Subdued Growth No Barrier To Sinocelltech Group Limited (SHSE:688520) With Shares Advancing 29%

Sinocelltech Group Limited (SHSE:688520) shareholders would be excited to see that the share price has had a great month, posting a 29% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 18% in the last twelve months.

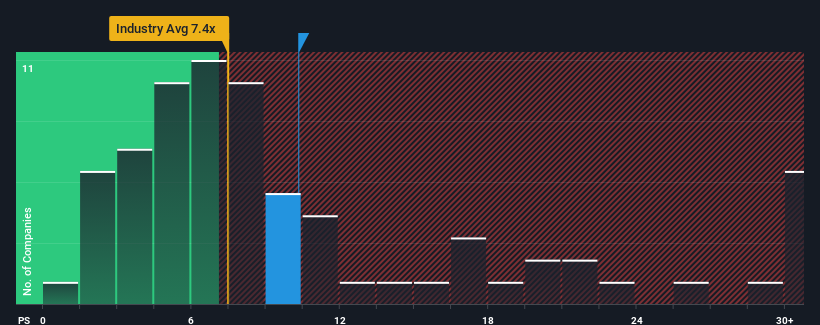

Following the firm bounce in price, you could be forgiven for thinking Sinocelltech Group is a stock not worth researching with a price-to-sales ratios (or "P/S") of 10.3x, considering almost half the companies in China's Biotechs industry have P/S ratios below 7.4x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Sinocelltech Group

How Sinocelltech Group Has Been Performing

With revenue growth that's superior to most other companies of late, Sinocelltech Group has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Sinocelltech Group will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Sinocelltech Group?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Sinocelltech Group's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 82%. This great performance means it was also able to deliver immense revenue growth over the last three years. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 34% as estimated by the sole analyst watching the company. With the industry predicted to deliver 237% growth, the company is positioned for a weaker revenue result.

In light of this, it's alarming that Sinocelltech Group's P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Sinocelltech Group's P/S Mean For Investors?

The large bounce in Sinocelltech Group's shares has lifted the company's P/S handsomely. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It comes as a surprise to see Sinocelltech Group trade at such a high P/S given the revenue forecasts look less than stellar. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Having said that, be aware Sinocelltech Group is showing 2 warning signs in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on Sinocelltech Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688520

Sinocelltech Group

A biotech company, engages in the research and development, and industrialization of recombinant proteins, monoclonal antibodies, and innovative vaccines in China.

High growth potential and slightly overvalued.

Market Insights

Community Narratives