- Hong Kong

- /

- Medical Equipment

- /

- SEHK:1066

Top Three Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As global markets show resilience with major U.S. indexes nearing record highs and positive economic indicators like falling jobless claims, investors are increasingly focusing on stable income sources amid ongoing geopolitical uncertainties. In this environment, dividend stocks can offer a reliable stream of income and potential for capital appreciation, making them an attractive option for those looking to bolster their portfolios with steady returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.54% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.28% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.62% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.89% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.60% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.46% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.56% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.45% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.92% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.70% | ★★★★★☆ |

Click here to see the full list of 1964 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

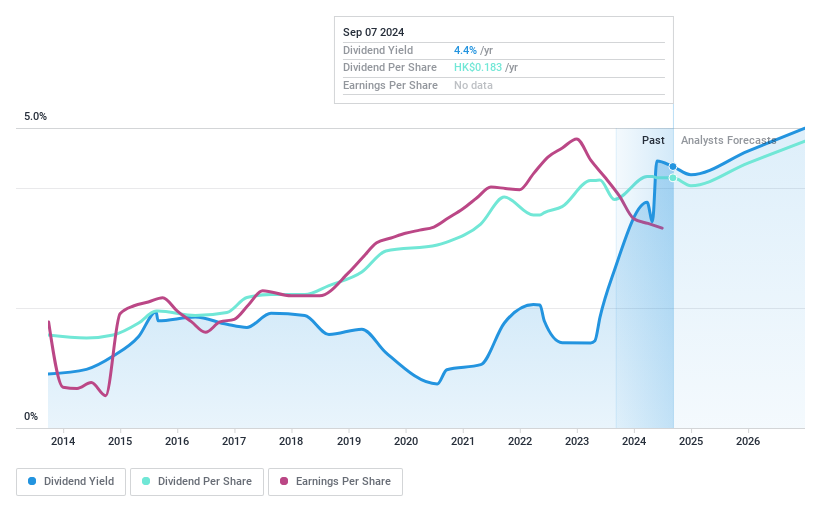

Shandong Weigao Group Medical Polymer (SEHK:1066)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shandong Weigao Group Medical Polymer Company Limited is involved in the research, development, production, wholesale, and sale of medical devices in China with a market cap of approximately HK$20.57 billion.

Operations: Shandong Weigao Group Medical Polymer's revenue is derived from several segments, including CN¥6.74 billion from Medical Device Products, CN¥2.13 billion from Pharma Packaging Products, CN¥1.99 billion from Interventional Products, CN¥1.22 billion from Orthopaedic Products, and CN¥936.84 million from Blood Management Products.

Dividend Yield: 4%

Shandong Weigao Group Medical Polymer recently approved an interim dividend of RMB 0.0919 per share. Despite a history of volatile and unreliable dividends, the current payout is well covered by earnings and cash flows, with low payout ratios of 43.9% and 37.5%, respectively. The stock trades at a significant discount to its estimated fair value, though its dividend yield remains below top-tier levels in the Hong Kong market.

- Delve into the full analysis dividend report here for a deeper understanding of Shandong Weigao Group Medical Polymer.

- Our expertly prepared valuation report Shandong Weigao Group Medical Polymer implies its share price may be lower than expected.

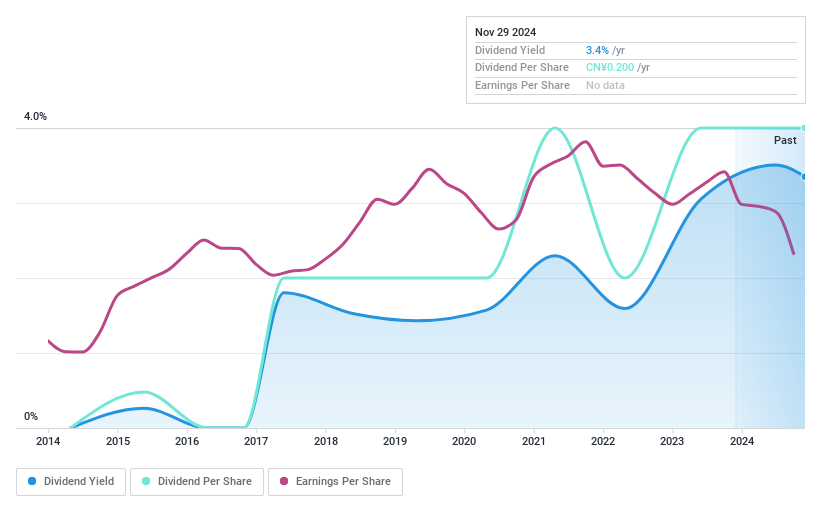

Renhe PharmacyLtd (SZSE:000650)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Renhe Pharmacy Co., Ltd is engaged in the production and sale of pharmaceutical products, with a market cap of CN¥8.27 billion.

Operations: Renhe Pharmacy Co., Ltd generates revenue primarily from its medicine segment, including health products, totaling CN¥4.26 billion.

Dividend Yield: 3.4%

Renhe Pharmacy's dividend yield of 3.35% is among the top 25% in the Chinese market, but its sustainability is questionable due to a high cash payout ratio of 92.4%, indicating dividends are not well covered by free cash flows. Despite a reasonable payout ratio of 62.5%, earnings have declined with net income dropping to CNY 415.68 million for the first nine months of 2024, suggesting potential volatility in future payouts.

- Dive into the specifics of Renhe PharmacyLtd here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Renhe PharmacyLtd is trading beyond its estimated value.

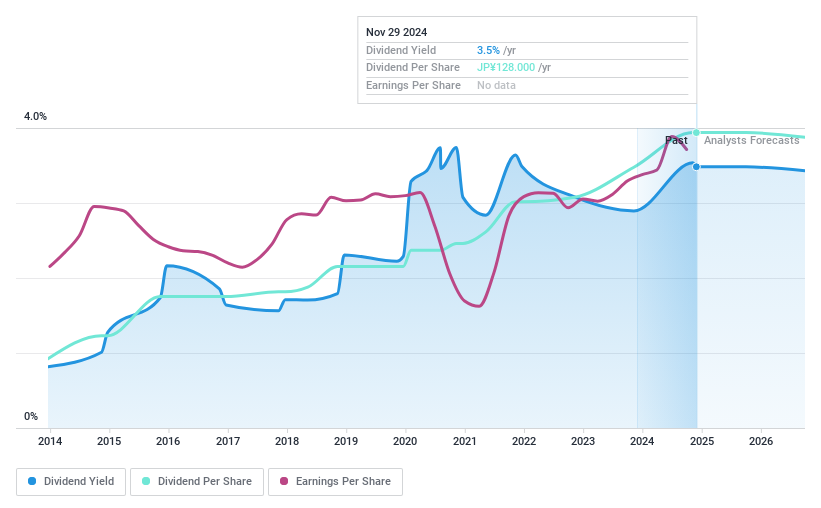

Nishio Holdings (TSE:9699)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nishio Holdings Co., Ltd. operates in the construction machinery rental industry both in Japan and internationally, with a market cap of ¥102.03 billion.

Operations: Nishio Holdings Co., Ltd. generates revenue primarily from its rental segment, amounting to ¥191.50 million.

Dividend Yield: 3.5%

Nishio Holdings offers a stable dividend yield of 3.48%, supported by a low cash payout ratio of 16.8% and an earnings payout ratio of 30.2%, ensuring dividends are well covered by both earnings and cash flows. The company has consistently increased its dividends over the past decade, reflecting reliability with minimal volatility. Trading at 27% below estimated fair value, Nishio appears to be a good relative value compared to peers, despite its yield being slightly below top-tier levels in Japan.

- Click here to discover the nuances of Nishio Holdings with our detailed analytical dividend report.

- Our valuation report here indicates Nishio Holdings may be undervalued.

Summing It All Up

- Access the full spectrum of 1964 Top Dividend Stocks by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1066

Shandong Weigao Group Medical Polymer

Engages in the research and development, production, wholesale, and sale of medical devices in the People’s Republic of China.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives