Discovering Hidden Opportunities With These 3 Undiscovered Gems

Reviewed by Simply Wall St

As global markets navigate a landscape marked by central bank rate adjustments and mixed economic indicators, small-cap stocks have faced challenges, with the Russell 2000 Index underperforming larger indices. Amidst this backdrop, identifying promising opportunities requires a keen eye for stocks that exhibit resilience and potential growth despite broader market headwinds.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Xiangtan Electrochemical ScientificLtd | 44.62% | 13.70% | 36.55% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Wuxi Chemical Equipment | NA | 12.26% | -0.74% | ★★★★★★ |

| All E Technologies | NA | 27.05% | 31.58% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Hunan Investment GroupLtd | 7.09% | 33.04% | 20.37% | ★★★★★☆ |

| Keli Motor Group | 21.66% | 9.99% | -12.19% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Proeduca Altus (BME:PRO)

Simply Wall St Value Rating: ★★★★☆☆

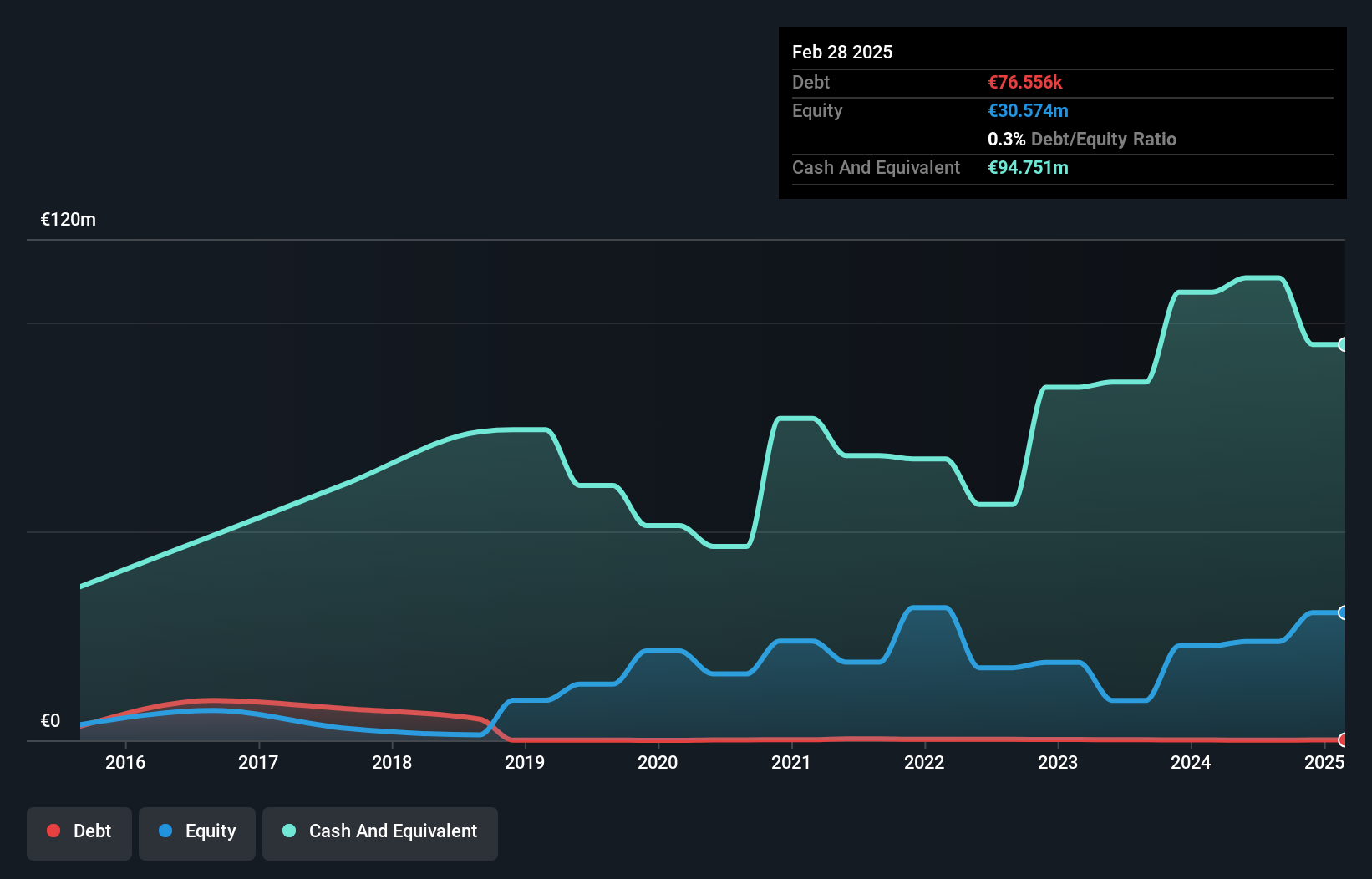

Overview: Proeduca Altus, S.A. offers online education services and has a market capitalization of approximately €1.29 billion.

Operations: Proeduca generates revenue primarily from the provision of services, amounting to €315.28 million, with a minor contribution from sales at €0.04 million.

Proeduca Altus, a relatively small player in the education sector, shows some intriguing financial characteristics. The company has more cash than total debt, indicating a strong balance sheet position. However, its earnings growth over the past year was negative at -1.8%, contrasting sharply with the Consumer Services industry average of 14.2%. Despite this setback, Proeduca's high-quality earnings suggest solid operational efficiency. Recently declared a cash dividend of €0.27 per share on October 9, 2024, reflecting confidence in its financial stability and commitment to returning value to shareholders amidst fluctuating performance metrics.

Nederman Holding (OM:NMAN)

Simply Wall St Value Rating: ★★★★☆☆

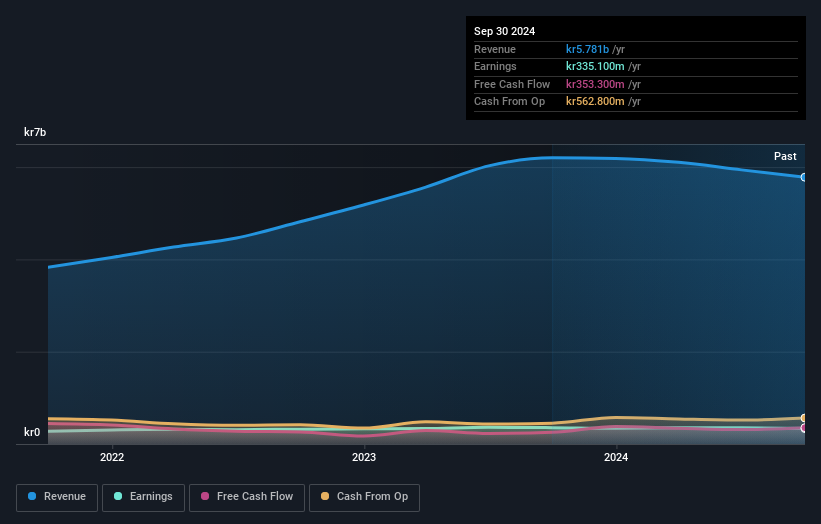

Overview: Nederman Holding AB (publ) is an environmental technology company that operates globally across the Americas, Asia Pacific, Europe, the Middle East, and Asia with a market capitalization of approximately SEK7.71 billion.

Operations: Nederman generates revenue primarily from its Extraction & Filtration Technology segment, contributing SEK2.61 billion, followed by Process Technology at SEK1.64 billion. The Duct & Filter Technology and Monitoring & Control Technology segments add SEK864.5 million and SEK784.4 million, respectively.

Nederman Holding, a small cap player in the industrial sector, is trading at 21% below its estimated fair value. Despite a high net debt to equity ratio of 45.7%, the company maintains strong financial health with interest payments well-covered by EBIT at 5.9 times coverage. Recent earnings reports show a dip, with third-quarter sales reaching SEK 1,415 million compared to SEK 1,574 million last year and net income dropping to SEK 70 million from SEK 85 million. The firm remains profitable and continues generating positive free cash flow despite facing industry challenges like negative earnings growth of -5.5%.

- Delve into the full analysis health report here for a deeper understanding of Nederman Holding.

Assess Nederman Holding's past performance with our detailed historical performance reports.

PKU HealthCareLtd (SZSE:000788)

Simply Wall St Value Rating: ★★★★★★

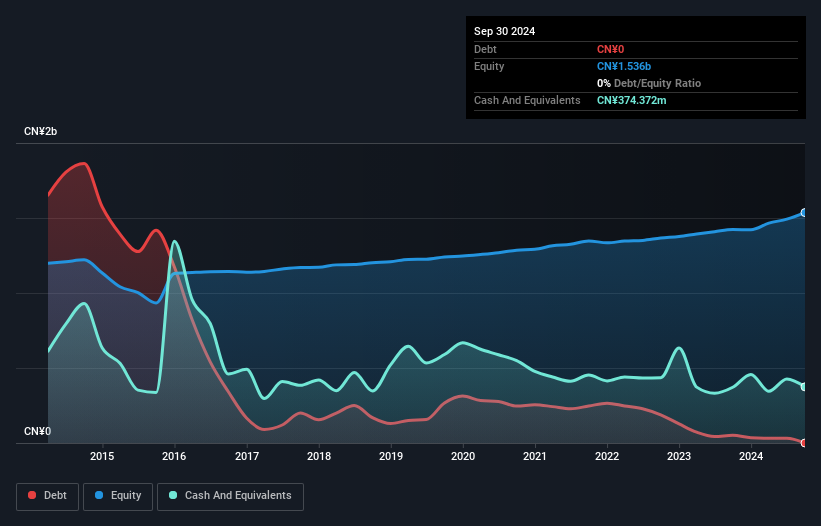

Overview: PKU HealthCare Corp., Ltd. is engaged in the research, development, manufacturing, and sale of pharmaceutical products in China with a market capitalization of approximately CN¥4.12 billion.

Operations: PKU HealthCare generates revenue primarily through the sale of pharmaceutical products in China. The company's financial performance is characterized by its focus on cost management and profitability, with particular attention to maintaining a competitive net profit margin.

PKU HealthCare has shown impressive earnings growth of 130.5% over the past year, outpacing the broader pharmaceuticals industry. The company is debt-free, a significant improvement from five years ago when its debt-to-equity ratio stood at 21.5%. This financial health supports high-quality earnings and ensures interest payments aren't a concern. Despite sales dipping to CNY 1.53 billion from CNY 1.66 billion last year, net income rose sharply to CNY 130 million compared to CNY 46 million previously, reflecting strong operational performance with basic EPS climbing to CNY 0.22 from CNY 0.08 last year.

Seize The Opportunity

- Explore the 4509 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nederman Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NMAN

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives