Is Zhejiang Hisoar Pharmaceutical (SZSE:002099) Using Debt In A Risky Way?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Zhejiang Hisoar Pharmaceutical Co., Ltd. (SZSE:002099) does use debt in its business. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Zhejiang Hisoar Pharmaceutical

How Much Debt Does Zhejiang Hisoar Pharmaceutical Carry?

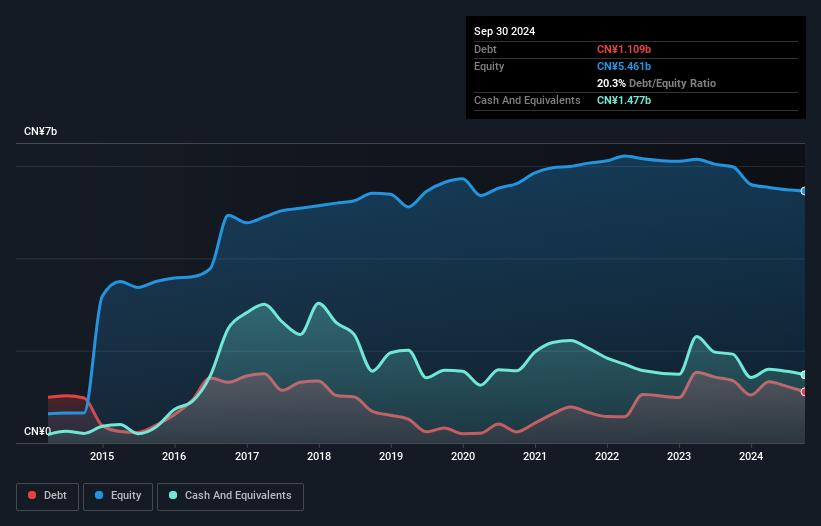

As you can see below, Zhejiang Hisoar Pharmaceutical had CN¥1.11b of debt at September 2024, down from CN¥1.35b a year prior. However, its balance sheet shows it holds CN¥1.48b in cash, so it actually has CN¥368.4m net cash.

A Look At Zhejiang Hisoar Pharmaceutical's Liabilities

The latest balance sheet data shows that Zhejiang Hisoar Pharmaceutical had liabilities of CN¥2.05b due within a year, and liabilities of CN¥95.3m falling due after that. Offsetting this, it had CN¥1.48b in cash and CN¥401.6m in receivables that were due within 12 months. So it has liabilities totalling CN¥270.4m more than its cash and near-term receivables, combined.

Given Zhejiang Hisoar Pharmaceutical has a market capitalization of CN¥7.84b, it's hard to believe these liabilities pose much threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. While it does have liabilities worth noting, Zhejiang Hisoar Pharmaceutical also has more cash than debt, so we're pretty confident it can manage its debt safely. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Zhejiang Hisoar Pharmaceutical will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, Zhejiang Hisoar Pharmaceutical made a loss at the EBIT level, and saw its revenue drop to CN¥1.9b, which is a fall of 16%. We would much prefer see growth.

So How Risky Is Zhejiang Hisoar Pharmaceutical?

Although Zhejiang Hisoar Pharmaceutical had an earnings before interest and tax (EBIT) loss over the last twelve months, it generated positive free cash flow of CN¥47m. So taking that on face value, and considering the net cash situation, we don't think that the stock is too risky in the near term. Until we see some positive EBIT, we're a bit cautious of the stock, not least because of the rather modest revenue growth. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For example - Zhejiang Hisoar Pharmaceutical has 1 warning sign we think you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Hisoar Pharmaceutical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002099

Zhejiang Hisoar Pharmaceutical

Engages in the manufacture of pharmaceutical products and dyes in China and internationally.

Mediocre balance sheet and overvalued.

Market Insights

Community Narratives