Changzhou Qianhong Biopharma CO.,LTD (SZSE:002550) Held Back By Insufficient Growth Even After Shares Climb 37%

Changzhou Qianhong Biopharma CO.,LTD (SZSE:002550) shareholders would be excited to see that the share price has had a great month, posting a 37% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 38% in the last year.

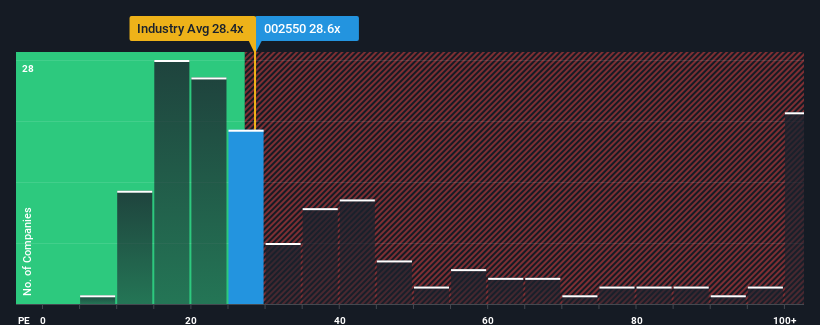

Even after such a large jump in price, Changzhou Qianhong BiopharmaLTD's price-to-earnings (or "P/E") ratio of 28.6x might still make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 33x and even P/E's above 64x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Recent times have been pleasing for Changzhou Qianhong BiopharmaLTD as its earnings have risen in spite of the market's earnings going into reverse. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Changzhou Qianhong BiopharmaLTD

Does Growth Match The Low P/E?

In order to justify its P/E ratio, Changzhou Qianhong BiopharmaLTD would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered an exceptional 19% gain to the company's bottom line. Still, EPS has barely risen at all from three years ago in total, which is not ideal. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Looking ahead now, EPS is anticipated to climb by 24% during the coming year according to the three analysts following the company. That's shaping up to be materially lower than the 37% growth forecast for the broader market.

In light of this, it's understandable that Changzhou Qianhong BiopharmaLTD's P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Changzhou Qianhong BiopharmaLTD's P/E

The latest share price surge wasn't enough to lift Changzhou Qianhong BiopharmaLTD's P/E close to the market median. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Changzhou Qianhong BiopharmaLTD's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 1 warning sign for Changzhou Qianhong BiopharmaLTD that we have uncovered.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002550

Changzhou Qianhong BiopharmaLTD

Manufactures and distributes polysaccharide and protease drugs in China.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives