Jiangsu Aidea Pharmaceutical Co., Ltd.'s (SHSE:688488) 30% Share Price Plunge Could Signal Some Risk

Unfortunately for some shareholders, the Jiangsu Aidea Pharmaceutical Co., Ltd. (SHSE:688488) share price has dived 30% in the last thirty days, prolonging recent pain. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 17% share price drop.

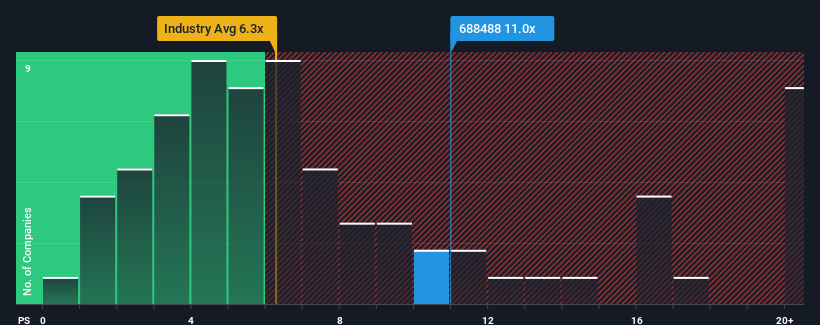

Even after such a large drop in price, when almost half of the companies in China's Biotechs industry have price-to-sales ratios (or "P/S") below 6.3x, you may still consider Jiangsu Aidea Pharmaceutical as a stock not worth researching with its 11x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Jiangsu Aidea Pharmaceutical

What Does Jiangsu Aidea Pharmaceutical's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Jiangsu Aidea Pharmaceutical has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Jiangsu Aidea Pharmaceutical will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Jiangsu Aidea Pharmaceutical would need to produce outstanding growth that's well in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 22%. The latest three year period has also seen a 21% overall rise in revenue, aided extensively by its short-term performance. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 50% over the next year. With the industry predicted to deliver 265% growth, the company is positioned for a weaker revenue result.

With this information, we find it concerning that Jiangsu Aidea Pharmaceutical is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

Even after such a strong price drop, Jiangsu Aidea Pharmaceutical's P/S still exceeds the industry median significantly. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It comes as a surprise to see Jiangsu Aidea Pharmaceutical trade at such a high P/S given the revenue forecasts look less than stellar. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. At these price levels, investors should remain cautious, particularly if things don't improve.

You should always think about risks. Case in point, we've spotted 1 warning sign for Jiangsu Aidea Pharmaceutical you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688488

Jiangsu Aidea Pharmaceutical

Develops, produces, and sells pharmaceutical products.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives