As global markets navigate a mixed start to the year, with U.S. equities showing resilience despite recent economic data and European inflation trends influencing monetary policy discussions, investors are keeping a close eye on growth opportunities. In this environment, stocks with high insider ownership can be particularly appealing as they often signal confidence from those closest to the company’s operations and strategy.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 23.8% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Let's explore several standout options from the results in the screener.

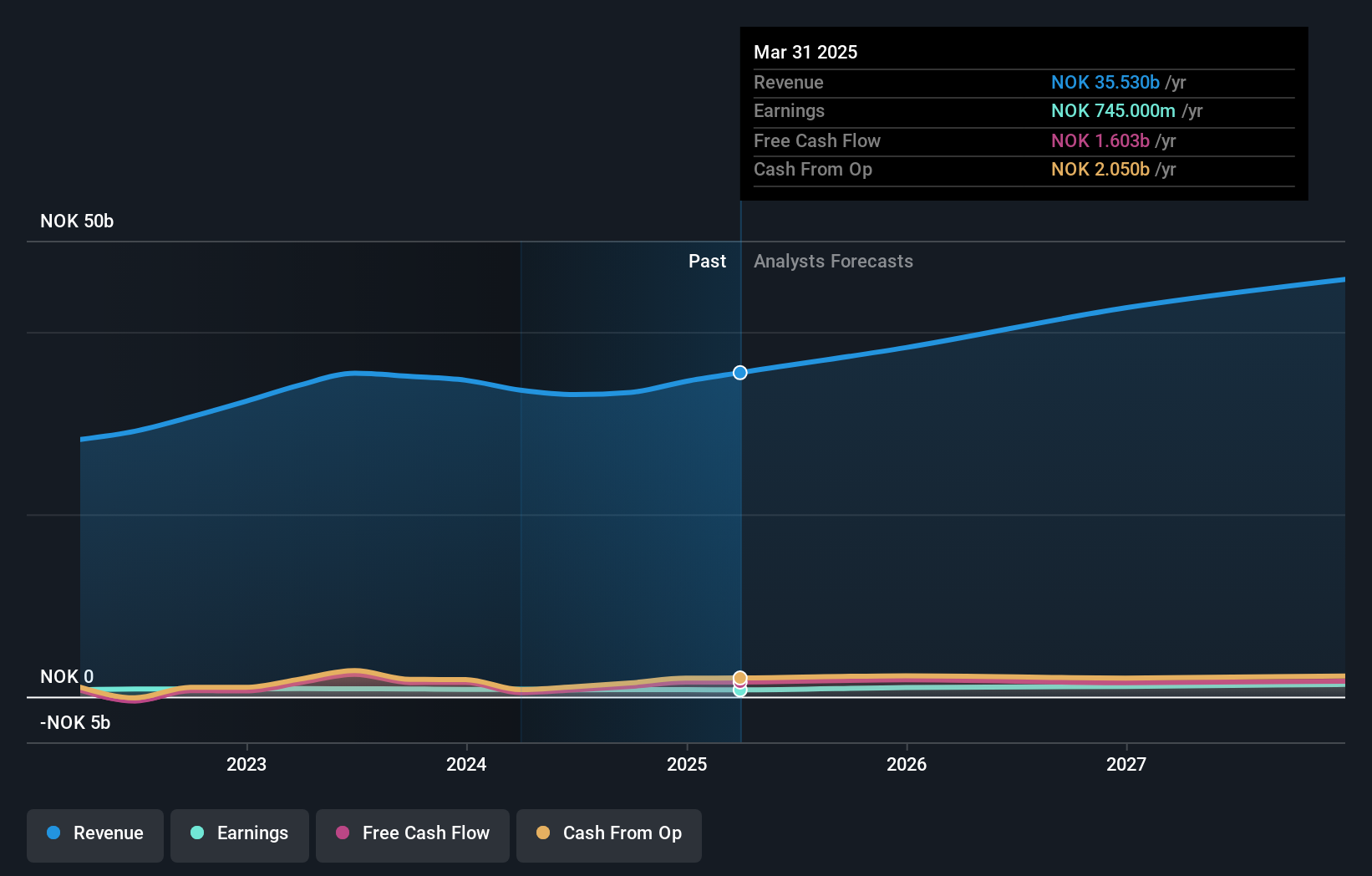

Atea (OB:ATEA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Atea ASA offers IT infrastructure and related solutions to businesses and public sector organizations in the Nordic countries and Baltic regions, with a market cap of NOK15.79 billion.

Operations: The company's revenue segments include NOK8.28 billion from Norway, NOK12.44 billion from Sweden, NOK7.37 billion from Denmark, NOK3.62 billion from Finland, and NOK1.76 billion from the Baltics.

Insider Ownership: 29.0%

Earnings Growth Forecast: 18.9% p.a.

Atea ASA's recent share repurchase program, authorized for up to NOK 10 million, highlights insider confidence. Despite a slight decline in nine-month sales to NOK 23.97 billion, earnings per share remain stable. Forecasts suggest Atea's earnings will grow at 18.9% annually, outpacing the Norwegian market average of 8.9%. However, its dividend yield of 4.96% is not fully covered by earnings, and revenue growth is projected at a moderate pace of 8.3% per year.

- Get an in-depth perspective on Atea's performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that Atea is trading behind its estimated value.

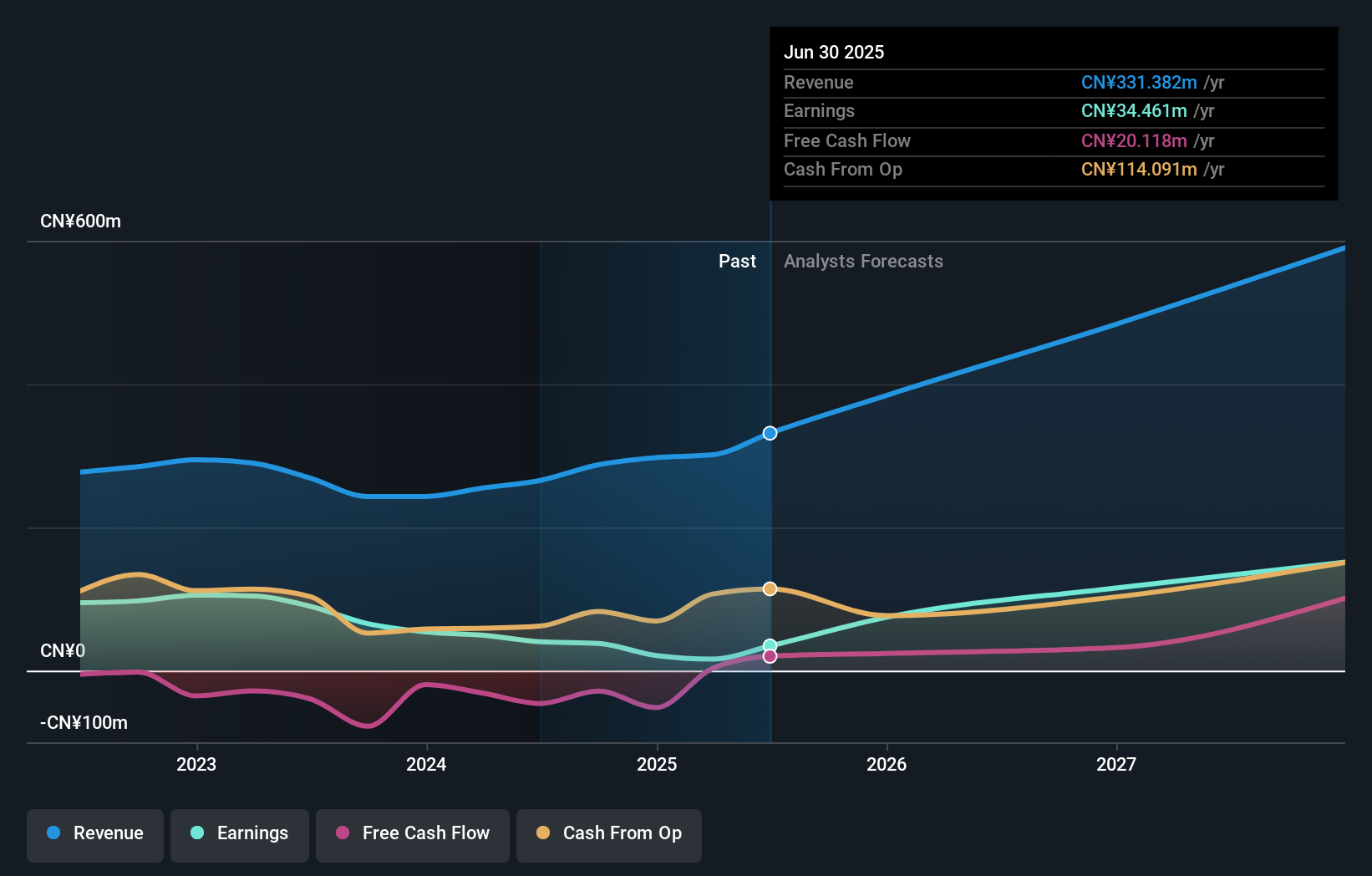

Shanghai OPM Biosciences (SHSE:688293)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shanghai OPM Biosciences Co., Ltd. specializes in providing cell culture media and CDMO services both within China and internationally, with a market cap of CN¥4.15 billion.

Operations: Revenue Segments (in millions of CN¥): The company generates revenue through its offerings in cell culture media and CDMO services.

Insider Ownership: 24.9%

Earnings Growth Forecast: 60% p.a.

Shanghai OPM Biosciences shows strong growth potential, with earnings expected to rise 60% annually, outpacing the Chinese market. Revenue is also projected to grow at 36.6% per year. Despite this, recent performance has been mixed—sales increased to CNY 215.86 million for the first nine months of 2024, but net income fell from CNY 43.18 million to CNY 27.23 million year-over-year. Additionally, its share price has been highly volatile recently and it was dropped from the S&P Global BMI Index in December 2024.

- Delve into the full analysis future growth report here for a deeper understanding of Shanghai OPM Biosciences.

- The valuation report we've compiled suggests that Shanghai OPM Biosciences' current price could be inflated.

Sichuan Yahua Industrial Group (SZSE:002497)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sichuan Yahua Industrial Group Co., Ltd. and its subsidiaries engage in the research, production, and sale of civil explosives and blasting services both in China and internationally, with a market cap of CN¥13.26 billion.

Operations: Sichuan Yahua Industrial Group Co., Ltd. generates revenue through its operations in civil explosives production and blasting services, serving both domestic and international markets.

Insider Ownership: 17.5%

Earnings Growth Forecast: 74.2% p.a.

Sichuan Yahua Industrial Group's insider ownership aligns with its growth trajectory, as earnings are forecast to rise 74.19% annually, surpassing market expectations. However, recent financials show a decline in revenue to CNY 5.92 billion and net income to CNY 154.61 million for the first nine months of 2024 compared to the previous year. Despite trading at a significant discount below estimated fair value, revenue growth is projected at a modest pace of 13.6% annually.

- Take a closer look at Sichuan Yahua Industrial Group's potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential undervaluation of Sichuan Yahua Industrial Group shares in the market.

Make It Happen

- Take a closer look at our Fast Growing Companies With High Insider Ownership list of 1492 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688293

Shanghai OPM Biosciences

Provides cell culture media and CDMO services in China and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives