After Leaping 47% Shanghai OPM Biosciences Co., Ltd. (SHSE:688293) Shares Are Not Flying Under The Radar

Despite an already strong run, Shanghai OPM Biosciences Co., Ltd. (SHSE:688293) shares have been powering on, with a gain of 47% in the last thirty days. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 22% over that time.

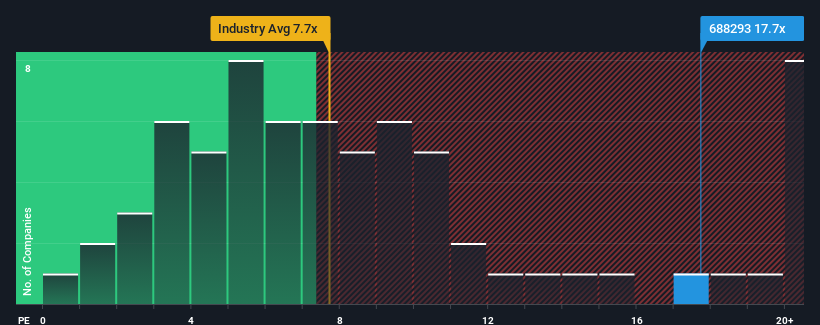

Following the firm bounce in price, you could be forgiven for thinking Shanghai OPM Biosciences is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 17.7x, considering almost half the companies in China's Biotechs industry have P/S ratios below 7.7x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Shanghai OPM Biosciences

How Shanghai OPM Biosciences Has Been Performing

With revenue growth that's inferior to most other companies of late, Shanghai OPM Biosciences has been relatively sluggish. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Shanghai OPM Biosciences' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Shanghai OPM Biosciences would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered an exceptional 18% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 35% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 60% as estimated by the three analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 53%, which is noticeably less attractive.

With this information, we can see why Shanghai OPM Biosciences is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Shanghai OPM Biosciences' P/S has grown nicely over the last month thanks to a handy boost in the share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Shanghai OPM Biosciences maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Biotechs industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

Having said that, be aware Shanghai OPM Biosciences is showing 4 warning signs in our investment analysis, and 1 of those can't be ignored.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688293

Shanghai OPM Biosciences

Provides cell culture media and CDMO services in China and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives