High Growth Tech Stocks Including CanSino Biologics With Potential

Reviewed by Simply Wall St

In recent weeks, global markets have been grappling with cautious commentary from the U.S. Federal Reserve, which has led to a broad decline in stock indices, particularly impacting smaller-cap stocks. Amid this backdrop of economic uncertainty and fluctuating interest rates, identifying high growth tech stocks such as CanSino Biologics requires careful consideration of their potential to navigate and thrive in volatile market conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| CD Projekt | 24.92% | 27.00% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

Click here to see the full list of 1273 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

CanSino Biologics (SEHK:6185)

Simply Wall St Growth Rating: ★★★★★☆

Overview: CanSino Biologics Inc. is a company based in the People's Republic of China that focuses on the development, manufacturing, and commercialization of vaccines, with a market capitalization of approximately HK$11.25 billion.

Operations: The company primarily generates revenue through the research and development of vaccine products for human use, amounting to CN¥748.53 million.

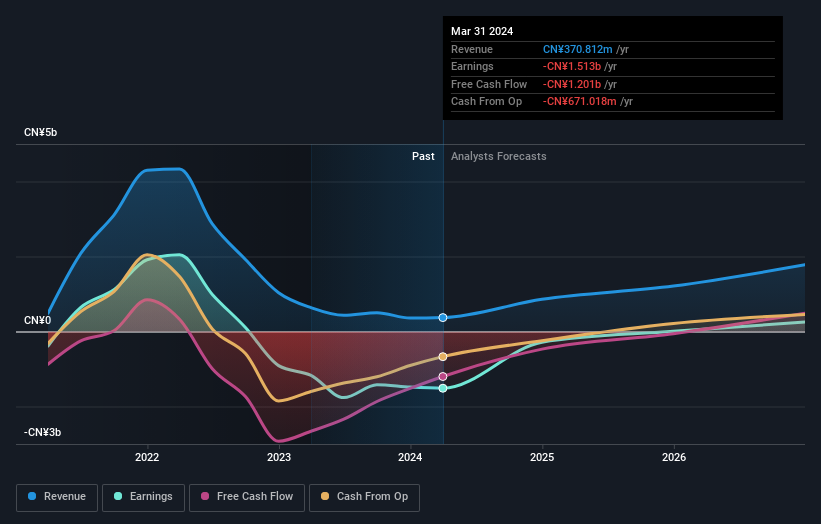

CanSino Biologics, amidst a challenging landscape for biotech innovation, is making significant strides with its recent clinical trials and vaccine developments. The company's revenue is projected to grow at an impressive rate of 33.3% annually, outpacing the Hong Kong market average of 7.8%. Despite current unprofitability, CanSino's earnings are expected to surge by 141.45% per year, positioning it for profitability within three years. Recent advancements include initiating Phase I/II trials for a non-infectious polio vaccine in Indonesia and Phase II/III trials in China for a diphtheria, tetanus, and pertussis booster vaccine—addressing significant unmet needs in these markets. These efforts highlight CanSino's commitment to addressing global health challenges through innovative R&D initiatives while navigating the complexities of biotech development effectively.

- Take a closer look at CanSino Biologics' potential here in our health report.

Examine CanSino Biologics' past performance report to understand how it has performed in the past.

Shanghai OPM Biosciences (SHSE:688293)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shanghai OPM Biosciences Co., Ltd. offers cell culture media and CDMO services both in China and internationally, with a market cap of CN¥4.27 billion.

Operations: Shanghai OPM Biosciences generates revenue through the provision of cell culture media and CDMO services, targeting both domestic and international markets. The company focuses on biotechnology solutions, leveraging its expertise to cater to diverse client needs in the life sciences sector.

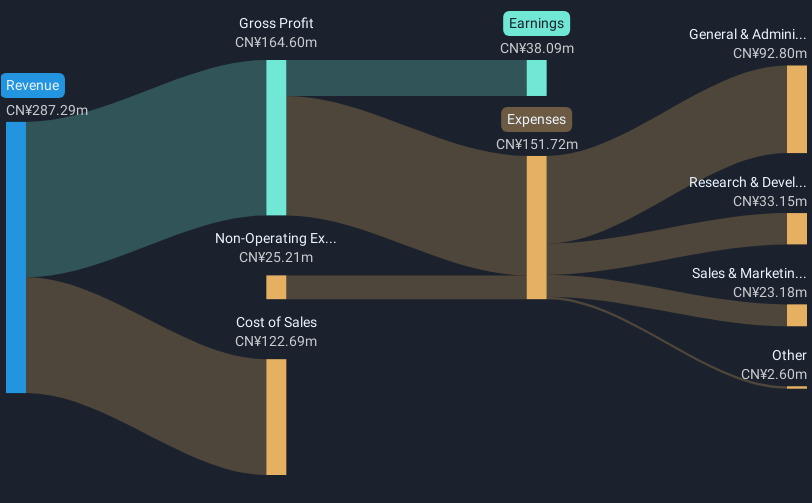

Shanghai OPM Biosciences, despite recent market challenges indicated by its drop from the S&P Global BMI Index, demonstrates robust financial growth with a 36.6% increase in annual revenue and an impressive 60% earnings growth forecast. The company's commitment to innovation is evident in its R&D spending, which remains a significant focus as seen in the latest financials—allocating substantial resources to develop cutting-edge technologies. This strategic emphasis on research not only fuels their product pipeline but also positions them well within the competitive landscape of biotech firms transitioning towards specialized markets.

- Navigate through the intricacies of Shanghai OPM Biosciences with our comprehensive health report here.

Understand Shanghai OPM Biosciences' track record by examining our Past report.

Shenzhen Sinovatio Technology (SZSE:002912)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Sinovatio Technology Co., Ltd. specializes in network visualization, data and network security, big data analysis and application, with a market cap of CN¥4.48 billion.

Operations: Sinovatio Technology focuses on providing solutions in network visualization, data and network security, and big data analysis. The company generates revenue primarily from these specialized technology services.

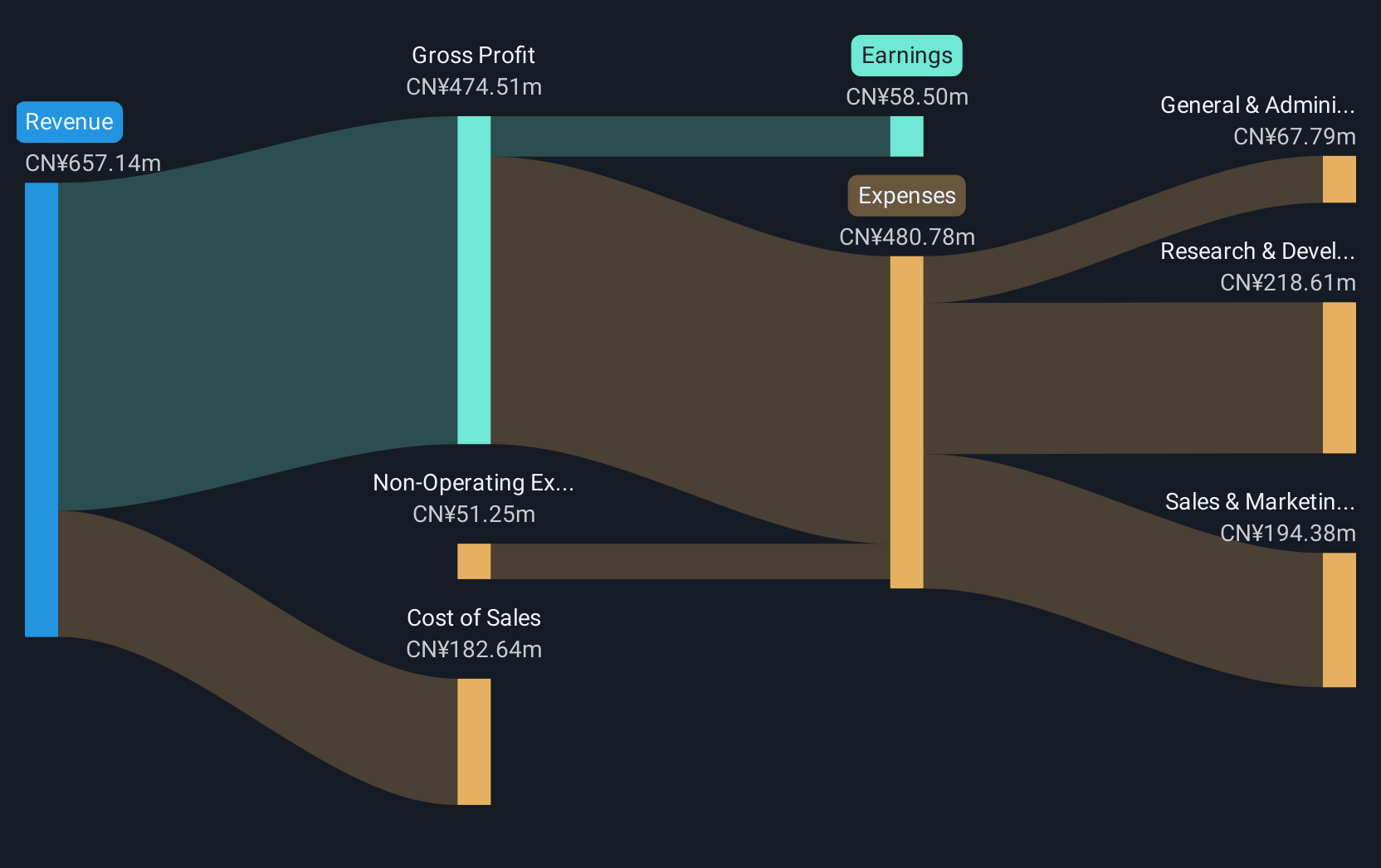

Despite a recent drop from the S&P Global BMI Index, Shenzhen Sinovatio Technology showcases resilience with its projected annual revenue growth at 23.9%, outpacing the Chinese market's average of 13.7%. This tech firm has faced challenges, evidenced by a shift from net income to a net loss in its latest nine-month financial report; however, it is poised for a robust turnaround with earnings expected to surge by 104.65% annually. The company's commitment to innovation is underscored by significant R&D investments aimed at reversing current setbacks and capturing future market opportunities, positioning it favorably within the competitive landscape of tech innovators focused on recovery and growth.

- Click here and access our complete health analysis report to understand the dynamics of Shenzhen Sinovatio Technology.

Gain insights into Shenzhen Sinovatio Technology's past trends and performance with our Past report.

Key Takeaways

- Dive into all 1273 of the High Growth Tech and AI Stocks we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688293

Shanghai OPM Biosciences

Provides cell culture media and CDMO services in China and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives