Optimistic Investors Push Shanghai OPM Biosciences Co., Ltd. (SHSE:688293) Shares Up 28% But Growth Is Lacking

Those holding Shanghai OPM Biosciences Co., Ltd. (SHSE:688293) shares would be relieved that the share price has rebounded 28% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 43% over that time.

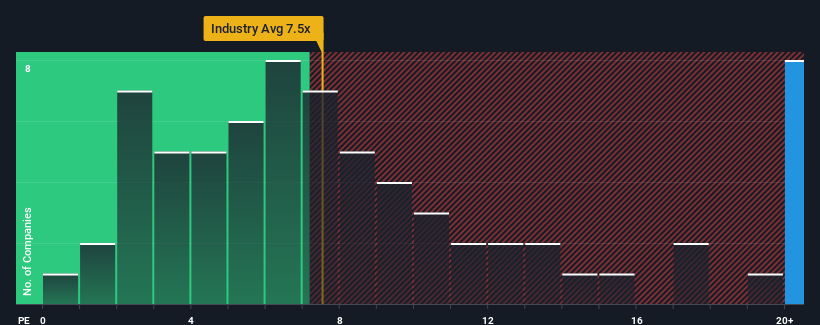

After such a large jump in price, when almost half of the companies in China's Biotechs industry have price-to-sales ratios (or "P/S") below 7.5x, you may consider Shanghai OPM Biosciences as a stock not worth researching with its 21.8x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Shanghai OPM Biosciences

What Does Shanghai OPM Biosciences' P/S Mean For Shareholders?

Shanghai OPM Biosciences hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Shanghai OPM Biosciences will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Shanghai OPM Biosciences?

In order to justify its P/S ratio, Shanghai OPM Biosciences would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a frustrating 17% decrease to the company's top line. Even so, admirably revenue has lifted 95% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Turning to the outlook, the next year should generate growth of 54% as estimated by the dual analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 163%, which is noticeably more attractive.

With this in consideration, we believe it doesn't make sense that Shanghai OPM Biosciences' P/S is outpacing its industry peers. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What We Can Learn From Shanghai OPM Biosciences' P/S?

Shanghai OPM Biosciences' P/S has grown nicely over the last month thanks to a handy boost in the share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've concluded that Shanghai OPM Biosciences currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Before you take the next step, you should know about the 2 warning signs for Shanghai OPM Biosciences (1 shouldn't be ignored!) that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688293

Shanghai OPM Biosciences

Provides cell culture media and CDMO services in China and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives