- India

- /

- Healthcare Services

- /

- NSEI:APOLLOHOSP

Three High Growth Companies With Significant Insider Ownership

Reviewed by Simply Wall St

As global markets grapple with the uncertainties surrounding the incoming Trump administration's policies, investors are keenly observing how these developments might impact various sectors, particularly those sensitive to regulatory changes. Amidst this backdrop of fluctuating indices and sector-specific volatility, identifying growth companies with significant insider ownership can provide insights into potential investment opportunities. In such a dynamic environment, stocks where insiders have substantial stakes may indicate confidence in the company's long-term prospects and resilience against market shifts.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 31.1% | 52.4% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Pharma Mar (BME:PHM) | 11.8% | 56.9% |

| Medley (TSE:4480) | 34% | 31.7% |

| Findi (ASX:FND) | 34.8% | 71.5% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 103.6% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.8% | 95% |

| Alkami Technology (NasdaqGS:ALKT) | 11% | 98.6% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

Here we highlight a subset of our preferred stocks from the screener.

Apollo Hospitals Enterprise (NSEI:APOLLOHOSP)

Simply Wall St Growth Rating: ★★★★★☆

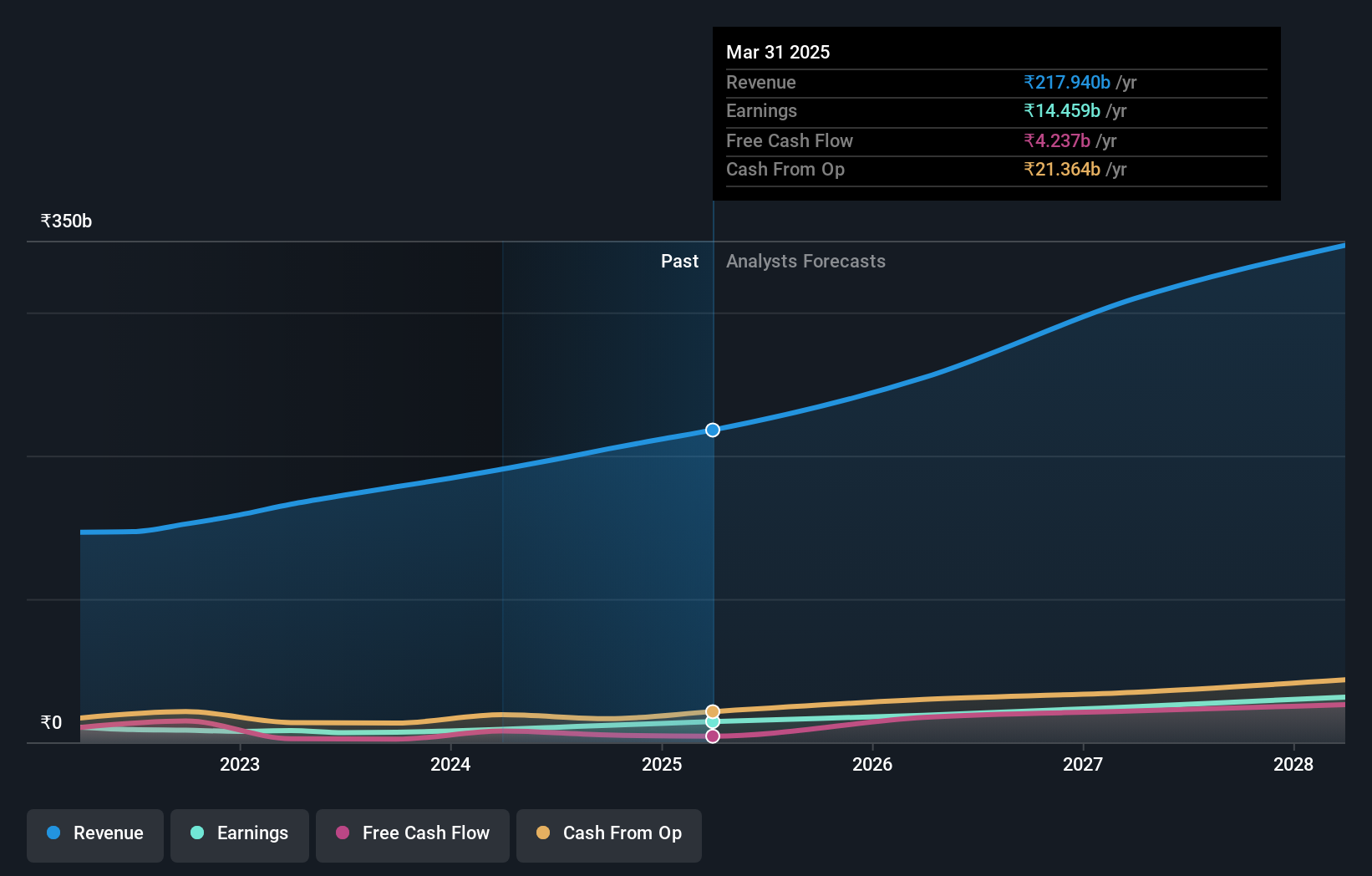

Overview: Apollo Hospitals Enterprise Limited, along with its subsidiaries, provides healthcare services in India and internationally with a market cap of ₹969.47 billion.

Operations: The company's revenue segments include Healthcare Services at ₹106.37 billion, Retail Health & Diagnostics at ₹14.61 billion, and Digital Health & Pharmacy Distribution at ₹84.40 billion.

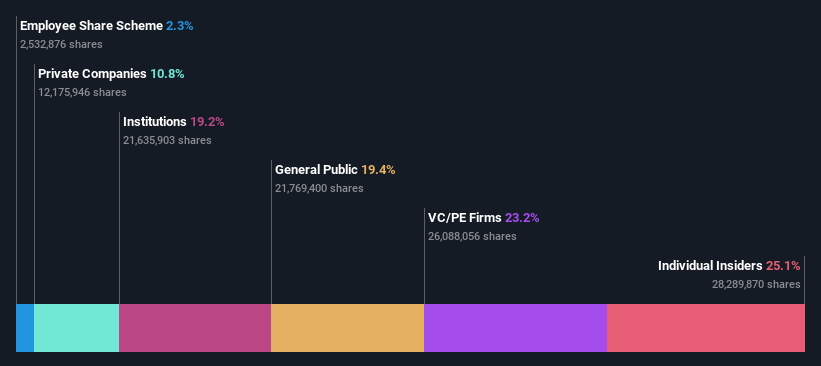

Insider Ownership: 10.4%

Earnings Growth Forecast: 30.7% p.a.

Apollo Hospitals Enterprise demonstrates robust growth potential with its earnings expected to increase significantly at 30.7% annually, outpacing the Indian market's 18%. Recent Q2 results show impressive revenue and net income growth, reflecting strong operational performance. The company's strategic expansions in Mumbai and Lucknow aim to enhance capacity, funded through internal accruals and debt. Despite no recent insider trading activity, high insider ownership aligns interests with shareholders, supporting long-term value creation.

- Take a closer look at Apollo Hospitals Enterprise's potential here in our earnings growth report.

- According our valuation report, there's an indication that Apollo Hospitals Enterprise's share price might be on the expensive side.

Shanghai OPM Biosciences (SHSE:688293)

Simply Wall St Growth Rating: ★★★★★☆

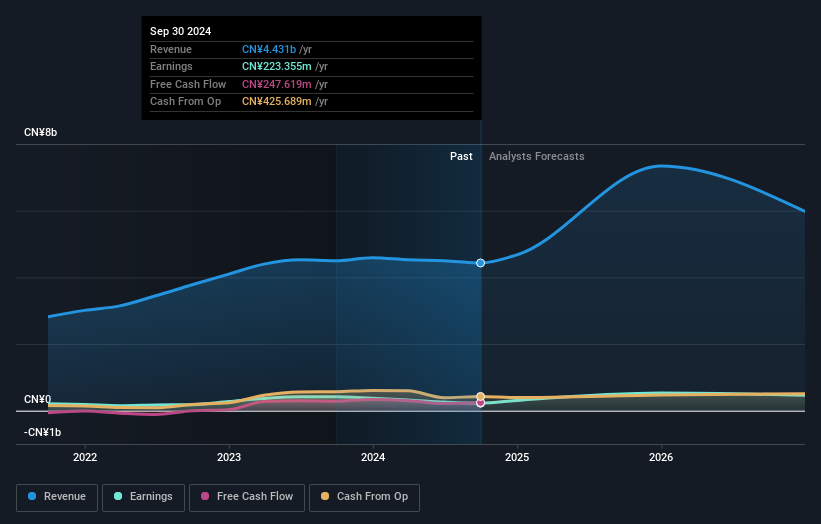

Overview: Shanghai OPM Biosciences Co., Ltd. offers cell culture media and CDMO services both in China and internationally, with a market cap of CN¥5.04 billion.

Operations: The company's revenue segments include the provision of cell culture media and CDMO services domestically and abroad.

Insider Ownership: 24.9%

Earnings Growth Forecast: 60% p.a.

Shanghai OPM Biosciences is poised for rapid growth, with earnings projected to surge by 60% annually, outstripping the Chinese market's average. Despite a volatile share price and declining profit margins from 26.9% to 13.3%, revenue is forecasted to rise significantly at 36.6% per year. Recent earnings reports show sales of CNY 215.86 million, yet net income has decreased compared to last year, highlighting potential challenges amidst strong insider ownership that aligns management with shareholder interests.

- Click here and access our complete growth analysis report to understand the dynamics of Shanghai OPM Biosciences.

- Our comprehensive valuation report raises the possibility that Shanghai OPM Biosciences is priced higher than what may be justified by its financials.

Shenzhen INVT ElectricLtd (SZSE:002334)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen INVT Electric Co., Ltd operates in the industrial automation and energy and power sectors globally, with a market cap of CN¥5.79 billion.

Operations: The company generates revenue from its industrial automation and energy and power segments worldwide.

Insider Ownership: 16.2%

Earnings Growth Forecast: 34.8% p.a.

Shenzhen INVT Electric is experiencing significant earnings growth, forecasted at 34.8% annually, surpassing the Chinese market's average. Despite a lower return on equity forecast and declining profit margins from 9.2% to 5%, it trades at a favorable price-to-earnings ratio of 25.9x compared to the market's 35.9x. Recent results show decreased revenue and net income, with sales at CNY 3.14 billion and net income dropping to CNY 152.83 million for nine months ending September 2024, amid a completed share buyback program worth CNY 36.53 million.

- Click here to discover the nuances of Shenzhen INVT ElectricLtd with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential undervaluation of Shenzhen INVT ElectricLtd shares in the market.

Key Takeaways

- Delve into our full catalog of 1530 Fast Growing Companies With High Insider Ownership here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:APOLLOHOSP

Apollo Hospitals Enterprise

Engages in the provision of healthcare services in India and internationally.

High growth potential with solid track record.