Amidst a backdrop of geopolitical tensions and consumer spending concerns, U.S. stocks experienced a volatile week with major indices like the S&P 500 initially reaching record highs before succumbing to losses. As economic indicators such as the U.S. Services PMI enter contraction territory and inflation expectations rise, investors are increasingly focused on high growth tech stocks that demonstrate resilience through innovation and adaptability in challenging market environments.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| CD Projekt | 27.11% | 39.37% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

| Travere Therapeutics | 28.04% | 65.55% | ★★★★★★ |

| Pharma Mar | 23.77% | 45.40% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| AVITA Medical | 27.78% | 55.33% | ★★★★★★ |

| TG Therapeutics | 29.48% | 45.20% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.67% | 58.73% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

Click here to see the full list of 1193 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Bouvet (OB:BOUV)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bouvet ASA is a consultancy firm offering IT and digital communication services to both public and private sector clients across Norway, Sweden, and internationally, with a market cap of NOK7.36 billion.

Operations: The firm generates revenue primarily from IT consultancy services, amounting to NOK3.92 billion. It serves both public and private sectors in Norway, Sweden, and internationally.

Bouvet ASA stands out with its robust financial performance, showcasing a consistent revenue growth at 9.6% annually, surpassing the Norwegian market's average of 3.6%. This growth trajectory is complemented by an earnings increase of 8.6% per year, again outpacing the local market norm of 8.3%. The firm's strategic emphasis on R&D investments aligns with its forward-looking approach in the competitive IT sector. Recently, Bouvet confirmed its commitment to shareholder returns by announcing a dividend of NOK 3.00 per share for FY2024, underlining its stable financial health amidst growing sales which reached NOK 3.92 billion last year, up from NOK 3.53 billion the previous year—an indication of sustained demand for their services and potential for future profitability.

- Navigate through the intricacies of Bouvet with our comprehensive health report here.

Gain insights into Bouvet's past trends and performance with our Past report.

Chanjet Information Technology (SEHK:1588)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Chanjet Information Technology Company Limited operates in the cloud service and software sectors within Mainland China, with a market capitalization of HK$2.33 billion.

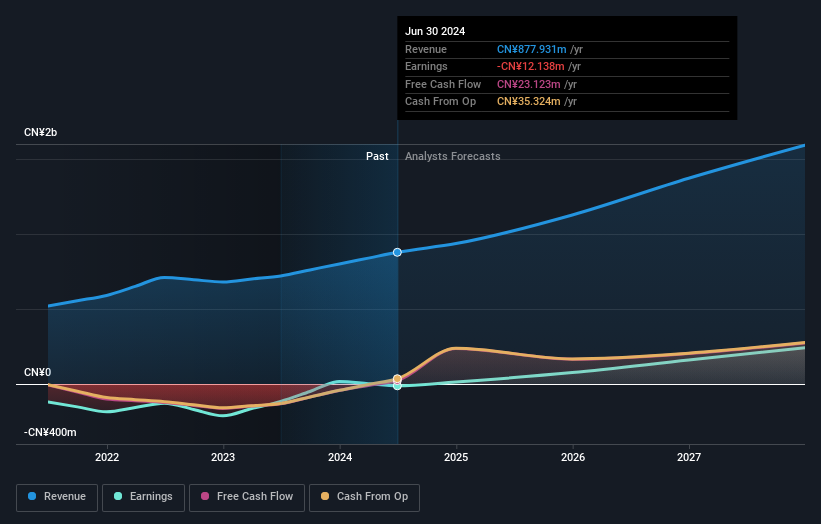

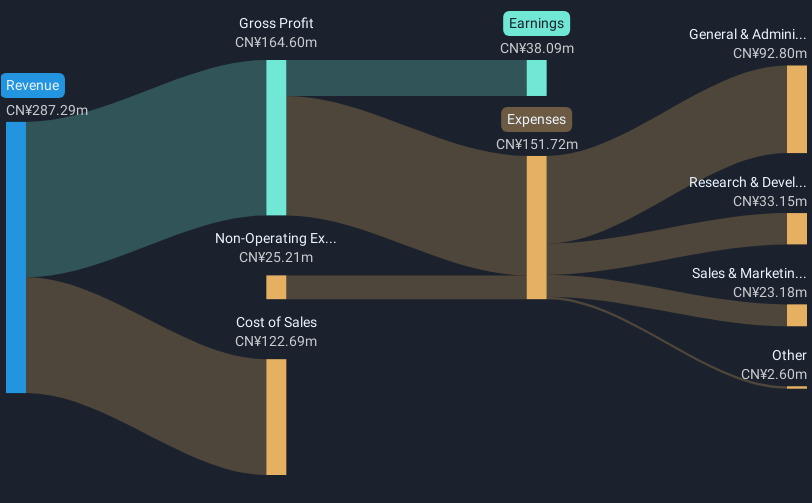

Operations: Chanjet Information Technology focuses on cloud services and software in Mainland China, generating CN¥877.93 million from its cloud service business.

Chanjet Information Technology is poised for significant growth, with expected revenue increases of 19% to 21% this year, driven largely by a robust expansion in cloud subscriptions, which are anticipated to surge by 33% to 35%. This focus on cloud-based solutions highlights a strategic shift towards recurring revenue streams, crucial in the tech sector's evolution. Impressively, profits attributable to owners are projected to jump by 95% to 127%, despite the absence of last year's one-time gains from business disposals and equity investments. This financial trajectory underscores Chanjet’s potential in leveraging technology trends and market demands effectively.

Shanghai OPM Biosciences (SHSE:688293)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shanghai OPM Biosciences Co., Ltd. specializes in offering cell culture media and CDMO services both within China and globally, with a market capitalization of CN¥4.66 billion.

Operations: OPM Biosciences generates revenue primarily through its cell culture media and CDMO services. The company operates both domestically in China and internationally, contributing to its market presence.

Despite recent challenges, including its removal from the S&P Global BMI Index, Shanghai OPM Biosciences showcases robust growth prospects with a revenue increase forecast at 27.3% annually and earnings expected to soar by 60.1% per year. This performance is significantly above the Chinese market average, highlighting its potential in a competitive landscape. The company's focus on R&D is evident from its substantial investment, marking a strategic emphasis on innovation to sustain its rapid growth trajectory in biotechnologies.

Taking Advantage

- Access the full spectrum of 1193 High Growth Tech and AI Stocks by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1588

Chanjet Information Technology

Engages in the cloud service and software businesses in Mainland China and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives