- China

- /

- Metals and Mining

- /

- SZSE:000758

Undiscovered Gems Three Promising Stocks To Explore In December 2024

Reviewed by Simply Wall St

As the global markets continue to navigate a landscape marked by mixed performances across major indexes, with growth stocks leading the charge while small-cap indices like the Russell 2000 face challenges, investors are keenly observing economic indicators such as job growth and interest rate expectations. Amidst this backdrop, identifying promising stocks often involves looking for companies with strong fundamentals and potential for growth that may not yet be fully appreciated by the broader market.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ruentex Interior Design | NA | 37.70% | 48.02% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Cita Mineral Investindo | NA | -3.08% | 16.56% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

China Nonferrous Metal Industry's Foreign Engineering and ConstructionLtd (SZSE:000758)

Simply Wall St Value Rating: ★★★★★★

Overview: China Nonferrous Metal Industry's Foreign Engineering and Construction Co., Ltd. (SZSE:000758) is involved in engineering and construction services within the nonferrous metal industry, with a market cap of CN¥10.53 billion.

Operations: The company generates revenue primarily through its engineering and construction services in the nonferrous metal sector. Its financial performance is influenced by various cost components, with a focus on managing expenses to optimize profitability.

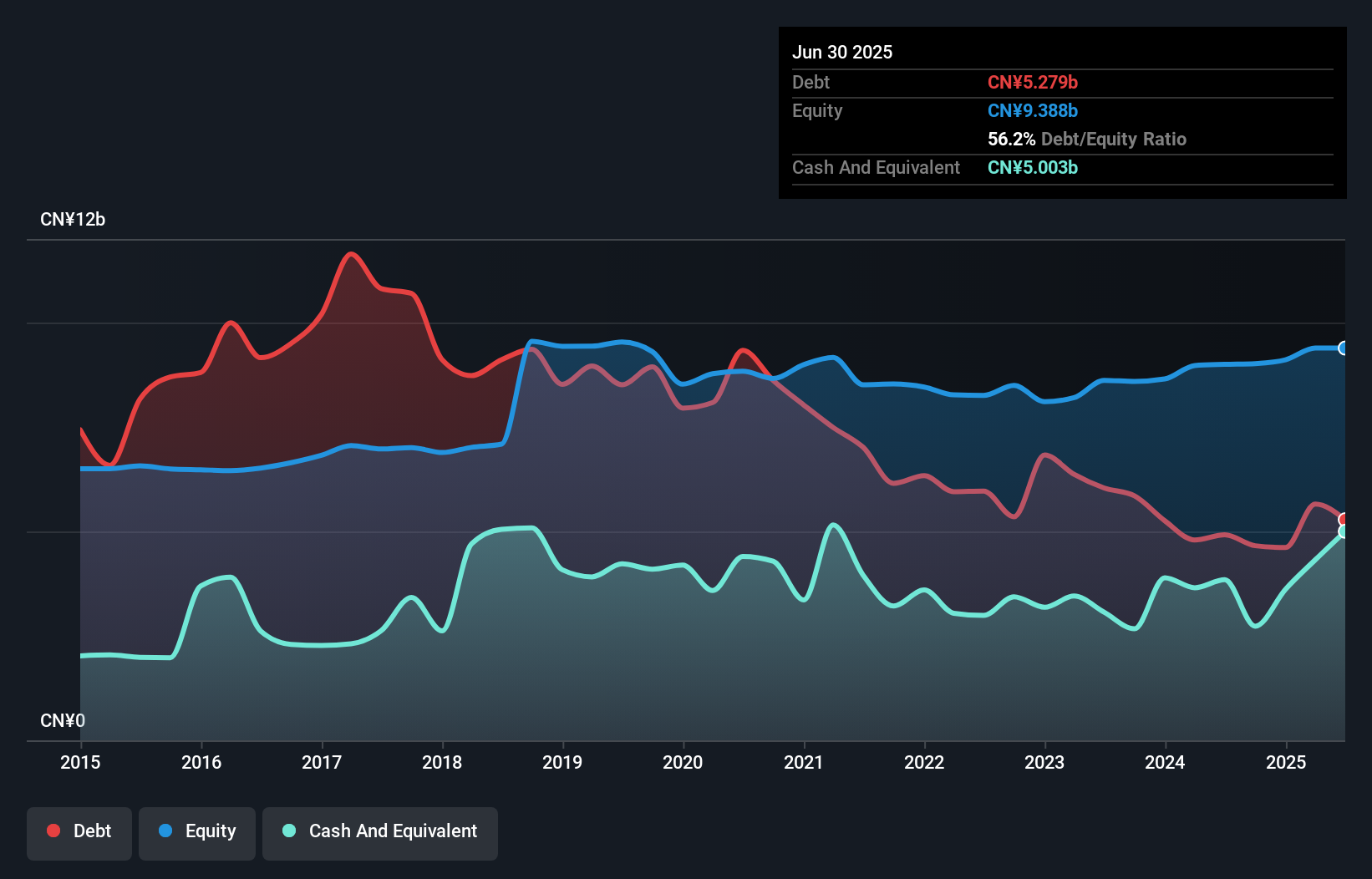

China Nonferrous Metal Industry's Foreign Engineering and Construction Co., Ltd. showcases a compelling profile with its debt to equity ratio dropping from 96.1% to 51.7% over five years, indicating prudent financial management. The company reported earnings growth of 781.6% over the past year, significantly outpacing the industry average of -2.3%. Trading at 43.2% below estimated fair value suggests potential undervaluation in the market, while interest payments are comfortably covered by EBIT at a multiple of 41.7x, highlighting robust operational efficiency and financial stability in this niche sector.

Tibet Cheezheng Tibetan Medicine (SZSE:002287)

Simply Wall St Value Rating: ★★★★★☆

Overview: Tibet Cheezheng Tibetan Medicine Co., Ltd. is a company that specializes in the production and sale of traditional Tibetan medicinal products, with a market cap of CN¥12.19 billion.

Operations: The company generates revenue primarily through the sale of traditional Tibetan medicinal products. It focuses on optimizing its cost structure to enhance profitability, with a notable emphasis on maintaining an efficient production process. The company's net profit margin has shown significant variability over recent periods, reflecting changes in operational efficiency and market conditions.

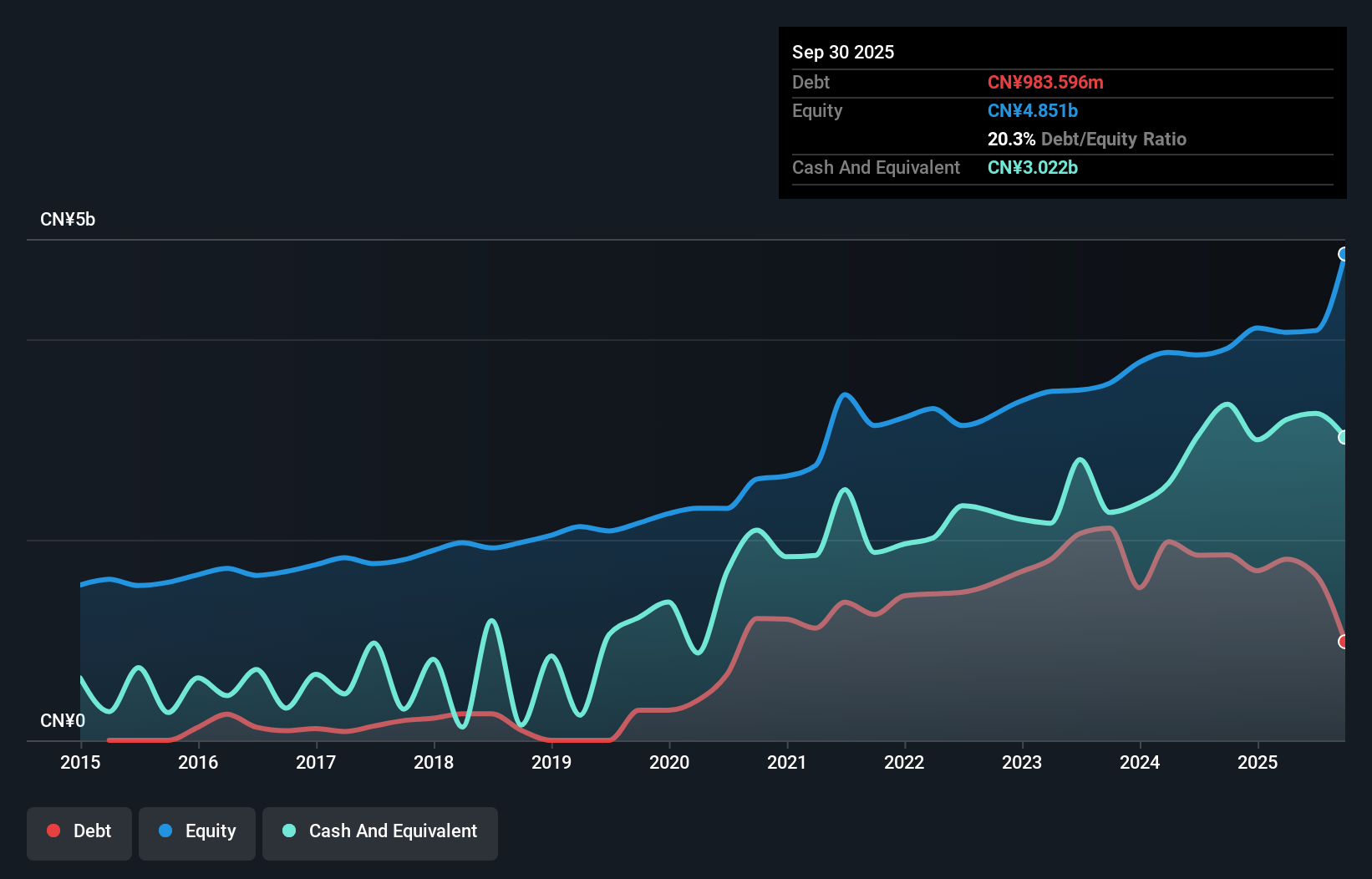

Tibet Cheezheng Tibetan Medicine, a nimble player in its field, has shown robust performance with earnings growth of 20.4%, outpacing the pharmaceutical industry’s -2.5% over the past year. The company reported sales of CNY 1.47 billion for nine months ending September 2024, up from CNY 1.25 billion the previous year, while net income reached CNY 393 million compared to CNY 380 million last year. With interest payments well covered by EBIT at an impressive ratio of 8.4x and trading at a discount of about 34% below estimated fair value, it seems positioned attractively for potential investors despite increased debt-to-equity from 13.8% to 47.3%.

Okinawa Cellular Telephone (TSE:9436)

Simply Wall St Value Rating: ★★★★★★

Overview: Okinawa Cellular Telephone Company offers telecommunication and mobile phone services in Japan, with a market capitalization of ¥211.52 billion.

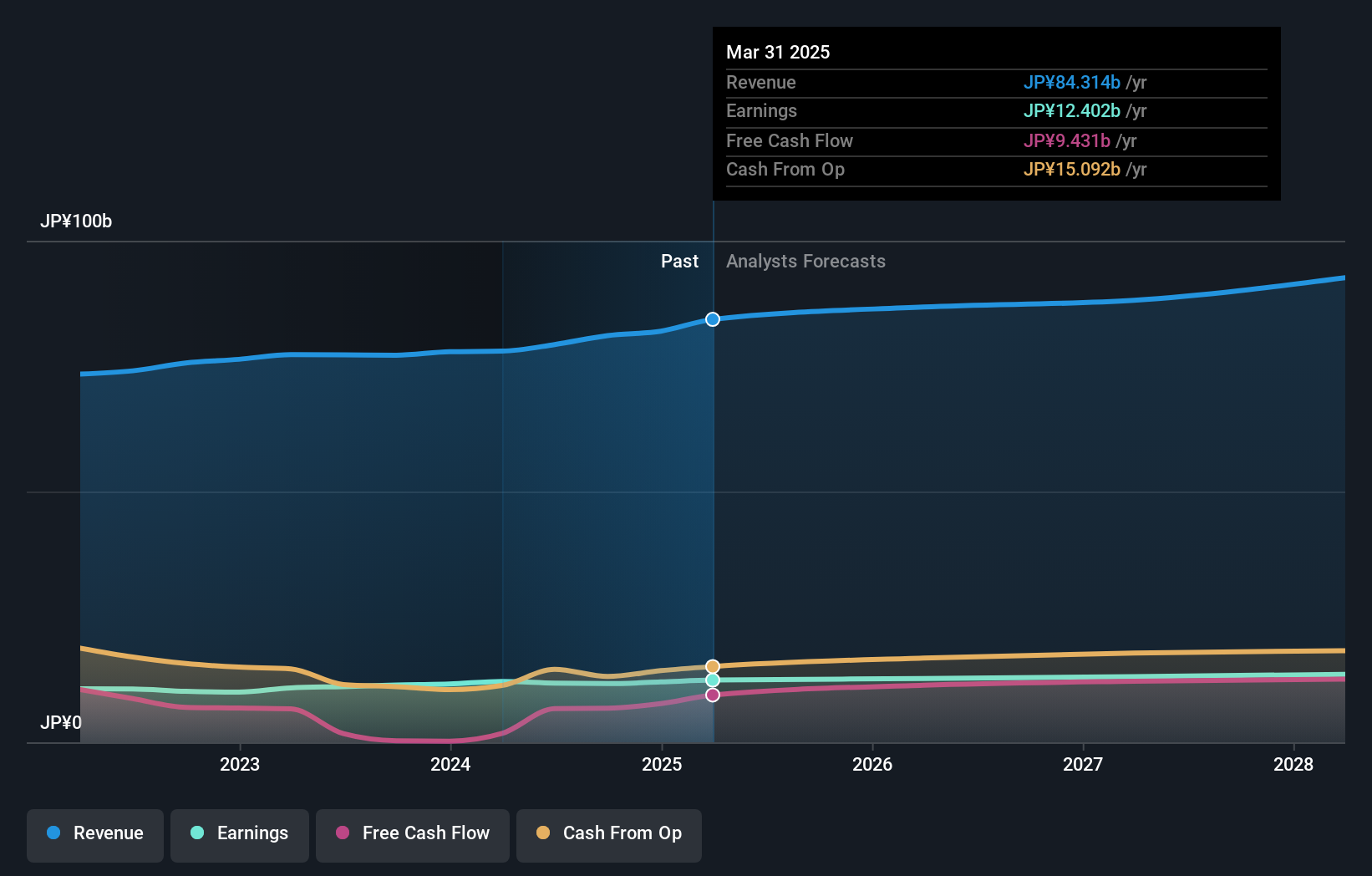

Operations: The company generates revenue primarily from its telecommunications business, amounting to ¥81.10 billion.

Okinawa Cellular, a nimble player in the telecom sector, stands out with its debt-free status, having eliminated a 0.07% debt to equity ratio over five years. Its earnings growth of 2.4% surpasses the broader industry's -10.3%, showcasing resilience and potential for future value as it trades at 28.6% below estimated fair value. The company recently expanded its share buyback program by authorizing an additional ¥1 billion, totaling ¥5 billion, and repurchased 572,200 shares for ¥2.31 billion from July to September 2024—actions likely reflecting confidence in its financial health and market position.

- Take a closer look at Okinawa Cellular Telephone's potential here in our health report.

Understand Okinawa Cellular Telephone's track record by examining our Past report.

Next Steps

- Dive into all 4629 of the Undiscovered Gems With Strong Fundamentals we have identified here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000758

China Nonferrous Metal Industry's Foreign Engineering and ConstructionLtd

China Nonferrous Metal Industry's Foreign Engineering and Construction Co.,Ltd.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives