Undiscovered Gems in Global Featuring 3 Promising Small Caps

Reviewed by Simply Wall St

In the wake of recent global trade tensions, markets have experienced significant volatility, with small-cap stocks particularly impacted as the Russell 2000 Index saw a steep decline. Amid this uncertainty, investors may find opportunities in lesser-known small-cap companies that demonstrate resilience and potential for growth despite broader market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Xuchang Yuandong Drive ShaftLtd | 0.38% | -11.74% | -29.32% | ★★★★★★ |

| Mega Union Technology | 9.42% | 12.79% | 52.00% | ★★★★★★ |

| Camelot Electronics TechnologyLtd | 8.13% | 12.53% | -2.82% | ★★★★★★ |

| La Forestière Equatoriale | NA | -58.49% | 45.78% | ★★★★★★ |

| Shenzhen Zhongheng Huafa | NA | 0.80% | 18.00% | ★★★★★★ |

| Intellego Technologies | 11.59% | 68.05% | 72.76% | ★★★★★★ |

| Nanjing Well Pharmaceutical GroupLtd | 25.29% | 10.45% | 0.43% | ★★★★★☆ |

| Moury Construct | 2.93% | 10.42% | 27.28% | ★★★★★☆ |

| Castellana Properties Socimi | 53.49% | 6.64% | 21.96% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 15.57% | 6.53% | 7.16% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Shiyue Daotian Group (SEHK:9676)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shiyue Daotian Group Co., Ltd. is engaged in the manufacturing and sale of pantry staple foods in the People's Republic of China, with a market capitalization of approximately HK$6.49 billion.

Operations: The company generates revenue primarily from rice products, contributing CN¥4.01 billion, followed by corn products at CN¥815.11 million. Dried food and whole grain segments add CN¥446.22 million and CN¥469.54 million respectively to the revenue stream.

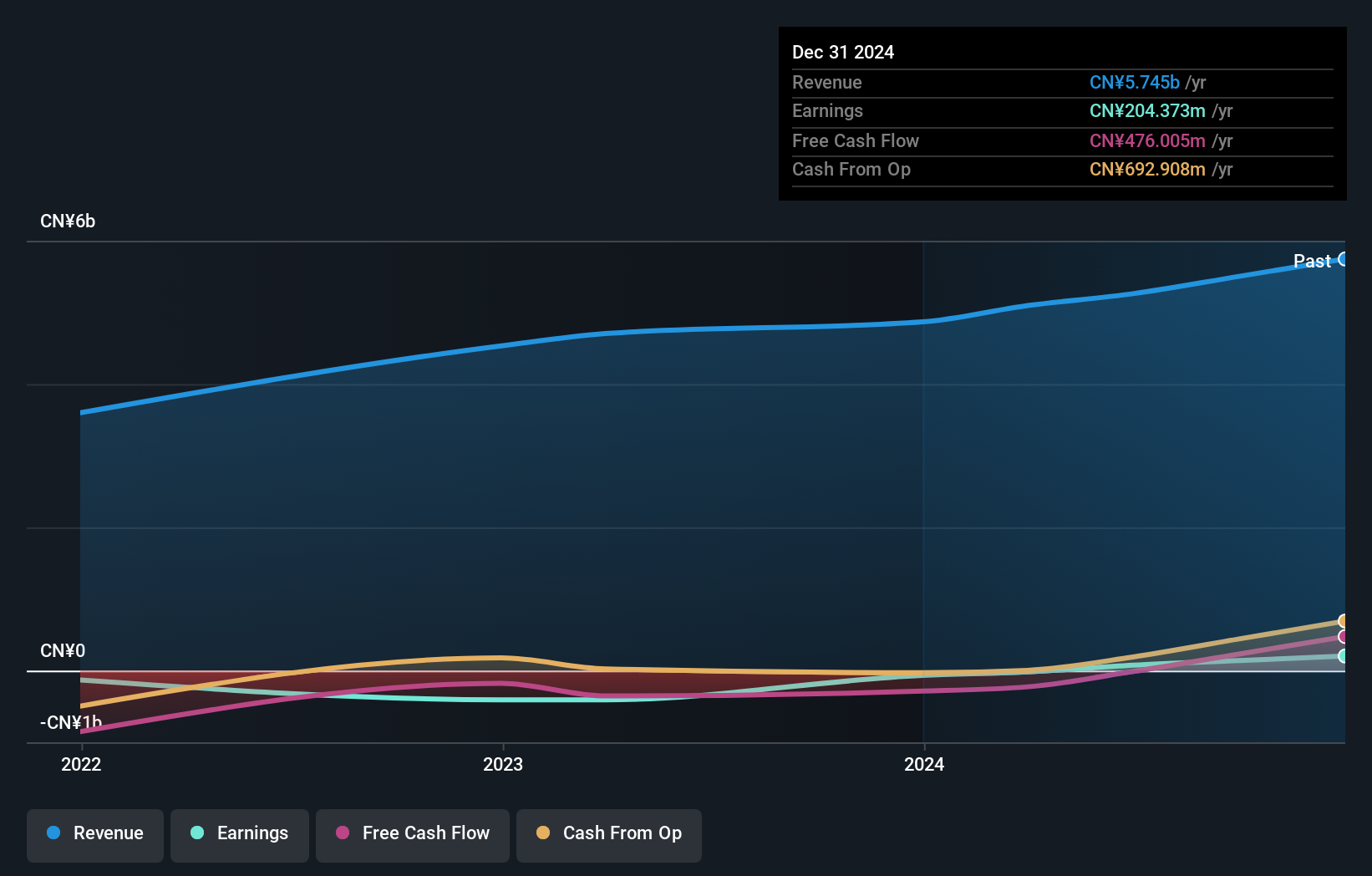

Shiyue Daotian Group, a small player in its sector, has recently turned profitable, with sales reaching CNY 5.75 billion for 2024 compared to CNY 4.87 billion the previous year. The company's net income climbed to CNY 204 million from a net loss of CNY 65 million last year, demonstrating significant improvement in financial health. Basic earnings per share rose to CNY 0.19 from a loss of CNY 0.08 previously, reflecting this turnaround. Additionally, Shiyue Daotian proposed a final dividend of RMB 0.164 per share for the year ended December 2024, indicating confidence in its ongoing performance and future prospects.

- Click here and access our complete health analysis report to understand the dynamics of Shiyue Daotian Group.

Understand Shiyue Daotian Group's track record by examining our Past report.

Elegant Home-Tech (SHSE:603221)

Simply Wall St Value Rating: ★★★★★☆

Overview: Elegant Home-Tech Co., Ltd. specializes in the R&D, production, and sales of PVC elastic floorings both domestically and internationally, with a market cap of CN¥2.56 billion.

Operations: Elegant Home-Tech generates revenue primarily through the production and sale of PVC elastic floorings. The company's financial performance is influenced by its cost structure, which includes expenses related to research, development, and manufacturing processes.

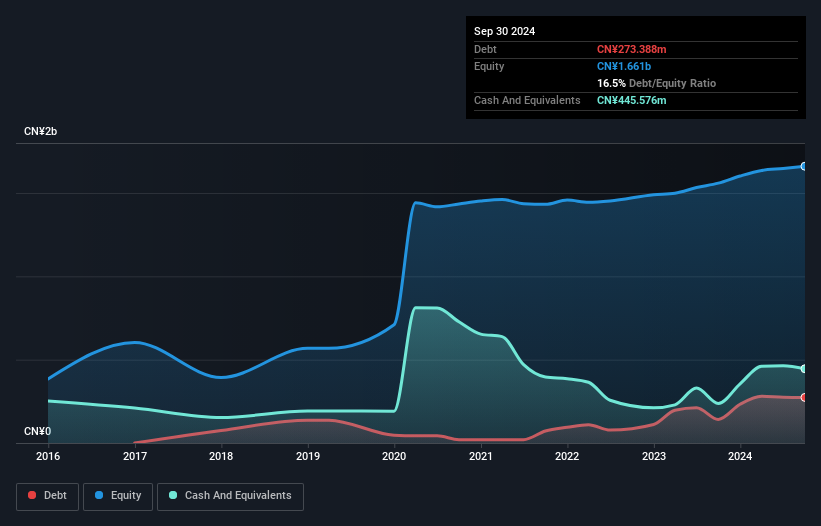

Elegant Home-Tech, a nimble player in the building industry, has shown remarkable earnings growth of 481.1% over the past year, outpacing the industry's -8.9%. With its price-to-earnings ratio at 20.2x, it stands attractively below the CN market average of 37.3x, suggesting potential value for investors. The company's interest payments are well covered by EBIT at a robust 20 times coverage, highlighting financial stability despite an increase in debt to equity ratio from 11.6% to 16.5% over five years. Its high-quality earnings and positive free cash flow hint at promising prospects ahead for this dynamic enterprise.

- Delve into the full analysis health report here for a deeper understanding of Elegant Home-Tech.

Evaluate Elegant Home-Tech's historical performance by accessing our past performance report.

Shenzhen Weiguang Biological Products (SZSE:002880)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shenzhen Weiguang Biological Products Co., Ltd. operates in the biotechnology sector and focuses on the development and production of biological products, with a market cap of CN¥6.29 billion.

Operations: Shenzhen Weiguang generates revenue primarily from its biotechnology products. The company's net profit margin shows a notable trend, reaching 20% in recent financial periods.

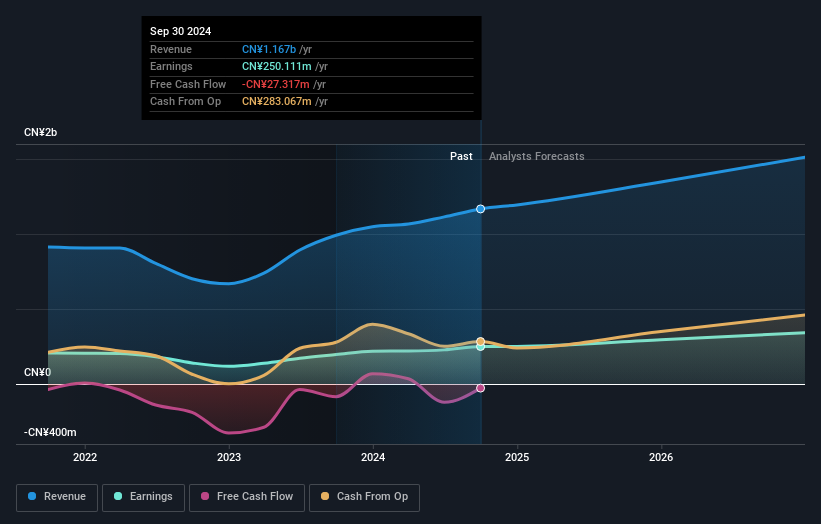

Shenzhen Weiguang Biological Products stands out with high-quality earnings and a net debt to equity ratio of 10.1%, which is satisfactory. The company has shown impressive growth, with earnings increasing by 27.6% over the past year, far surpassing the biotech industry's average of 3.5%. Despite a rise in its debt to equity ratio from 0% to 29.7% over five years, interest payments are well covered at 22.8 times by EBIT, indicating strong financial health. Looking ahead, earnings are projected to grow at an annual rate of 13.81%, suggesting potential for continued expansion in its niche market segment.

Turning Ideas Into Actions

- Access the full spectrum of 3216 Global Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Elegant Home-Tech, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Elegant Home-Tech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603221

Elegant Home-Tech

Engages in the research and development, production, and sales of polyvinyl chloride (PVC) elastic floorings in China and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives