We Think You Can Look Beyond Hangzhou Biotest BiotechLtd's (SHSE:688767) Lackluster Earnings

The market was pleased with the recent earnings report from Hangzhou Biotest Biotech Co.,Ltd. (SHSE:688767), despite the profit numbers being soft. Our analysis suggests that investors may have noticed some promising signs beyond the statutory profit figures.

See our latest analysis for Hangzhou Biotest BiotechLtd

Examining Cashflow Against Hangzhou Biotest BiotechLtd's Earnings

Many investors haven't heard of the accrual ratio from cashflow, but it is actually a useful measure of how well a company's profit is backed up by free cash flow (FCF) during a given period. The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. The ratio shows us how much a company's profit exceeds its FCF.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

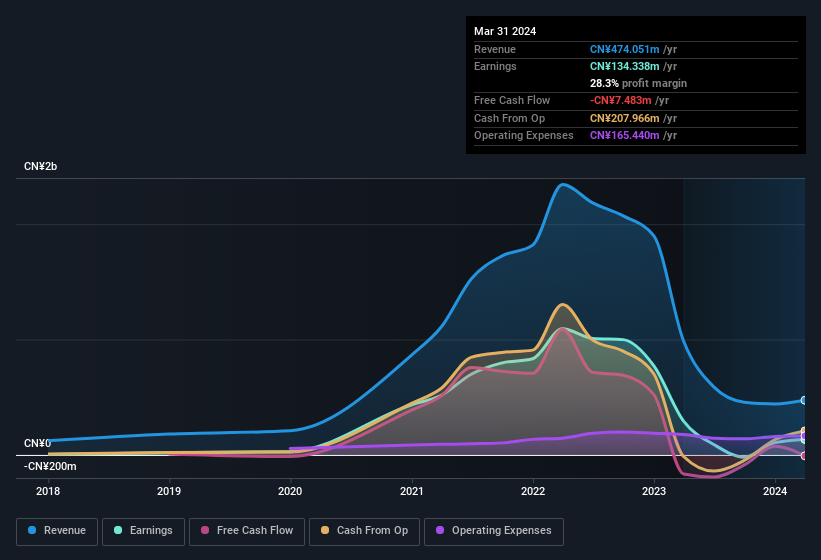

For the year to March 2024, Hangzhou Biotest BiotechLtd had an accrual ratio of 0.23. Unfortunately, that means its free cash flow fell significantly short of its reported profits. Over the last year it actually had negative free cash flow of CN¥7.5m, in contrast to the aforementioned profit of CN¥134.3m. We also note that Hangzhou Biotest BiotechLtd's free cash flow was actually negative last year as well, so we could understand if shareholders were bothered by its outflow of CN¥7.5m. Having said that, there is more to the story. We can see that unusual items have impacted its statutory profit, and therefore the accrual ratio.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Hangzhou Biotest BiotechLtd.

The Impact Of Unusual Items On Profit

Unfortunately (in the short term) Hangzhou Biotest BiotechLtd saw its profit reduced by unusual items worth CN¥57m. If this was a non-cash charge, it would have made the accrual ratio better, if cashflow had stayed strong, so it's not great to see in combination with an uninspiring accrual ratio. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And that's hardly a surprise given these line items are considered unusual. Hangzhou Biotest BiotechLtd took a rather significant hit from unusual items in the year to March 2024. As a result, we can surmise that the unusual items made its statutory profit significantly weaker than it would otherwise be.

Our Take On Hangzhou Biotest BiotechLtd's Profit Performance

Hangzhou Biotest BiotechLtd saw unusual items weigh on its profit, which should have made it easier to show high cash conversion, which it did not do, according to its accrual ratio. Considering all the aforementioned, we'd venture that Hangzhou Biotest BiotechLtd's profit result is a pretty good guide to its true profitability, albeit a bit on the conservative side. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. For example - Hangzhou Biotest BiotechLtd has 3 warning signs we think you should be aware of.

Our examination of Hangzhou Biotest BiotechLtd has focussed on certain factors that can make its earnings look better than they are. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you're looking to trade Hangzhou Biotest BiotechLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hangzhou Biotest BiotechLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688767

Hangzhou Biotest BiotechLtd

Engages in the research and development, manufacture, sale, and service of in vitro diagnostic assays and reagents, and instruments in China and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives