPING International (Singapore) derives its revenue primarily from logistics, contributing SGD149.87 million, and ship repair and marine-related activities, which add SGD20.14 million. Property management also contributes to the revenue with SGD3.45 million. The company's financial performance is influenced by its net profit margin trends over the periods analyzed.

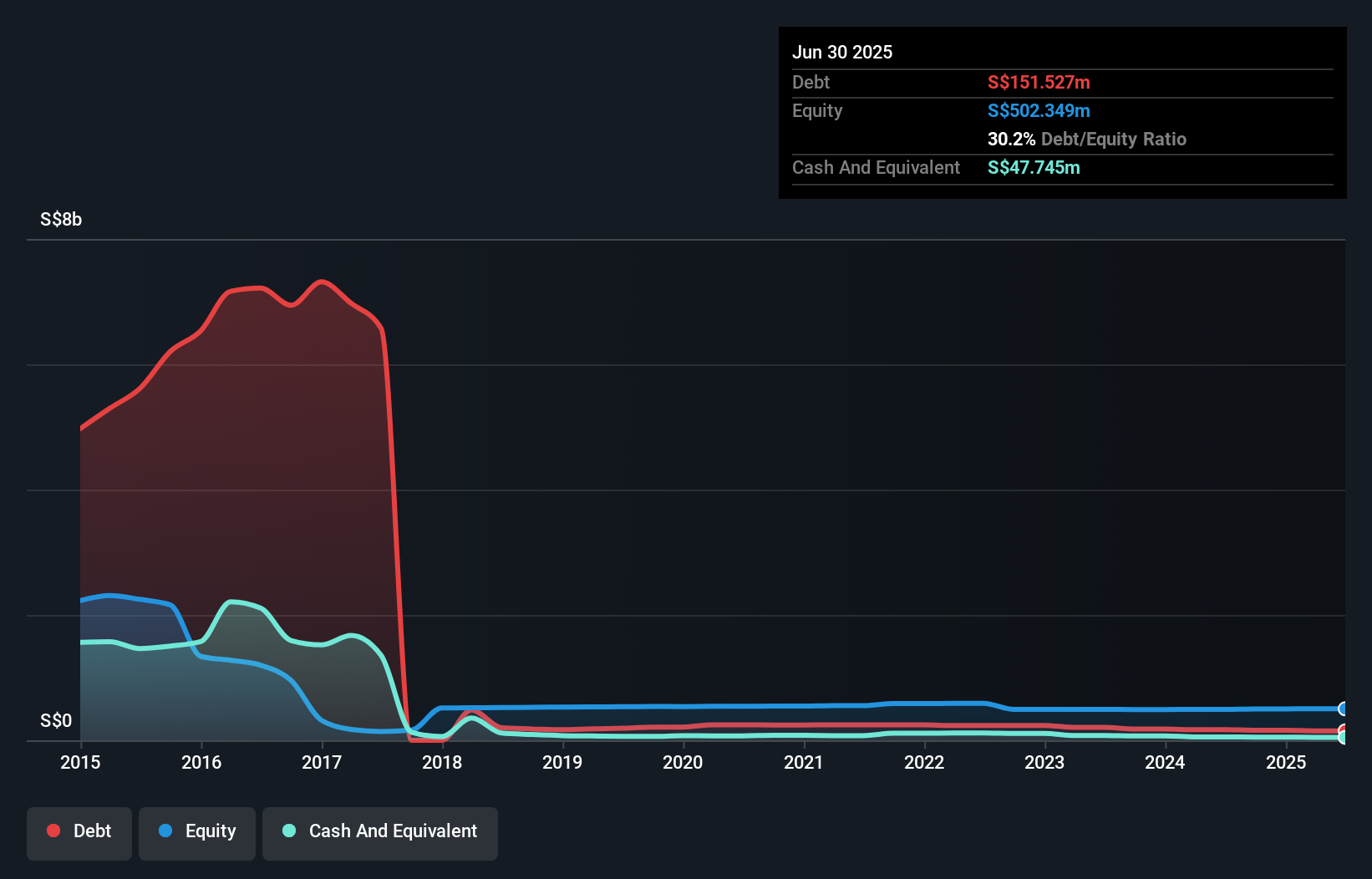

COSCO SHIPPING International (Singapore) showcases a stable financial footing with a net debt to equity ratio of 22.1%, deemed satisfactory, and interest payments well covered by EBIT at 3.7 times. Despite an impressive earnings growth of 188.1% over the past year, it slightly lagged behind the broader logistics industry at 193.5%. The company has been proactive in expanding its operations, with construction underway for the Jurong Island Logistics Hub Phase II, expected to complete by late 2026. However, shareholders faced substantial dilution recently due to a SGD 273 million rights offering completed in July 2025.

Chongqing Pharscin Pharmaceutical (SZSE:002907)

Simply Wall St Value Rating: ★★★★★★

Overview: Chongqing Pharscin Pharmaceutical Co., Ltd. is a company involved in the pharmaceutical industry with a market capitalization of CN¥8.66 billion.

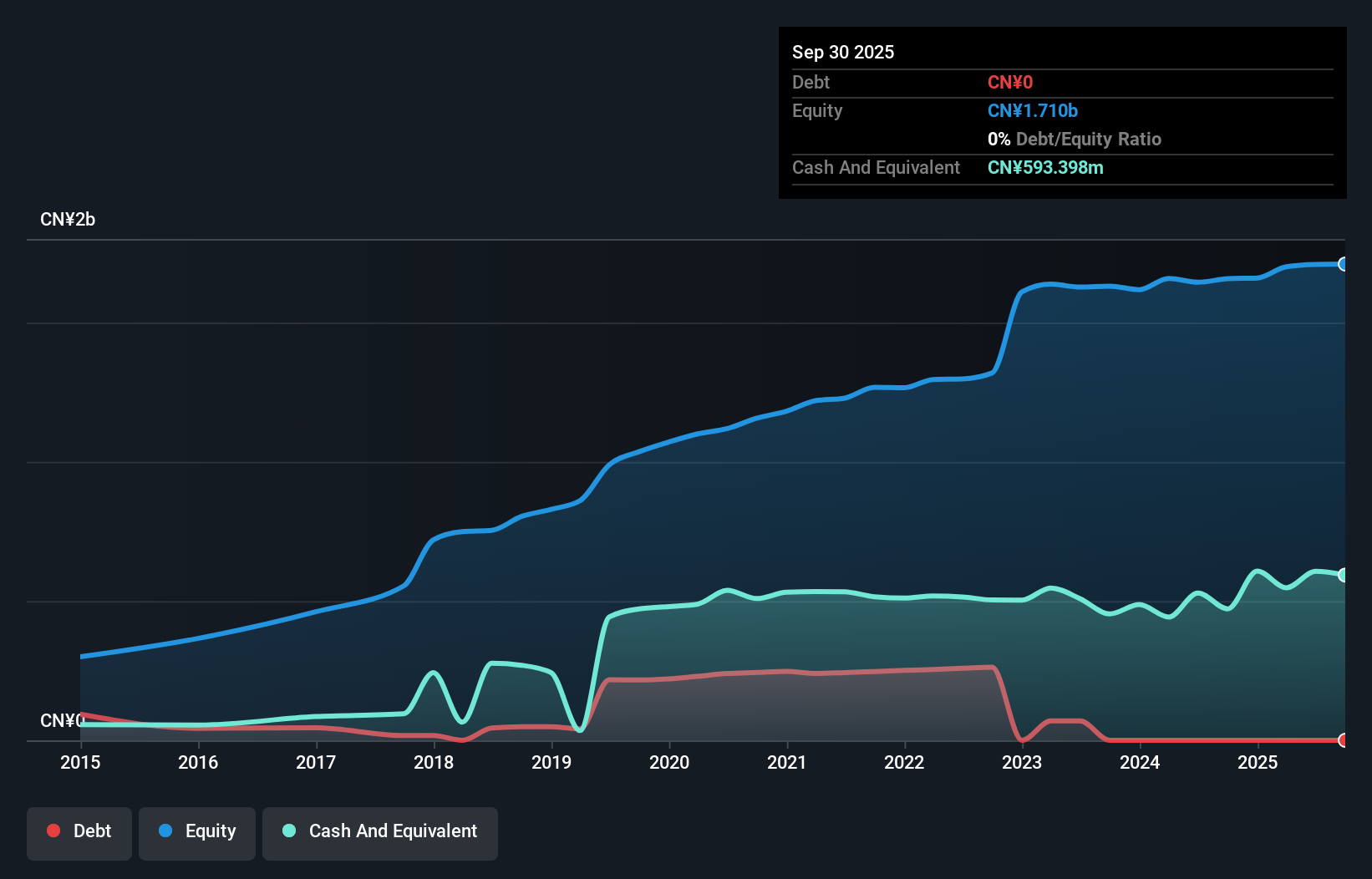

Operations: Pharscin generates its revenue primarily from pharmaceutical sales. The company recorded a market capitalization of CN¥8.66 billion.

Chongqing Pharscin Pharmaceutical stands out with its recent earnings surge of 78.7%, significantly outperforming the broader Pharmaceuticals industry, which saw a -2.6% change. Despite a volatile share price over the last three months, the company maintains a debt-free status, contrasting sharply with its previous debt to equity ratio of 20.9% five years ago. A notable CN¥22.6M one-off gain has influenced recent financial outcomes, highlighting some irregularities in earnings quality. The approval of a cash dividend for 2024 and changes in board composition underscore ongoing strategic adjustments within this dynamic pharmaceutical player in Asia's market landscape.

- Dive into the specifics of Chongqing Pharscin Pharmaceutical here with our thorough health report.

Learn about Chongqing Pharscin Pharmaceutical's historical performance.

Beijing Scitop Bio-tech (SZSE:300858)

Simply Wall St Value Rating: ★★★★★★

Overview: Beijing Scitop Bio-tech Co., Ltd. engages in the research, development, manufacturing, and sale of probiotic lactic acid bacteria and related products in China with a market capitalization of CN¥5.38 billion.

Operations: Scitop Bio-tech generates revenue primarily from the sale of probiotic lactic acid bacteria products. The company has a market capitalization of CN¥5.38 billion, reflecting its financial stature in the industry.

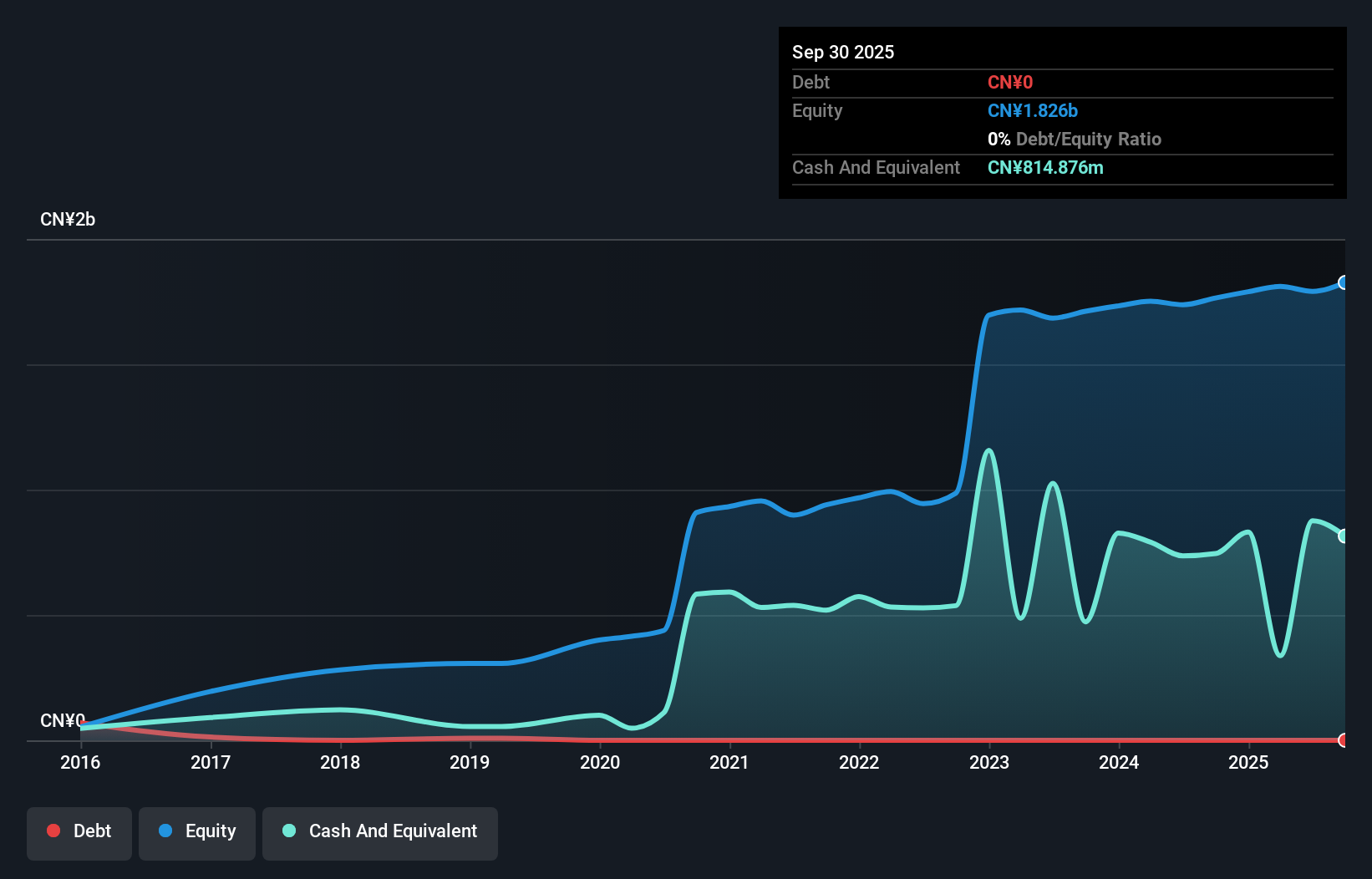

Beijing Scitop Bio-tech, a smaller player in the biotech sector, has shown resilience with high-quality earnings and no debt over the past five years. Despite a volatile share price recently, its earnings growth of 4.6% last year surpassed the broader food industry’s -5% trend. However, its free cash flow remains negative at -139.99 million CNY as of March 2025, indicating potential challenges in liquidity management. The company approved a cash dividend of CNY 1.50 per ten shares for 2024, reflecting confidence despite declining earnings by 1% annually over five years.

- Click here and access our complete health analysis report to understand the dynamics of Beijing Scitop Bio-tech.

Evaluate Beijing Scitop Bio-tech's historical performance by accessing our past performance report.

Summing It All Up

- Click this link to deep-dive into the 2576 companies within our Asian Undiscovered Gems With Strong Fundamentals screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:F83

COSCO SHIPPING International (Singapore)

An investment holding company, provides integrated logistics services in South and Southeast Asia.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.