- China

- /

- Life Sciences

- /

- SHSE:688315

Some Confidence Is Lacking In Novogene Co., Ltd. (SHSE:688315) As Shares Slide 26%

The Novogene Co., Ltd. (SHSE:688315) share price has fared very poorly over the last month, falling by a substantial 26%. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 58% loss during that time.

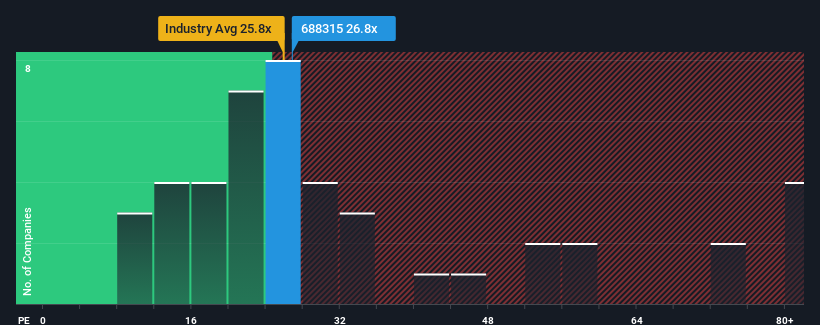

In spite of the heavy fall in price, there still wouldn't be many who think Novogene's price-to-earnings (or "P/E") ratio of 26.8x is worth a mention when the median P/E in China is similar at about 29x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Novogene hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Novogene

Does Growth Match The P/E?

Novogene's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. Fortunately, a few good years before that means that it was still able to grow EPS by 23% in total over the last three years. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Shifting to the future, estimates from the four analysts covering the company suggest earnings should grow by 17% per year over the next three years. That's shaping up to be materially lower than the 25% per annum growth forecast for the broader market.

In light of this, it's curious that Novogene's P/E sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

The Final Word

Novogene's plummeting stock price has brought its P/E right back to the rest of the market. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Novogene's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

You should always think about risks. Case in point, we've spotted 1 warning sign for Novogene you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Novogene might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688315

Novogene

Provides genomic services and solutions in Mainland China, Hong Kong, Macau, Taiwan, and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026