Yifan Pharmaceutical Co., Ltd.'s (SZSE:002019) Shares Leap 28% Yet They're Still Not Telling The Full Story

Yifan Pharmaceutical Co., Ltd. (SZSE:002019) shareholders would be excited to see that the share price has had a great month, posting a 28% gain and recovering from prior weakness. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 5.5% in the last twelve months.

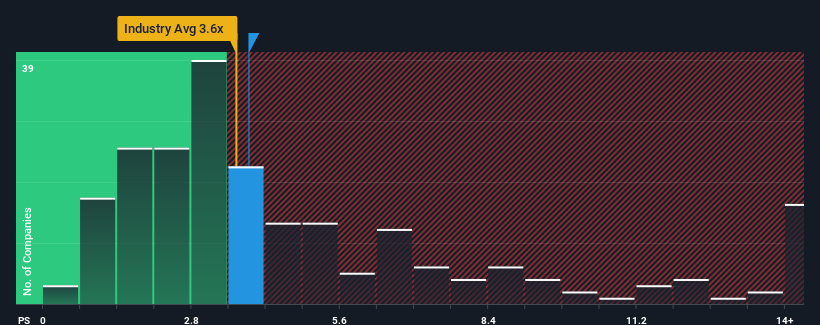

Although its price has surged higher, there still wouldn't be many who think Yifan Pharmaceutical's price-to-sales (or "P/S") ratio of 3.9x is worth a mention when the median P/S in China's Pharmaceuticals industry is similar at about 3.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Yifan Pharmaceutical

How Has Yifan Pharmaceutical Performed Recently?

With revenue growth that's inferior to most other companies of late, Yifan Pharmaceutical has been relatively sluggish. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Yifan Pharmaceutical will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Yifan Pharmaceutical?

In order to justify its P/S ratio, Yifan Pharmaceutical would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company grew revenue by an impressive 15% last year. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 16% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 26% as estimated by the three analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 18%, which is noticeably less attractive.

With this information, we find it interesting that Yifan Pharmaceutical is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On Yifan Pharmaceutical's P/S

Its shares have lifted substantially and now Yifan Pharmaceutical's P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Yifan Pharmaceutical currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Yifan Pharmaceutical with six simple checks.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade Yifan Pharmaceutical, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002019

Yifan Pharmaceutical

Engages in the researches and develops, produces, and sells macromolecules, biosimilars, generic drugs, small molecules, synthetic biologics, and special traditional Chinese medicines in China Southeast Asia, Europe, North America, Singapore, South Korea, Italy, Germany, and the United States, and internationally.

Reasonable growth potential and fair value.