Yifan Pharmaceutical Co., Ltd.'s (SZSE:002019) Share Price Could Signal Some Risk

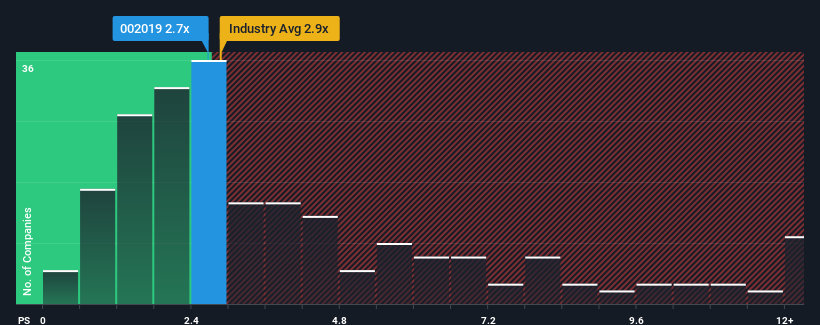

It's not a stretch to say that Yifan Pharmaceutical Co., Ltd.'s (SZSE:002019) price-to-sales (or "P/S") ratio of 2.7x right now seems quite "middle-of-the-road" for companies in the Pharmaceuticals industry in China, where the median P/S ratio is around 2.9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Yifan Pharmaceutical

What Does Yifan Pharmaceutical's Recent Performance Look Like?

Recent times haven't been great for Yifan Pharmaceutical as its revenue has been rising slower than most other companies. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Yifan Pharmaceutical.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Yifan Pharmaceutical would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 19%. However, this wasn't enough as the latest three year period has seen the company endure a nasty 4.2% drop in revenue in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 24% over the next year. With the industry predicted to deliver 122% growth, the company is positioned for a weaker revenue result.

With this in mind, we find it intriguing that Yifan Pharmaceutical's P/S is closely matching its industry peers. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What Does Yifan Pharmaceutical's P/S Mean For Investors?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look at the analysts forecasts of Yifan Pharmaceutical's revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You should always think about risks. Case in point, we've spotted 1 warning sign for Yifan Pharmaceutical you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade Yifan Pharmaceutical, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002019

Yifan Pharmaceutical

Engages in the researches and develops, produces, and sells macromolecules, biosimilars, generic drugs, small molecules, synthetic biologics, and special traditional Chinese medicines in China Southeast Asia, Europe, North America, Singapore, South Korea, Italy, Germany, and the United States, and internationally.

Reasonable growth potential and fair value.