Global markets have shown resilience with U.S. indexes approaching record highs, buoyed by a strong labor market and positive home sales reports, despite ongoing geopolitical tensions and policy uncertainties. In this context, penny stocks—often smaller or newer companies—continue to present intriguing opportunities for investors seeking potential growth at a lower entry cost. Though the term may seem outdated, these stocks can offer significant upside when backed by solid financials, making them worth watching in today's evolving market landscape.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.21 | MYR340.59M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.475 | MYR2.36B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.85 | HK$539.57M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.59 | A$69.16M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.155 | £811.93M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.05 | £402.8M | ★★★★☆☆ |

| Embark Early Education (ASX:EVO) | A$0.81 | A$148.62M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.56 | £67.89M | ★★★★☆☆ |

| Stelrad Group (LSE:SRAD) | £1.41 | £179.57M | ★★★★★☆ |

Click here to see the full list of 5,799 stocks from our Penny Stocks screener.

Let's dive into some prime choices out of the screener.

NanJi E-Commerce (SZSE:002127)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NanJi E-Commerce Co., LTD operates in China offering brand authorization, retail, and mobile Internet marketing services with a market cap of CN¥10.08 billion.

Operations: The company generates revenue of CN¥3.03 billion from its operations in China.

Market Cap: CN¥10.08B

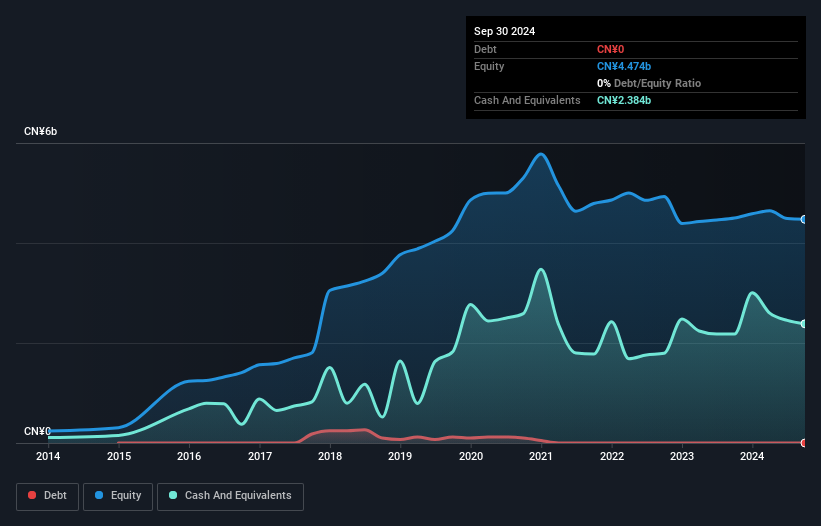

NanJi E-Commerce has shown mixed financial performance, with recent earnings indicating a decline in net income to CN¥54.23 million for the nine months ended September 30, 2024, despite an increase in revenue to CN¥2.41 billion. The company operates debt-free, which reduces financial risk and enhances its liquidity position with short-term assets of CN¥3.7 billion covering liabilities comfortably. However, profitability challenges persist as earnings have declined by a large margin over the past five years. While management and the board are experienced, dividend sustainability is questionable given current earnings coverage issues.

- Click to explore a detailed breakdown of our findings in NanJi E-Commerce's financial health report.

- Review our historical performance report to gain insights into NanJi E-Commerce's track record.

Guangxi Oriental Intelligent Manufacturing Technology (SZSE:002175)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Guangxi Oriental Intelligent Manufacturing Technology Co., Ltd. operates in the intelligent manufacturing sector and has a market cap of CN¥5.23 billion.

Operations: Guangxi Oriental Intelligent Manufacturing Technology Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥5.23B

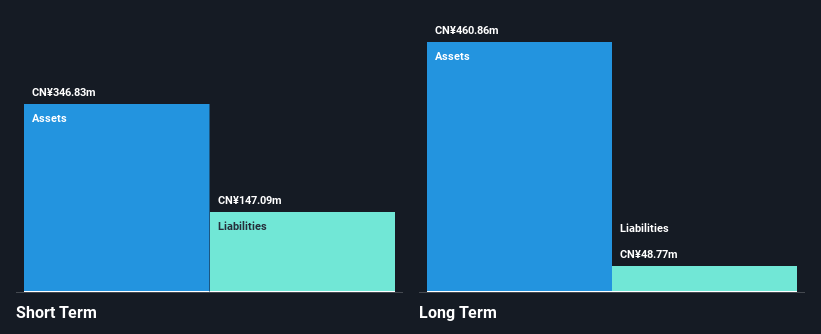

Guangxi Oriental Intelligent Manufacturing Technology Co., Ltd. has demonstrated a stable financial position with more cash than total debt and short-term assets of CN¥346.8 million exceeding both short and long-term liabilities. Despite this, the company faces profitability challenges, as net income for the nine months ended September 30, 2024, dropped to CN¥33.91 million from CN¥50.7 million a year ago, alongside declining profit margins to 8.3%. The management team and board are experienced with an average tenure of over four years each, yet recent earnings growth remains negative at -76.5%, highlighting ongoing operational hurdles in the intelligent manufacturing sector.

- Click here to discover the nuances of Guangxi Oriental Intelligent Manufacturing Technology with our detailed analytical financial health report.

- Explore historical data to track Guangxi Oriental Intelligent Manufacturing Technology's performance over time in our past results report.

Guizhou Xinbang Pharmaceutical (SZSE:002390)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Guizhou Xinbang Pharmaceutical Co., Ltd. engages in the research, development, manufacturing, and sale of Chinese herbal medicines and other pharmaceutical products both in China and internationally, with a market cap of CN¥7.19 billion.

Operations: Guizhou Xinbang Pharmaceutical Co., Ltd. has not reported specific revenue segments.

Market Cap: CN¥7.19B

Guizhou Xinbang Pharmaceutical Co., Ltd. maintains a solid financial footing with more cash than total debt and short-term assets of CN¥5.1 billion surpassing both short and long-term liabilities. Despite stable weekly volatility, the company experienced a decline in net income to CN¥176.59 million for the nine months ended September 30, 2024, from CN¥246.57 million a year earlier, alongside negative earnings growth of -5.5%. The management team is seasoned with an average tenure of 9.5 years, yet challenges persist as profit margins remain low at 3.5%, and return on equity is modest at 4%.

- Click here and access our complete financial health analysis report to understand the dynamics of Guizhou Xinbang Pharmaceutical.

- Examine Guizhou Xinbang Pharmaceutical's past performance report to understand how it has performed in prior years.

Summing It All Up

- Gain an insight into the universe of 5,799 Penny Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NanJi E-Commerce might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002127

NanJi E-Commerce

Provides brand authorization, retail, and mobile Internet marketing services in China.

Flawless balance sheet slight.