High Growth Tech Stocks Including Elm With Promising Potential

Reviewed by Simply Wall St

Amidst a backdrop of cautious sentiment in global markets, small-cap indexes have faced notable challenges, with the S&P 600 experiencing pronounced declines as investors react to the Federal Reserve's recent rate cut and its implications for future monetary policy. Despite these headwinds, economic indicators such as robust U.S. GDP growth and resilient consumer spending provide a complex environment where high-growth tech stocks can offer intriguing opportunities; these stocks often thrive by capitalizing on innovation and adaptability in fluctuating market conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| CD Projekt | 24.92% | 27.00% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

Click here to see the full list of 1273 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Elm (SASE:7203)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Elm Company offers ready-made and customized digital solutions in Saudi Arabia, with a market cap of SAR88.26 billion.

Operations: Elm generates revenue primarily from its Digital Business, accounting for SAR5.04 billion, complemented by Professional Services and Business Process Outsourcing segments.

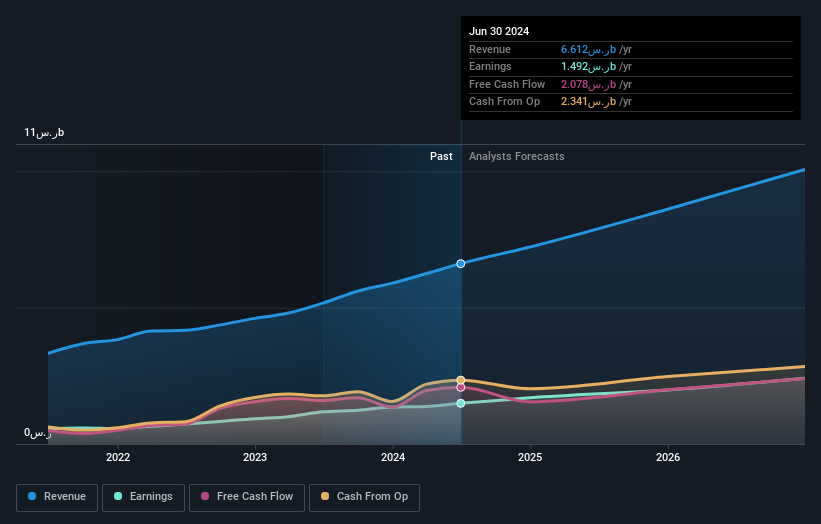

Elm's recent performance and market activities underscore its robust position in the tech sector. With a substantial increase in sales to SAR 1.87 billion and net income rising to SAR 498.24 million in Q3 2024, Elm has demonstrated significant financial growth, outpacing previous year's figures convincingly. This upward trajectory is mirrored by an earnings growth of 33.4% over the past year, surpassing the IT industry's average of 18.9%. Notably, Elm’s strategic presentations at key industry conferences such as Jefferies GEMS and J.P. Morgan’s Saudi Arabia Forum highlight its proactive engagement with global investors and sector peers, reinforcing its market presence. The company’s commitment to innovation is evident from its R&D investments which are crucial for maintaining competitive advantage in rapidly evolving tech landscapes; however, specific figures on R&D spending were not disclosed this time around. Looking ahead, Elm is expected to maintain a strong revenue growth rate at 15.8% annually which is impressive compared to the SA market’s contraction of -0.5%. Moreover, with forecasted annual earnings growth set at a healthy rate of 18.6%, Elm appears well-positioned for sustained financial health and industry leadership.

- Delve into the full analysis health report here for a deeper understanding of Elm.

Evaluate Elm's historical performance by accessing our past performance report.

Accelink Technologies CoLtd (SZSE:002281)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Accelink Technologies Co., Ltd. is engaged in the research, development, manufacturing, sales, and technical services of optoelectronic chips, devices, modules, and subsystem products primarily in China with a market capitalization of CN¥47.22 billion.

Operations: Accelink Technologies Co., Ltd. generates revenue primarily from its communication equipment manufacturing segment, which accounts for CN¥7.10 billion. The company's focus on optoelectronic technology supports its operations in developing advanced products for the communications sector in China.

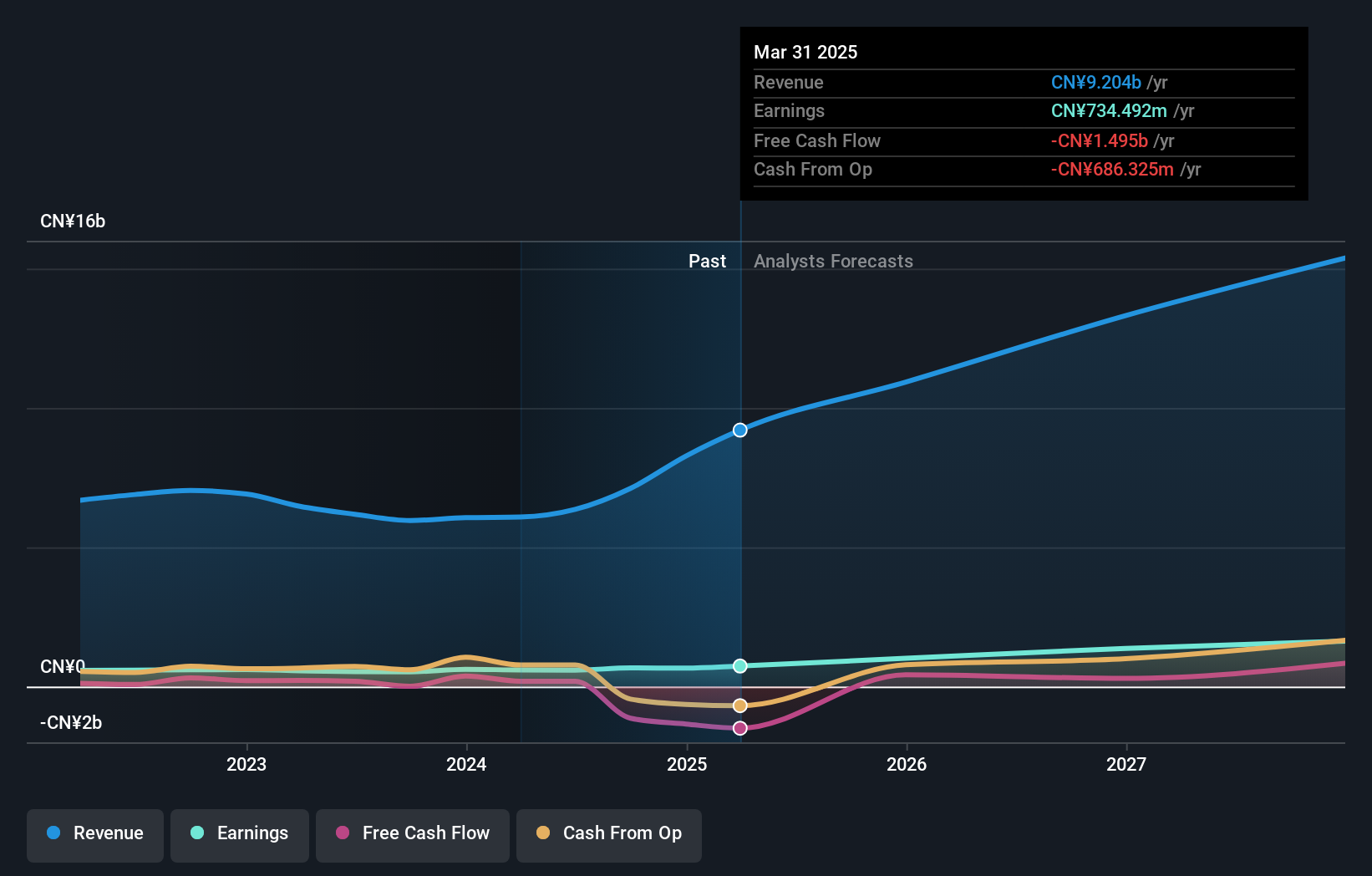

Accelink Technologies CoLtd has demonstrated a robust performance with its revenue surging to CNY 5.38 billion, up from CNY 4.33 billion year-over-year, reflecting a notable increase in market demand for their products. This growth is complemented by an earnings rise of 12.3%, with net income reaching CNY 464 million. The company's commitment to innovation is underscored by its R&D efforts, crucial for sustaining its competitive edge in the fast-evolving tech landscape; however, specific R&D expenditure figures were not disclosed in the recent updates. With earnings projected to grow at an annual rate of 27.9% and revenue expected to expand by 23.9% annually, Accelink appears well-positioned to capitalize on industry trends and maintain its trajectory in the high-growth tech sector.

iSoftStone Information Technology (Group) (SZSE:301236)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: iSoftStone Information Technology (Group) Co., Ltd. is a company specializing in IT services and solutions with a market capitalization of CN¥59.46 billion.

Operations: Due to the lack of detailed financial data provided in the business operations text, it's challenging to summarize iSoftStone Information Technology (Group) Co., Ltd.'s revenue streams or cost breakdowns. However, based on the overview, it is evident that the company operates within the IT services and solutions sector. Further specific financial details would be necessary for a more comprehensive analysis.

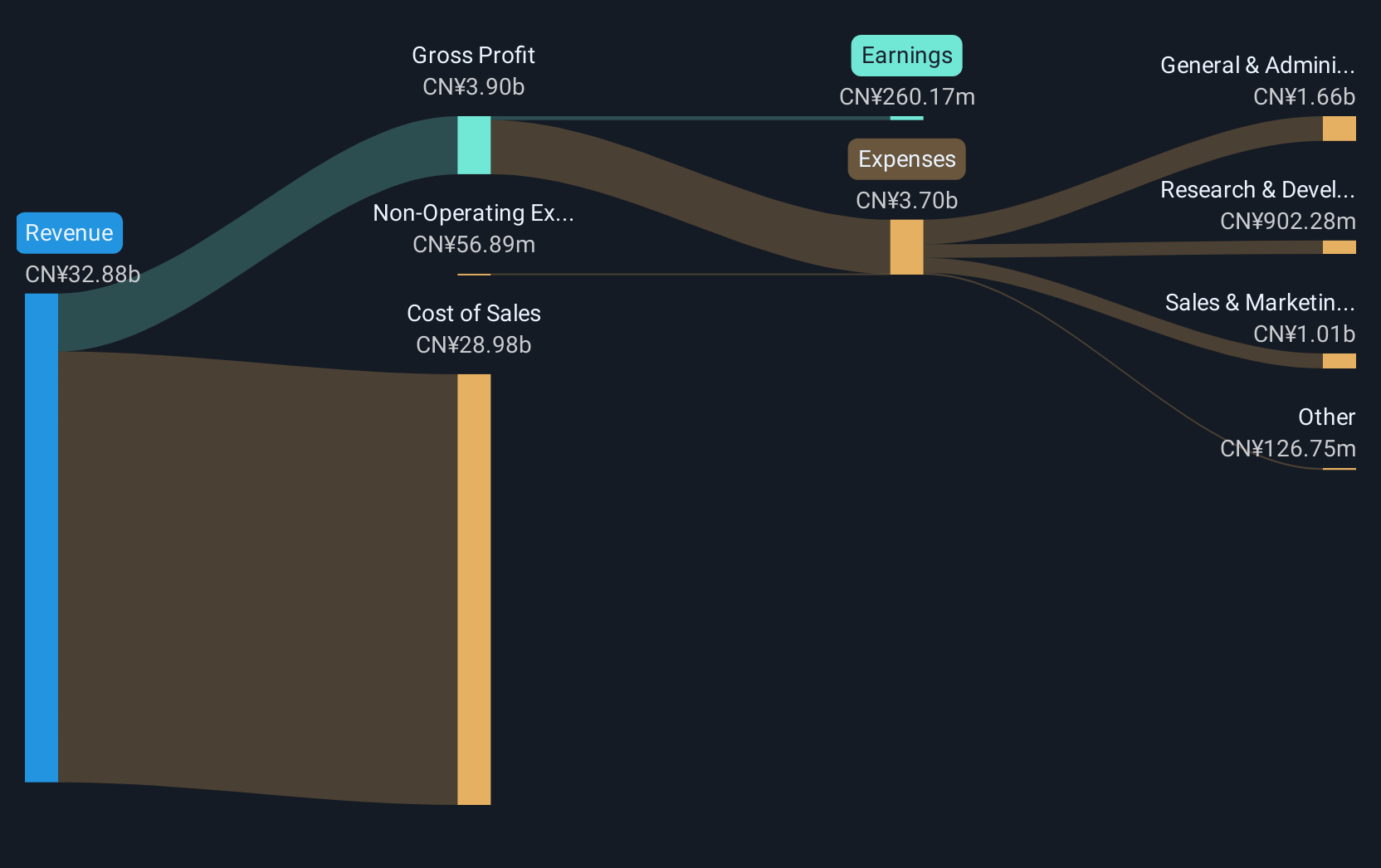

iSoftStone Information Technology (Group) Co., Ltd. has seen a significant surge in revenue, escalating from CNY 12.83 billion to CNY 22.21 billion within nine months, marking a robust growth trajectory in the tech sector. Despite this revenue growth, net income has notably decreased to CNY 75.94 million from CNY 352.31 million, reflecting challenges in profit retention amidst expansion efforts. The company's substantial investment in innovation is evident as they navigate through complex market dynamics and competitive pressures, aiming to bolster their technological offerings and market position.

Key Takeaways

- Investigate our full lineup of 1273 High Growth Tech and AI Stocks right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if iSoftStone Information Technology (Group) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301236

iSoftStone Information Technology (Group)

iSoftStone Information Technology (Group) Co., Ltd.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives