3 Asian Stocks Estimated To Be Trading Up To 39.1% Below Intrinsic Value

Reviewed by Simply Wall St

As Asian markets navigate a landscape marked by political uncertainties and trade tensions, investors are increasingly looking for opportunities that promise value amidst volatility. Identifying stocks trading below their intrinsic value can be a prudent strategy in such an environment, offering potential upside as market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| PropNex (SGX:OYY) | SGD1.34 | SGD2.67 | 49.7% |

| Medy-Tox (KOSDAQ:A086900) | ₩163000.00 | ₩322233.66 | 49.4% |

| Mandom (TSE:4917) | ¥1427.00 | ¥2828.12 | 49.5% |

| Lucky Harvest (SZSE:002965) | CN¥35.75 | CN¥70.35 | 49.2% |

| Japan Eyewear Holdings (TSE:5889) | ¥2151.00 | ¥4222.53 | 49.1% |

| HL Holdings (KOSE:A060980) | ₩41300.00 | ₩81736.71 | 49.5% |

| Cosmax (KOSE:A192820) | ₩243000.00 | ₩483155.97 | 49.7% |

| Astroscale Holdings (TSE:186A) | ¥673.00 | ¥1324.01 | 49.2% |

| ALUX (KOSDAQ:A475580) | ₩11490.00 | ₩22617.71 | 49.2% |

| Accton Technology (TWSE:2345) | NT$798.00 | NT$1590.11 | 49.8% |

Let's take a closer look at a couple of our picks from the screened companies.

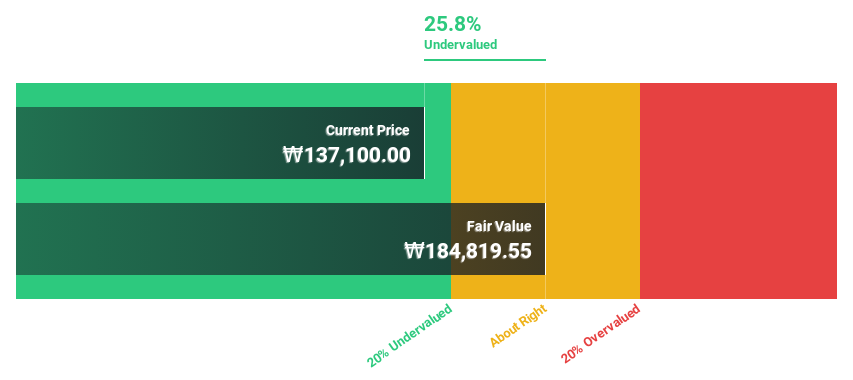

GC Biopharma (KOSE:A006280)

Overview: GC Biopharma Corp. is a biopharmaceutical company that develops and sells pharmaceutical drugs both in South Korea and internationally, with a market cap of approximately ₩1.75 trillion.

Operations: The company's revenue primarily comes from the manufacturing and sales of pharmaceuticals, totaling ₩1.65 trillion, complemented by ₩200.20 million from diagnosis and analysis of samples, etc.

Estimated Discount To Fair Value: 38.4%

GC Biopharma is trading at 38.4% below its estimated fair value, highlighting its potential as an undervalued stock based on cash flows. Despite a low forecasted return on equity of 4.3%, the company has become profitable this year with significant earnings growth expected to outpace the KR market. Recent product approvals and trials, such as BARYCELA's entry into Vietnam and Hunterase's promising Phase 3 results, bolster revenue prospects amidst robust sector demand.

- Upon reviewing our latest growth report, GC Biopharma's projected financial performance appears quite optimistic.

- Navigate through the intricacies of GC Biopharma with our comprehensive financial health report here.

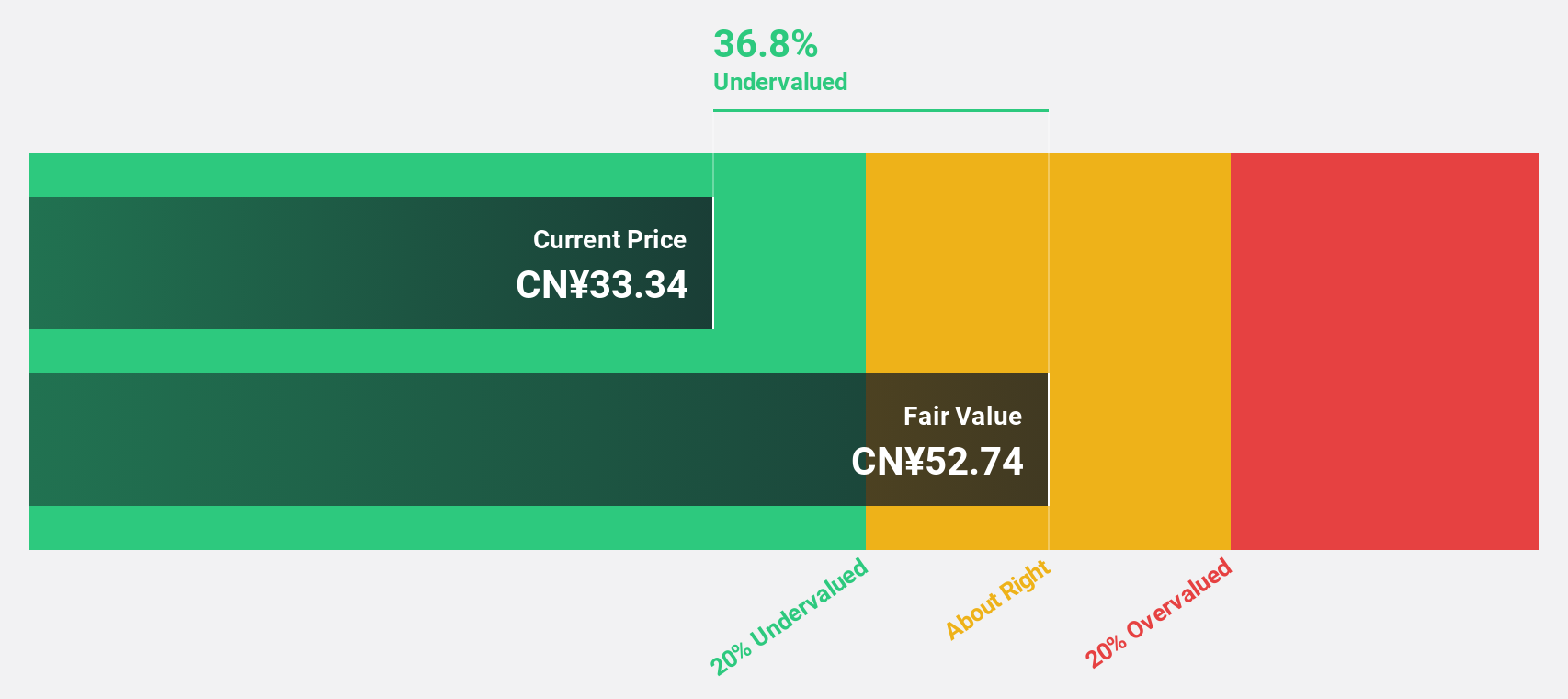

Beijing Kawin Technology Share-Holding (SHSE:688687)

Overview: Beijing Kawin Technology Share-Holding Co., Ltd. is a biopharmaceutical company that offers treatment solutions for viral and immune diseases in China, with a market cap of CN¥5.38 billion.

Operations: The company's revenue primarily comes from its Medicine Manufacturing segment, which generated CN¥1.25 billion.

Estimated Discount To Fair Value: 39.1%

Beijing Kawin Technology Share-Holding is trading 39.1% below its estimated fair value of CN¥52.74, presenting it as an undervalued stock based on cash flows. Despite a forecasted earnings growth of 20.67% per year, which is slower than the market average, revenue growth at 20% annually outpaces the market's 12.5%. Recent Q1 results show increased sales and net income compared to last year, although dividends remain minimally covered by free cash flows.

- The analysis detailed in our Beijing Kawin Technology Share-Holding growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in Beijing Kawin Technology Share-Holding's balance sheet health report.

Rayhoo Motor DiesLtd (SZSE:002997)

Overview: Rayhoo Motor Dies Co., Ltd. designs, develops, manufactures, and sells stamping dies and auto welding lines both in China and internationally, with a market cap of CN¥8.59 billion.

Operations: Rayhoo Motor Dies Ltd generates its revenue from the design, development, manufacturing, and sale of stamping dies and auto welding lines across domestic and international markets.

Estimated Discount To Fair Value: 32.3%

Rayhoo Motor Dies Ltd. trades at 32.3% below its estimated fair value of CNY 60.66, highlighting its undervaluation based on cash flows. Despite earnings growth forecasts of 21.8% annually, slightly below the market average, revenue is expected to grow robustly at 25.8%, surpassing the market's rate. Recent Q1 results show significant sales and net income increases year-on-year, though dividends are not well covered by free cash flows.

- Our comprehensive growth report raises the possibility that Rayhoo Motor DiesLtd is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Rayhoo Motor DiesLtd stock in this financial health report.

Where To Now?

- Embark on your investment journey to our 255 Undervalued Asian Stocks Based On Cash Flows selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002997

Rayhoo Motor DiesLtd

Designs, develops, manufactures, and sells stamping dies and auto welding lines in China and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives