Getting In Cheap On Sichuan Biokin Pharmaceutical Co.,Ltd. (SHSE:688506) Is Unlikely

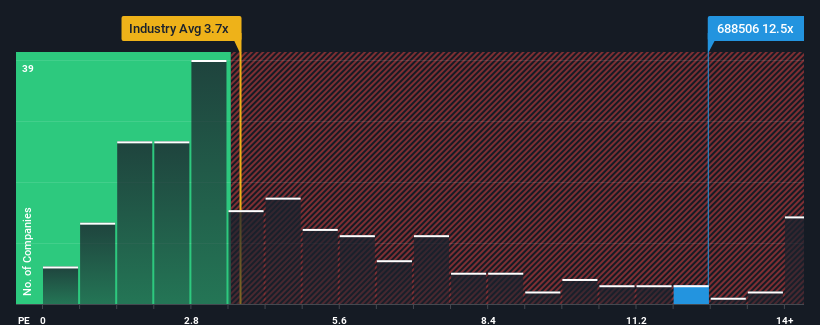

When close to half the companies in the Pharmaceuticals industry in China have price-to-sales ratios (or "P/S") below 3.7x, you may consider Sichuan Biokin Pharmaceutical Co.,Ltd. (SHSE:688506) as a stock to avoid entirely with its 12.5x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Sichuan Biokin PharmaceuticalLtd

How Sichuan Biokin PharmaceuticalLtd Has Been Performing

With revenue growth that's superior to most other companies of late, Sichuan Biokin PharmaceuticalLtd has been doing relatively well. The P/S is probably high because investors think this strong revenue performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think Sichuan Biokin PharmaceuticalLtd's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as steep as Sichuan Biokin PharmaceuticalLtd's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered an explosive gain to the company's top line. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Looking ahead now, revenue is anticipated to slump, contracting by 43% during the coming year according to the two analysts following the company. With the industry predicted to deliver 229% growth, that's a disappointing outcome.

With this in mind, we find it intriguing that Sichuan Biokin PharmaceuticalLtd's P/S is closely matching its industry peers. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh heavily on the share price eventually.

What We Can Learn From Sichuan Biokin PharmaceuticalLtd's P/S?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Sichuan Biokin PharmaceuticalLtd's analyst forecasts revealed that its shrinking revenue outlook isn't drawing down its high P/S anywhere near as much as we would have predicted. Right now we aren't comfortable with the high P/S as the predicted future revenue decline likely to impact the positive sentiment that's propping up the P/S. Unless these conditions improve markedly, it'll be a challenging time for shareholders.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Sichuan Biokin PharmaceuticalLtd (of which 1 doesn't sit too well with us!) you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688506

Sichuan Biokin PharmaceuticalLtd

Engages in the research and development, production, and marketing of small molecule chemical, macromolecular biological, and antibody-drug conjugate drugs in China and internationally.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives