- China

- /

- Electronic Equipment and Components

- /

- SHSE:688007

High Growth Tech Stocks Including Appotronics And Two Others

Reviewed by Simply Wall St

As global markets navigate mixed performances and economic indicators show varied signals, the tech sector continues to capture investor interest with its potential for high growth despite broader market uncertainties. In this context, identifying promising stocks involves assessing their innovation capabilities and resilience in adapting to changing economic landscapes, exemplified by companies like Appotronics and others in the tech industry.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| CD Projekt | 23.29% | 27.00% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 22.38% | 31.67% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| TG Therapeutics | 30.09% | 45.08% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 28.68% | 62.50% | ★★★★★★ |

Click here to see the full list of 1267 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Appotronics (SHSE:688007)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Appotronics Corporation Limited is involved in the research, development, production, sale, and leasing of laser display devices and machines in China with a market capitalization of CN¥6.71 billion.

Operations: Appotronics focuses on laser display technology, generating revenue primarily through the sale and leasing of its devices and machines. The company operates within China, leveraging its expertise in research and development to enhance its product offerings.

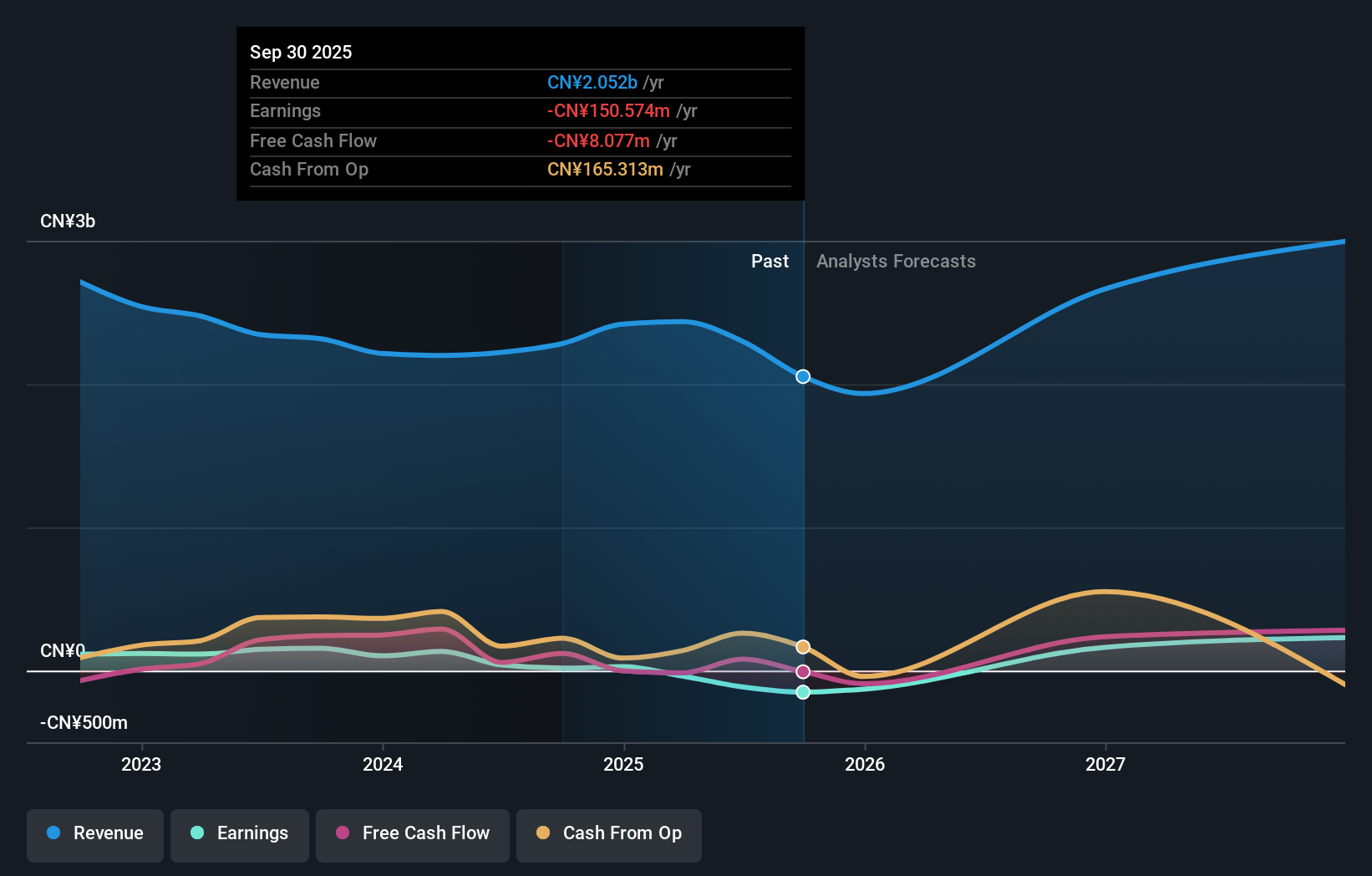

Appotronics has demonstrated a robust trajectory in high-tech growth, with revenue climbing by 21.2% annually, outpacing the Chinese market's average of 13.5%. Despite facing challenges such as a significant earnings drop of 88.8% over the past year and lower net profit margins at 0.8%, down from last year’s 6.8%, the company is poised for a strong recovery with forecasted earnings growth of 81% per year, substantially above the market norm of 25%. The firm actively engages in share buybacks, having repurchased shares worth CNY 145.42 million recently, signaling confidence in its future prospects despite current volatility and one-off losses impacting financial results.

- Unlock comprehensive insights into our analysis of Appotronics stock in this health report.

Gain insights into Appotronics' historical performance by reviewing our past performance report.

Beijing Kawin Technology Share-Holding (SHSE:688687)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing Kawin Technology Share-Holding Co., Ltd. operates in the field of medicine manufacturing and has a market capitalization of CN¥3.55 billion.

Operations: The company generates revenue primarily from medicine manufacturing, amounting to CN¥1.42 billion.

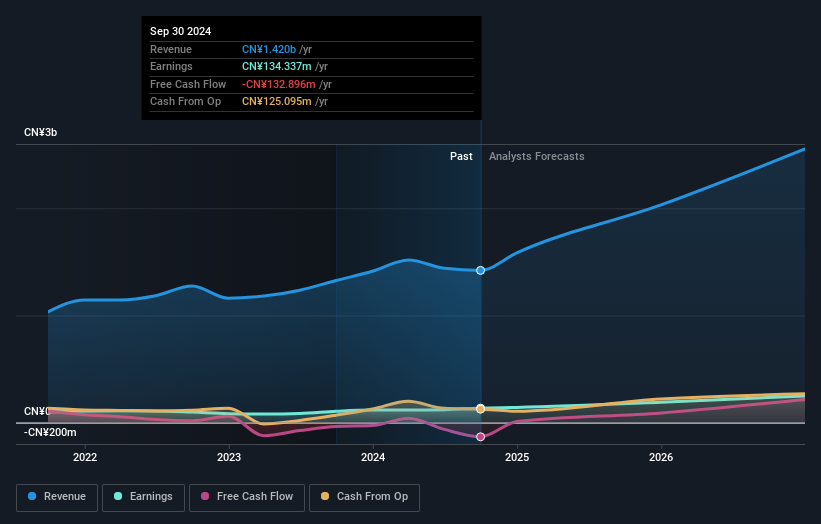

Beijing Kawin Technology Share-Holding Co., Ltd. has shown a promising trajectory, with revenues growing at 17.9% annually, outstripping the broader Chinese market's growth of 13.5%. This performance is underpinned by a significant commitment to innovation, as reflected in its R&D spending which stands at 15% of total revenue, aligning with industry leaders who prioritize continuous development for competitive advantage. Moreover, the company's earnings have surged by 28.6% per year, suggesting not only growth but also an improving efficiency in turning revenue into profit despite a challenging economic environment. Recent announcements reveal that for the nine months ending September 30, 2024, sales reached CNY 1.01 billion up from CNY 1 billion year-over-year with net income also rising to CNY108 million from CNY90 million; these figures underscore a robust operational stance poised for sustained growth amidst volatile tech landscapes.

Topcon (TSE:7732)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Topcon Corporation is a global company that specializes in developing, manufacturing, and selling positioning, eye care, and smart infrastructure products with a market capitalization of ¥299.21 billion.

Operations: The company's revenue primarily stems from its Positioning Business, generating ¥146.31 billion, followed by the Eye Care Business at ¥69.55 billion.

Topcon's strategic focus on integrating AI in healthcare imaging, as evidenced by its collaboration with BeeKeeperAI, underscores its innovative approach in a niche market. This partnership aims to enhance disease detection and management through advanced AI models applied to eye imaging data, showcasing Topcon's commitment to technological advancement in medical applications. Financially, the company projects robust growth with expected net sales of JPY 220 billion and an operating profit of JPY 12 billion for the fiscal year ending March 2025. These figures reflect a solid operational strategy set against a backdrop of significant R&D investment, aligning with industry trends towards high-tech solutions in healthcare.

Next Steps

- Investigate our full lineup of 1267 High Growth Tech and AI Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688007

Appotronics

Engages in the research and development, production, sale, and leasing of laser display devices and machines in China.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives