Puyang Refractories Group Leads The Charge With 2 Other Prominent Penny Stocks

Reviewed by Simply Wall St

As global markets experience a mix of advancements and retreats, with the S&P 500 Index showing gains and small-cap indices outperforming, investors are keenly observing opportunities across various sectors. Penny stocks, though often associated with smaller or newer companies, remain an intriguing area for those seeking potential value in today's market landscape. Despite their vintage moniker, these stocks can offer affordability and growth potential when backed by strong financials; here we explore three that stand out for their financial robustness.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.21 | MYR340.59M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.585 | MYR2.91B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.77 | HK$488.79M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.735 | MYR127.31M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.85 | £183.45M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.92 | MYR305.39M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.255 | £307.76M | ★★★★★★ |

| Hume Cement Industries Berhad (KLSE:HUMEIND) | MYR3.38 | MYR2.45B | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £4.08 | £405.78M | ★★★★☆☆ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$127.64M | ★★★★☆☆ |

Click here to see the full list of 5,800 stocks from our Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Puyang Refractories Group (SZSE:002225)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Puyang Refractories Group Co., Ltd. is involved in the research, production, and sales of various refractory materials and thermal equipment globally, with a market cap of CN¥3.84 billion.

Operations: The company generates its revenue from two main segments: CN¥4.07 billion from China and CN¥1.47 billion from overseas markets.

Market Cap: CN¥3.84B

Puyang Refractories Group has demonstrated stable financial performance with earnings growth of 14.9% over the past year, surpassing industry averages. Despite a high net debt to equity ratio of 41.7%, the company's debt is well covered by operating cash flow and EBIT, indicating sound financial management. The recent earnings report showed a slight decline in net income but an improvement in profit margins to 4.3%. Trading at a significant discount to its estimated fair value, Puyang offers potential upside; however, its unstable dividend history and large one-off gains impacting recent results warrant cautious consideration for investors interested in penny stocks.

- Take a closer look at Puyang Refractories Group's potential here in our financial health report.

- Understand Puyang Refractories Group's earnings outlook by examining our growth report.

Guizhou Xinbang Pharmaceutical (SZSE:002390)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Guizhou Xinbang Pharmaceutical Co., Ltd. engages in the research, development, manufacture, and sale of Chinese herbal medicines and other pharmaceutical products both in China and internationally, with a market cap of approximately CN¥6.73 billion.

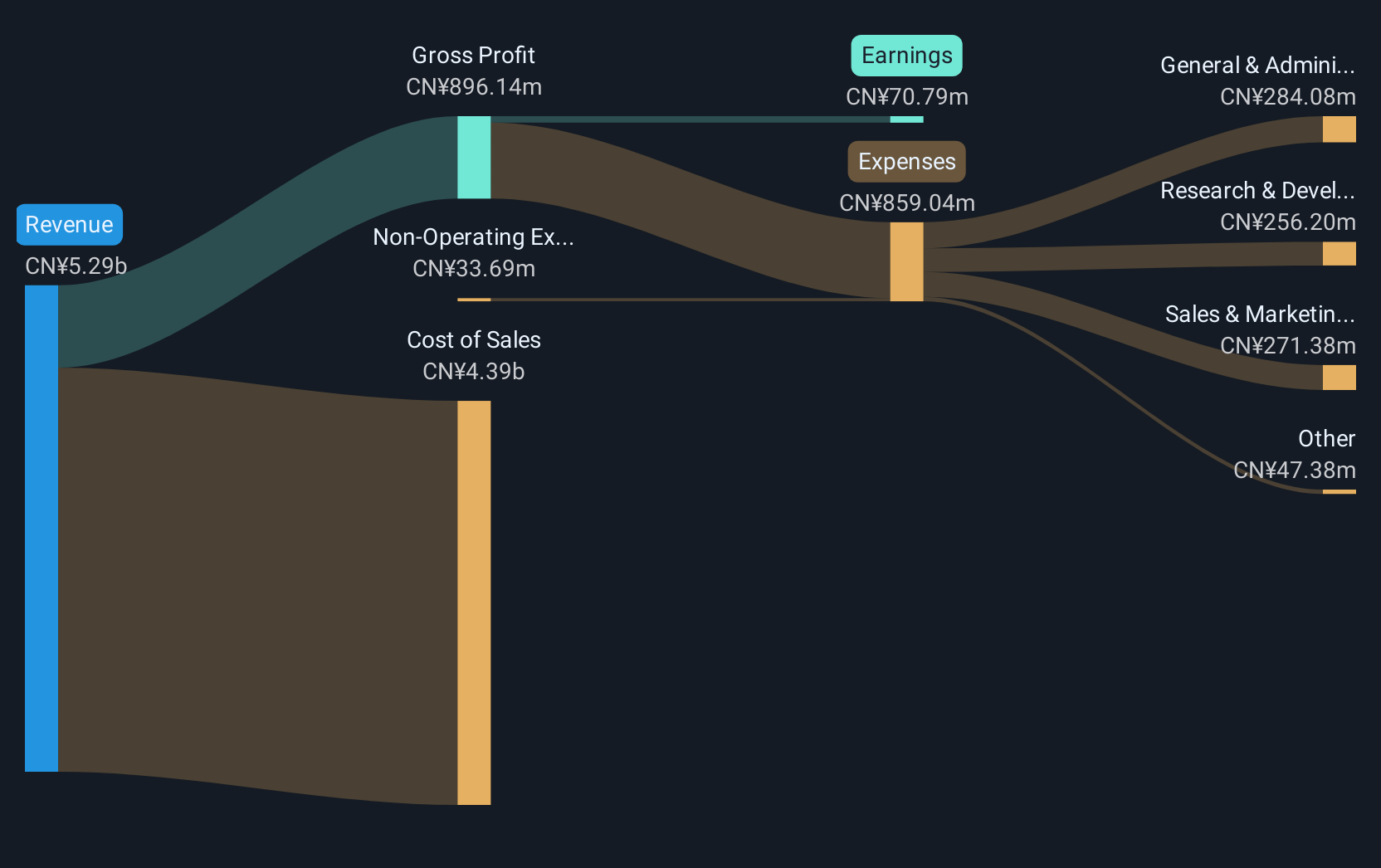

Operations: The company's revenue is primarily derived from Pharmaceutical Distribution (CN¥5.00 billion), Medical Services (CN¥1.67 billion), and Pharmaceutical Manufacturing (CN¥914.94 million).

Market Cap: CN¥6.73B

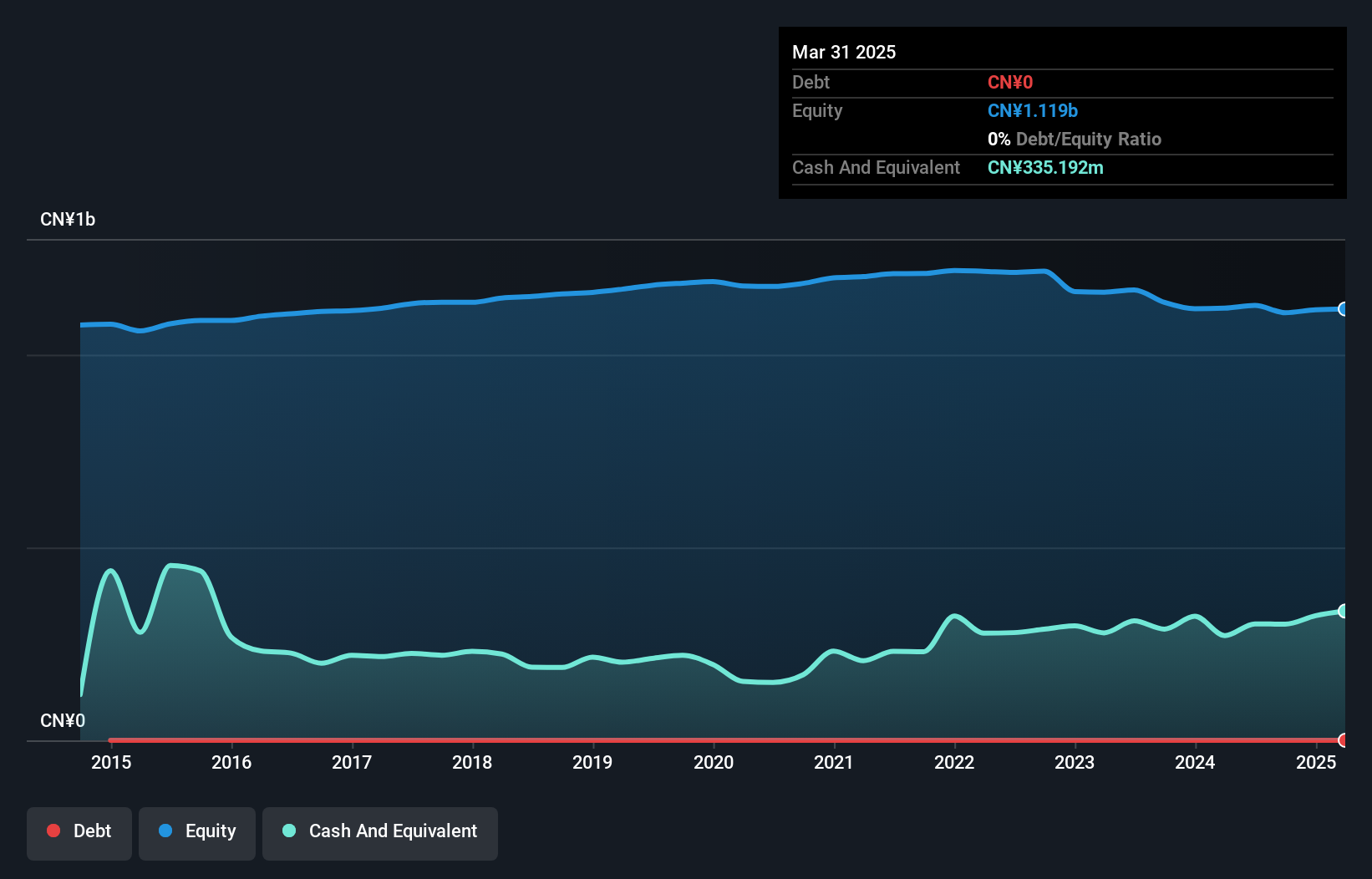

Guizhou Xinbang Pharmaceutical has shown financial stability with a seasoned management team averaging 9.4 years in tenure and a reduced debt-to-equity ratio from 75.3% to 11.6% over five years, indicating effective debt management. While the company's net profit margins improved slightly to 3.9%, recent earnings revealed a decline in both sales and net income for the first half of 2024 compared to the previous year, reflecting challenges in maintaining growth momentum. Despite trading at a significant discount to its estimated fair value, its unstable dividend record may concern investors seeking consistent returns from penny stocks.

- Jump into the full analysis health report here for a deeper understanding of Guizhou Xinbang Pharmaceutical.

- Gain insights into Guizhou Xinbang Pharmaceutical's past trends and performance with our report on the company's historical track record.

Guangdong Jialong Food (SZSE:002495)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Guangdong Jialong Food Co., Ltd. engages in the research, development, production, and sale of food products in China, with a market cap of CN¥2.02 billion.

Operations: The company's revenue is primarily derived from the food industry, amounting to CN¥226.80 million.

Market Cap: CN¥2.02B

Guangdong Jialong Food Co., Ltd. has navigated the challenges of being unprofitable while maintaining a stable financial position, evidenced by its debt-free status and strong liquidity, with short-term assets of CN¥383.3 million covering both short and long-term liabilities. Despite a decline in revenue to CN¥118.76 million for the first half of 2024 compared to the previous year, net income improved to CN¥8.17 million, reflecting some operational resilience. The company completed a share buyback program worth CN¥26.69 million, which may signal management's confidence in its future prospects despite current profitability issues.

- Get an in-depth perspective on Guangdong Jialong Food's performance by reading our balance sheet health report here.

- Learn about Guangdong Jialong Food's historical performance here.

Make It Happen

- Access the full spectrum of 5,800 Penny Stocks by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002390

Guizhou Xinbang Pharmaceutical

Researches, develops, manufactures, and sells Chinese herbal medicines and other pharmaceutical products in China and internationally.

Flawless balance sheet average dividend payer.